Retail investors in 2024 gravitated toward companies leading the charge in artificial intelligence, renewable energy, and advanced technology. A mix of large-cap tech giants and growth-oriented innovators captured the imagination of individual investors, reflecting a broader market trend that favored transformative industries. Here’s an in-depth look at the standout stocks of the year and the factors driving their popularity:

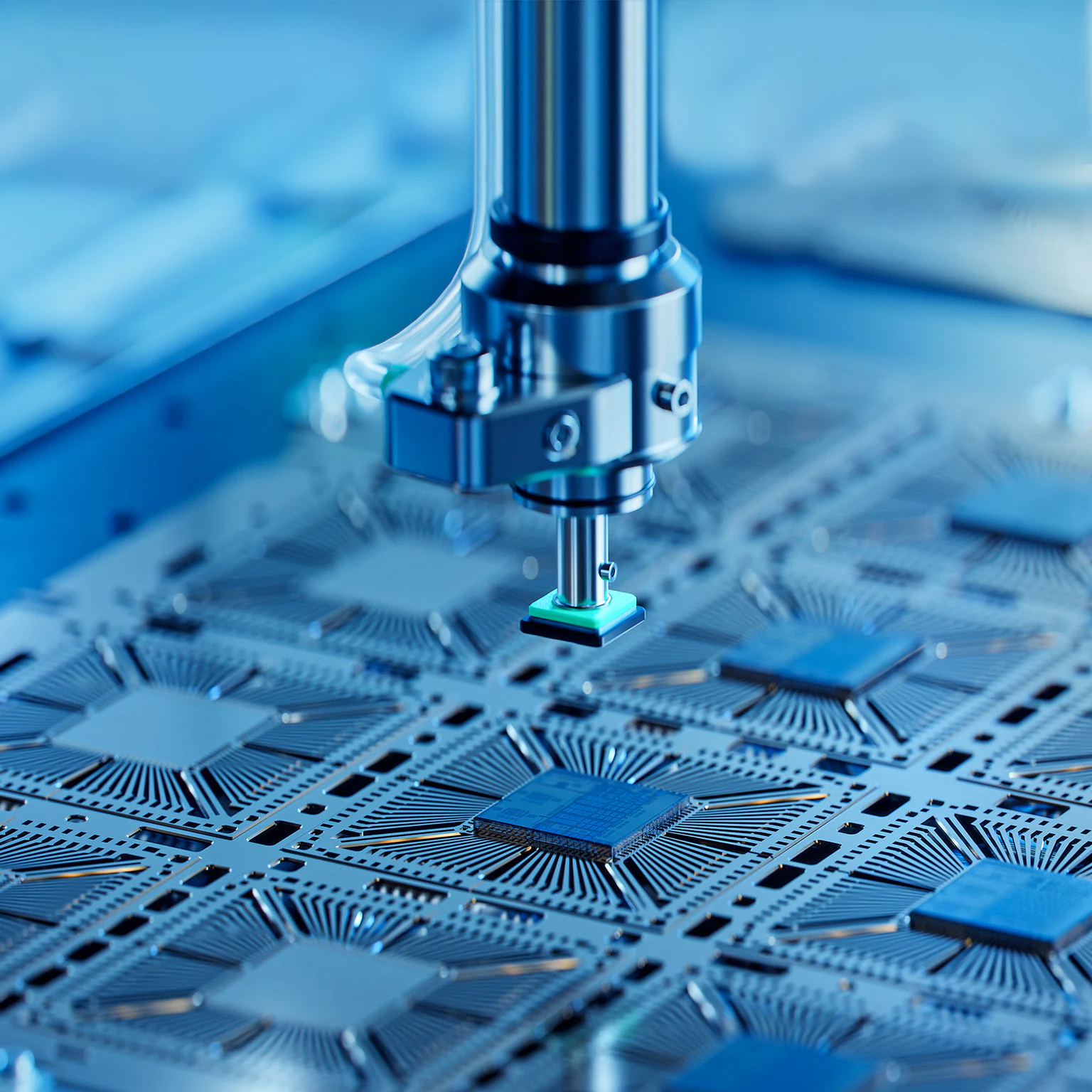

1. NVIDIA Corporation (NVDA)

NVIDIA emerged as the poster child for the AI revolution in 2024, bolstered by its dominance in AI hardware and software solutions. Retail investors significantly increased their holdings, drawn by NVIDIA’s unmatched position in supplying GPUs critical for AI workloads, machine learning, and data processing. Despite volatility and a lofty valuation, NVIDIA’s robust earnings growth and new product launches, such as the H200 GPUs, kept investors optimistic about its long-term prospects.

