What Happened

Abu Dhabi’s AI-investment firm MGX teamed up with Silver Lake to acquire a majority stake in Altera, a programmable chip business formerly wholly owned by Intel. As of the takeover, Intel retains a minority (49%) stake. The deal values Altera at about USD 8.75 billion. The exact amount MGX invested was not disclosed. The acquisition closed in mid-September.

Why This Move Is Important

- Programmable Chips Are Core to AI Infrastructure

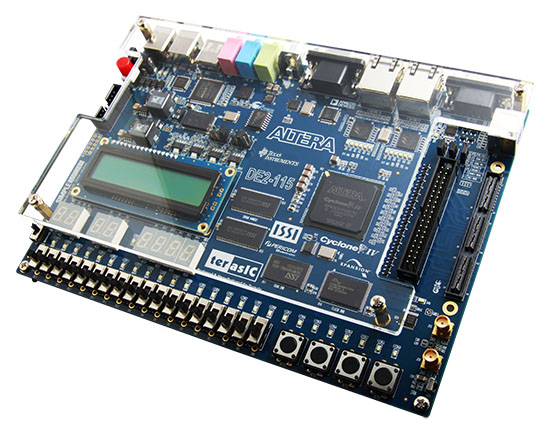

Field-Programmable Gate Arrays (FPGAs) like those Altera makes are critical for flexible, high-performance applications—inference, custom acceleration, edge compute, telecom and networking among others. Unlike fixed ASICs, they allow adaptability after deployment. This adds to AI systems’ resilience in an era of evolving software demands and regulatory pressures. - AI Infrastructure is Decoupling from Just GPUs

Much attention in AI investment has focused on GPUs and ASIC accelerators. But programmable chips like FPGAs, once a niche, are increasingly important in system design trade-offs (latency, power, cost). They fill a gap between general-purpose processor and fixed accelerators. - National / Sovereign Strategy

MGX is part of UAE’s play to build sovereign strength in AI: owning stakes in critical nodes of the AI value chain gives them leverage, technological as well as geopolitical. By partnering in such acquisitions, the UAE builds not just financial exposure but influence over supply chains, IP, and possibly, future innovation direction. - Valuation Implications

Intel had paid much more in 2015 for the full business; Altera is now valued much lower, reflecting lower growth expectations in its older business lines, competitive pressures, and maybe integration risk. This purchase gives MGX + Silver Lake the opportunity to extract value if they can modernize, expand margins, or re-position the product set for AI/edge growth.

Potential Investment Plays / Responses

Here are how I see this unfolding, and where investors might lean in:

| Area | Attractive Opportunities | What to Watch |

|---|---|---|

| FPGA & Configurable Compute Providers | Companies building programmable logic devices, FPGA-based accelerators, or those offering IP, tooling, software stacks for FPGA use. If Altera scales faster, downstream firms leveraging FPGA can gain economies. | Track product roadmaps, foundry yield, performance per watt, software toolchain strength, ability to integrate with AI stacks. |

| Foundry / Chip Manufacturing | Altera will need reliable foundry partners for advanced nodes, cleanrooms, capacity. Those foundries with AI-friendly, high volume production pipelines may benefit. | Watch capacity expansion, node migration (28nm → 16nm → 7/5/3nm if relevant), supply chain constraints, quality, lead times. |

| Edge & Telecom Equipment Makers | Networking gear, telecom infrastructure, edge data centers that need latency, re-programmability, and flexibility may lean more on FPGAs vs ASICs. Suppliers to those firms stand to gain. | Monitor order flows, design wins, telecom capital expenditure cycles, 5G/6G upgrades. |

| AI Hardware Stack Players (Software & Tools) | FPGA usage depends heavily on software tools, IP blocks, developer ecosystems. Players in the FPGA-toolchain, compilation, deployment, cloud orchestration for FPGAs could see upside. | See how tools evolve, how much open source vs proprietary value, how MGX/Silver Lake push strategy there. |

| Sovereign / PE-Backed AI & Infrastructure Funds | MGX’s move might accelerate similar investments by fund-backed sovereign or quasi-sovereign outfits. Funds that anticipate that shift may jump early into AI supply chain nodes. | Watch new fund launches, co-investment announcements, partnerships with Western chipmakers or foundries. |

Risks, Nuances & What Could Go Wrong

- Technology Risk: Altera under Intel had legacy product lines and competitive overlap with other programmable logic or accelerator solutions. Upgrading the roadmap, defending against newer architectures (ASIC, AI accelerators, emerging chips) will be crucial.

