August 14, 2025

In a significant departure from free-market norms, the Trump administration is reportedly in early-stage discussions to acquire an equity stake in Intel. The move aligns with a growing pattern of federal intervention in strategically vital technology companies, signaling a clear shift toward state-capitalist policies.

Key Developments

- What’s on the table?

Sources indicate the U.S. government is considering entering into an equity agreement with Intel to support its domestic chip manufacturing ambitions—most notably, its long-delayed Ohio semiconductor plant. - Recent high-level engagement.

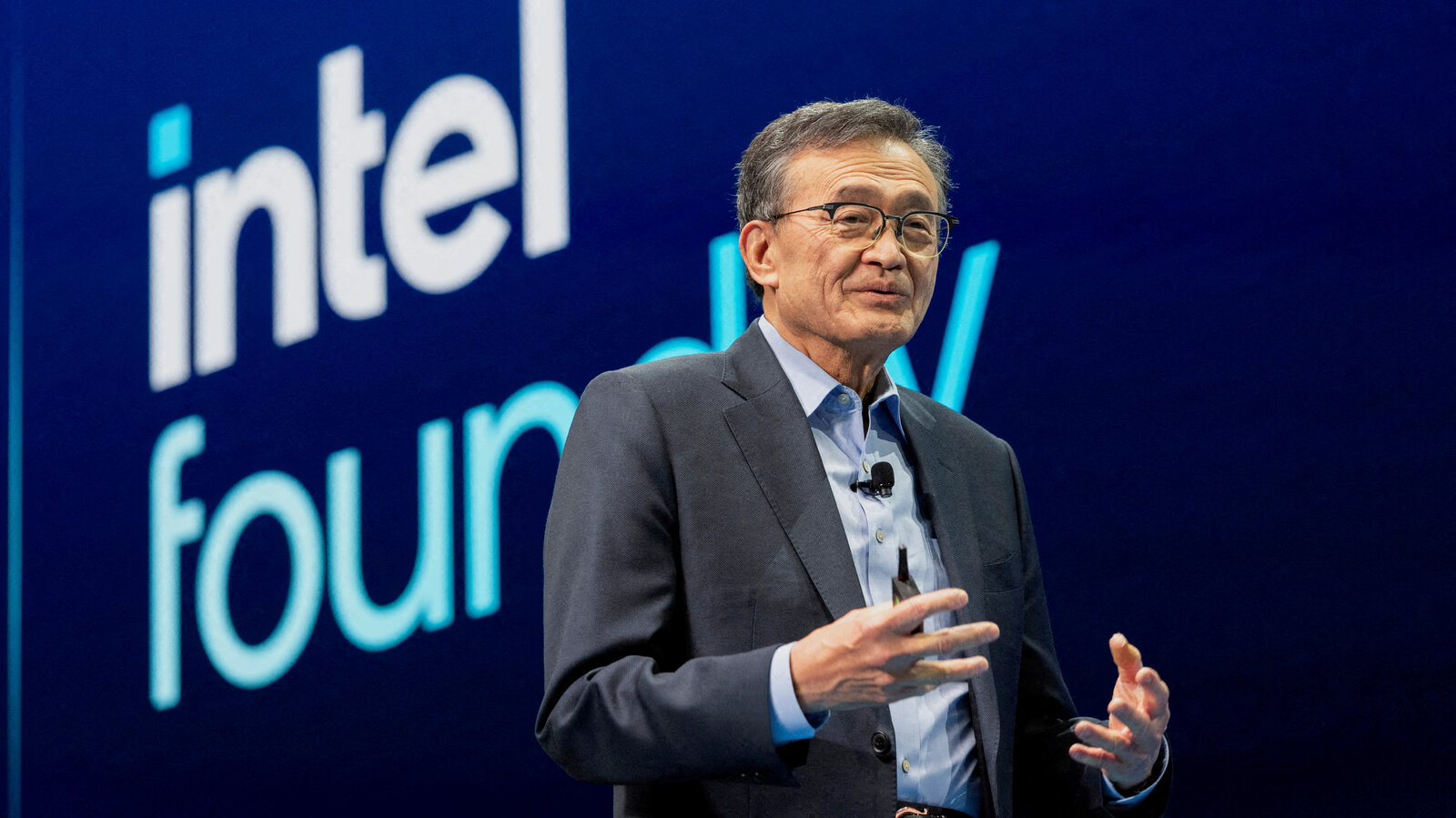

Intel CEO Lip-Bu Tan recently met with President Trump, Treasury Secretary Scott Bessent, and Commerce Secretary Howard Lutnick at the White House. The gathering appears to be the catalyst for breakthrough discussions. - Market response.

Intel’s stock surged roughly 7–7.4% in trading, a reflection of investor optimism around the federal lifeline and its potential to accelerate production scale-up. - Precedent-setting magnitude.

With Intel’s market capitalization hovering around $100 billion, this would be among the largest peacetime investments by the government in a private company—surpassing recent interventions in firms like MP Materials and U.S. Steel.

Strategic & National Imperatives

1. Industrial Policy in Action

This initiative marks a deliberate shift from economic minimalism to a more hands-on approach, echoing government models employed in other technology-intensive nations. It underscores the administration’s recognition that semiconductors are strategic assets, central to national security.

2. Rescuing a Domestic Champion

Intel, historically the backbone of U.S. chip production, has faced steep decline—from a $288 billion valuation in 2020 to around $104 billion in 2025. Its Ohio manufacturing project has stalled, increasing reliance on foreign foundries. A government stake could inject much-needed momentum.

3. Market Signaling & Investor Sentiment

The stock rally demonstrates how federal backing can restore confidence, mitigate execution risks, and potentially attract private capital. However, such optimism hinges on clarity around the deal structure and terms.

Risks & Uncertainties

- Still speculative.

Officials caution that these are simply discussions—not confirmed commitments. Public details remain scant, and terms of the potential stake (equity size, governance rights) are unknown. - Precedent concerns.

Critics warn that this intervention blurs lines between government and industry, raising questions about precedent, accountability, and the market’s role in innovation. - CEO and governance dynamics.

Amid this, Intel’s CEO—Lip-Bu Tan—is under scrutiny over past ties to Chinese entities and internal disputes over strategy and board alignment. The government’s involvement could reshape internal power dynamics.

Summary Table

| Aspect | Details |

|---|---|

| Stake Consideration | U.S. government exploring equity investment in Intel |

| Rationale | Support stalled Ohio fab, bolster domestic chip production |

| Negotiations Sparked By | White House meeting between Trump and Intel CEO |

| Stock Reaction | Share price rose ~7% on reports |

| Policy Shift | Embraces a state-capitalist approach amid national security concerns |

| Key Risks | Uncertainty of deal, governance implications, market intervention precedents |