2. Tesla, Inc. (TSLA)

Tesla maintained its place as a retail favorite thanks to its innovative approach to electric vehicles (EVs) and renewable energy. Investors were particularly excited about Tesla’s entry into the energy storage market with its advanced battery solutions and the expansion of its autonomous driving software. Despite facing increased competition in the EV space, Tesla’s global brand recognition and strong delivery numbers solidified its appeal.

3. Advanced Micro Devices, Inc. (AMD)

AMD gained attention for its advancements in semiconductor technologies, especially its role in AI computing. The company’s focus on developing high-performance chips to rival NVIDIA’s offerings in the AI space helped it secure a significant place in retail portfolios. Investors also viewed AMD’s growth in the gaming and data center markets as key drivers for sustained revenue expansion.

4. Apple Inc. (AAPL)

Apple remained a retail staple, driven by its consistent performance and the strength of its ecosystem. The company’s expansion into augmented reality (AR) and virtual reality (VR) with the Vision Pro headset generated excitement about its ability to innovate beyond its core product lines. Apple’s strong balance sheet and commitment to shareholder returns through dividends and buybacks further endeared it to retail investors.

5. Microsoft Corporation (MSFT)

Microsoft’s leadership in cloud computing and artificial intelligence made it a top pick for investors seeking exposure to tech growth. The integration of AI capabilities, particularly through Azure and OpenAI collaborations, positioned Microsoft as a key player in the AI arms race. Retail investors also valued its steady revenue growth and diversified business model.

6. Amazon.com, Inc. (AMZN)

Amazon regained favor among retail investors as its focus on AI-powered logistics and cloud services reinvigorated growth prospects. Amazon Web Services (AWS) continued to dominate the cloud space, while the company’s investments in generative AI solutions for e-commerce created new opportunities. Retail interest was further boosted by Amazon’s improved profitability and operational efficiency.

7. Meta Platforms, Inc. (META)

Meta’s pivot toward artificial intelligence and away from the “metaverse-first” strategy revitalized investor confidence. The company’s AI-driven advertising tools and investment in generative AI positioned it as a tech leader. Retail investors were also drawn to Meta’s strong revenue rebound, driven by increased engagement across its social media platforms.

8. Alphabet Inc. (GOOGL)

Alphabet saw increased retail interest due to its advancements in AI, particularly through its DeepMind subsidiary and Google Cloud’s AI capabilities. The company’s diverse revenue streams, including advertising, cloud services, and hardware, made it a resilient choice for investors. Alphabet’s competitive edge in the AI space, supported by breakthroughs in large language models, attracted tech-focused portfolios.

9. Palantir Technologies, Inc. (PLTR)

Palantir captivated retail investors with its growing presence in the AI and defense sectors. Its ability to deliver AI-driven data analytics solutions to government and commercial clients positioned the company for significant growth. Retail enthusiasm was fueled by Palantir’s profitability milestones and its ambitious plans to expand into new markets.

10. SoFi Technologies, Inc. (SOFI)

SoFi emerged as a retail favorite in the fintech space, benefiting from rising demand for online banking and financial services. Its innovative offerings, including AI-powered financial tools and products tailored to millennials and Gen Z, resonated strongly with individual investors. Retail interest surged as the company continued to grow its user base and expand its revenue streams.

Conclusion

Retail investors in 2024 showcased a clear preference for companies driving technological and societal change, particularly those leading in AI and renewable energy. The focus on these transformative sectors reflects broader market trends, as individuals increasingly look for opportunities aligned with future-oriented themes. Companies like NVIDIA, Tesla, and Microsoft exemplify how innovation can captivate retail investors, while newer players like Palantir and SoFi highlight the allure of growth potential in emerging markets.