August 7, 2025 — Washington, D.C.

In a sweeping escalation of his trade agenda, President Donald Trump has unveiled a bold new policy: a 100% tariff on imported semiconductor chips from countries that do not manufacture—or lack concrete plans to manufacture—on U.S. soil. The announcement came alongside a barrage of new “reciprocal” tariffs targeting over 100 nations, sharply redefining America’s stance on trade and industrial policy just as global supply chains struggle to recover from pandemic-era disruptions and geopolitical fragmentation.

The Chip Tariff: Protection or Provocation?

The centerpiece of the new policy is the 100% levy on semiconductors—a strategic move designed to force global chipmakers to either shift production to the United States or risk losing access to its lucrative domestic market. However, the policy includes key exemptions: companies like Taiwan’s TSMC and South Korea’s Samsung, which are actively building multi-billion-dollar fabs in Arizona and Texas respectively, will not face the new tariffs. American firms like Intel, Micron, AMD, and Nvidia—already deeply embedded in domestic production or planning further expansion—are also shielded.

This selective tariff is designed to reward reshoring and punish global dependencies, a direct shot at countries like China and others in Southeast Asia that continue to dominate chip assembly and manufacturing without committing to U.S. investment.

The message from the Trump administration is unambiguous: build in America, or pay dearly to sell here.

Broader Trade Barrage: Tariffs on 100+ Countries

In parallel, the administration implemented a new wave of generalized tariffs on imports from more than 100 nations, ranging from 10% to 50%, based on their trade balances with the U.S. and perceived levels of reciprocity. Brazil and India were among those slapped with 50% duties, while U.S. allies like the United Kingdom saw smaller—but still notable—tariffs imposed.

This effectively raises the average U.S. import tariff to levels unseen since the Smoot-Hawley Act of the 1930s, triggering fears of retaliatory trade wars and global inflationary pressures.

Despite this, the Trump administration argues that the tariffs are a necessary correction to decades of trade imbalances and exploitative foreign policies. According to the President, “American workers will no longer subsidize foreign industries that undercut our factories and jobs.”

Market Reaction: Chip Stocks Surge—For Now

In a paradoxical twist, semiconductor stocks rallied following the tariff announcement. Investors appeared encouraged by the clarity and predictability of the exemptions granted to companies investing domestically. TSMC and Samsung both saw moderate gains, with analysts noting that their U.S. investments may now serve as insulation against future regulatory shocks.

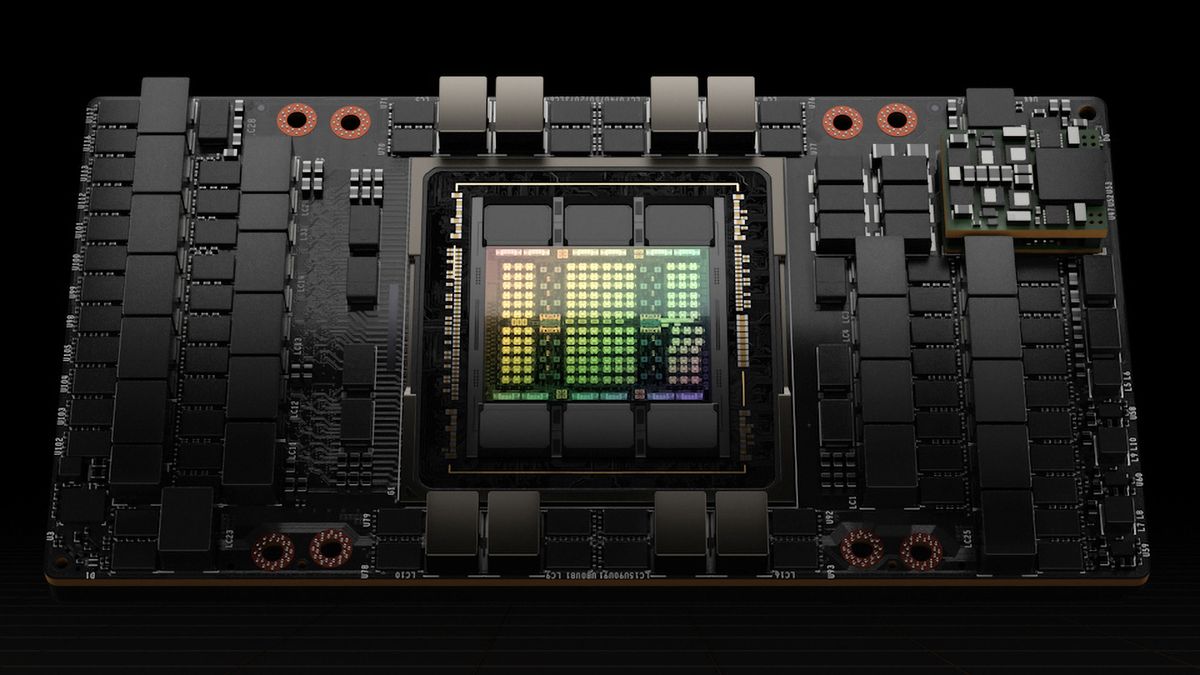

Intel, already the recipient of billions in CHIPS Act subsidies, saw a sharp rise in investor confidence, as did Micron and Nvidia. Markets interpreted the move as a net positive for companies with domestic supply chains—especially as demand for AI chips, high-bandwidth memory, and edge processors continues to soar.

Still, some observers caution that the rally could be short-lived if retaliatory tariffs from affected nations begin to materialize, or if domestic production fails to meet demand in time.

Consumer Impact: Inflationary Pressures Ahead

Economists warn that while the chip-specific tariffs may not be immediately felt by consumers, the broader basket of import taxes will ripple across the economy. Prices are expected to rise on everything from household electronics to groceries, furniture, and auto parts.

According to an analysis by the nonpartisan Yale Budget Lab, the new tariffs could translate to an effective loss of $2,400 per year in purchasing power per U.S. household, especially hurting lower-income families who spend a higher share of their income on imported goods.

Small and mid-sized businesses reliant on imported components may also face margin compression, or be forced to pass costs onto consumers.

Strategic Shift: From Globalism to Economic Nationalism

The new trade measures are not merely economic—they represent a foundational shift in U.S. industrial strategy. For decades, the global economy has revolved around lean, efficient, and often fragile supply chains. Trump’s tariffs signal a full embrace of economic nationalism, aiming to resurrect domestic manufacturing across sectors deemed critical to national security—chief among them, semiconductors.

Critics argue that this strategy risks isolating the U.S. from allies and undermining global cooperation. But supporters view it as a long-overdue correction to the offshoring wave that hollowed out American industry in the late 20th and early 21st centuries.

Notably, the tariffs bypass multilateral frameworks like the World Trade Organization and are being implemented unilaterally—raising questions about long-term enforcement, trade retaliation, and legal challenges at both domestic and international levels.

What Comes Next?

The coming weeks will be pivotal. Key questions include:

- Will allies retaliate with their own tariffs, or negotiate exemptions through investment promises?

- Can the U.S. semiconductor industry scale fast enough to meet rising domestic demand?

- How will China and other non-exempt players respond, especially in sensitive tech sectors?

- Will this deepen global fragmentation and fuel a new round of trade wars?

For now, the message from Washington is clear: economic leverage is back on the table—and the U.S. intends to use it.