- Margin Compression: FPGAs in certain markets (e.g. telecom, industrial) have long useful life cycles, but price erosion, foundry cost increases, energy inefficiencies can erode returns.

- Supply Chain & Foundry Constraints: If process nodes are hard to get, or yield/defect rates are below expectations, ramp costs could spike. Additionally, geopolitical/export controls could disrupt component or TSMC/Intel node access.

- Regulatory / Policy Risk: Given current geopolitics around semiconductors (export controls, IP protection, national security concerns), stakeholders like MGX might face compliance, licensing, or a risk of forced localization or restrictions.

- Valuation Risk: The buy price reflects expectations of turnaround / repositioning. If growth in FPGA demand slows (say, AI inference shifts more to fixed accelerators or even analog specialized hardware), or competition intensifies, returns may be lower than assumed.

Return Scenarios & Key Metrics

Here are how things might play out under different scenarios:

| Scenario | Key Assumptions | Potential Upside | Potential Downside |

|---|---|---|---|

| Base | Altera maintains existing FPGA market share, incremental growth driven by AI/edge demand, margin improvements, moderate foundry/nodes investment. | Mid to high teens IRR over 5-7 years; steady cash flows; unit margin expansion; licensing / IP revenue growth. | Cost overruns, foundry delays, slower ramp, margin pressure; slower AI demand vs expectation. |

| Upside | Strong AI demand, favorable policy (subsidies, export support), aggressive upgrade of product lines (e.g. newer process nodes), toolchain wins, strategic partnerships. | IRR in the 20-30% range; potential for spin-outs; strong multiple revaluation; possibly strong cash flow growth and optionality in edge markets. | |

| Downside | Competitive disruption (ASICs, other FPGA rivals), geopolitical restrictions, manufacturing bottlenecks, overestimated market size; slower tool/SDK ecosystem. | Low single‐digit returns; risk of capital write-downs; revenue stagnation; high cost base relative to competitive returns. |

Metrics to monitor:

- Revenue growth rates specific to FPGA/programmable chip deployments (AI inference, edge, telecom).

- Gross margin trends after the acquisition.

- Capital expenditure / node migration plans & execution.

- Customer concentration (are a few big buyers dominating?)

- Toolchain strength & developer adoption.

- Foundry relations & node roll-out schedule.

- Regulatory / trade policy developments in US, UAE (exports, IP, chip supply).

Big Picture Trends & Strategic Implications

- This transaction is part of a pattern: sovereign or quasi-sovereign investment houses in the Gulf are increasingly targeting high value, strategic tech assets—not just energy or infrastructure, but AI, semiconductors, and computing hardware. The aim is often long-term (control, influence, securing supply chain) more than short returns alone.

- For Western chipmakers or incumbents, MGX’s participation might signal both competition (access to capital, sovereign backing) and potential for partnerships. It raises the bar for scale and commitment required to compete.

- The aluminum-like simplification of compute is being challenged: newer architectures, reprogrammable logic, and flexible infrastructure are gaining traction. Investment bets will favor technology sets that allow adaptability over locked-in compute paths.

Tactical Portfolio Moves

If I were deploying capital now given this news, I’d be leaning:

- Core Longs

- Equity stakes in FPGA incumbents, or suppliers tied to FPGA production (e.g. foundries with relevant nodes).

- Exposure to companies that supply FPGA development tools and SDK ecosystems.

- Selective Private / PE Plays

- Co-investment or fund exposure to technology infrastructure deals in semiconductors where sovereign PE firms are active (MGX, Mubadala, etc.).

- Venture / growth opportunities upstream of Altera’s value chain – e.g. IP cores, edge deployment partners.

- Hedges / Protection

- Put options or partial hedges on pure GPU or ASIC accelerator firms if FPGA gains eat into some of their addressable markets.

- Keep exposure diversified geographically (don’t bet only on US or UAE; regulatory risk is real).

- Watchlist for Catalysts

- Announcements of new node investments.

- Device or platform wins where Altera’s FPGA is chosen over ASIC/GPU.

- Government subsidies/tax incentives for semiconductors (US CHIPS Act, UAE policy, Europe).

- Export control changes (favorable or unfavorable).

Bottom Line

MGX’s investment in Altera alongside Silver Lake positions the UAE more centrally in the global chip value chain. It’s a strategic bet: programmable hardware, flexibility, AI infrastructure—and not just capital, but influence. For players with deep understanding of semiconductors (both tech and policy sides), this deal offers potential upside. But execution risk, foundry/backing constraints, and valuation expectations must be carefully managed.