September 9, 2025 — Las Vegas

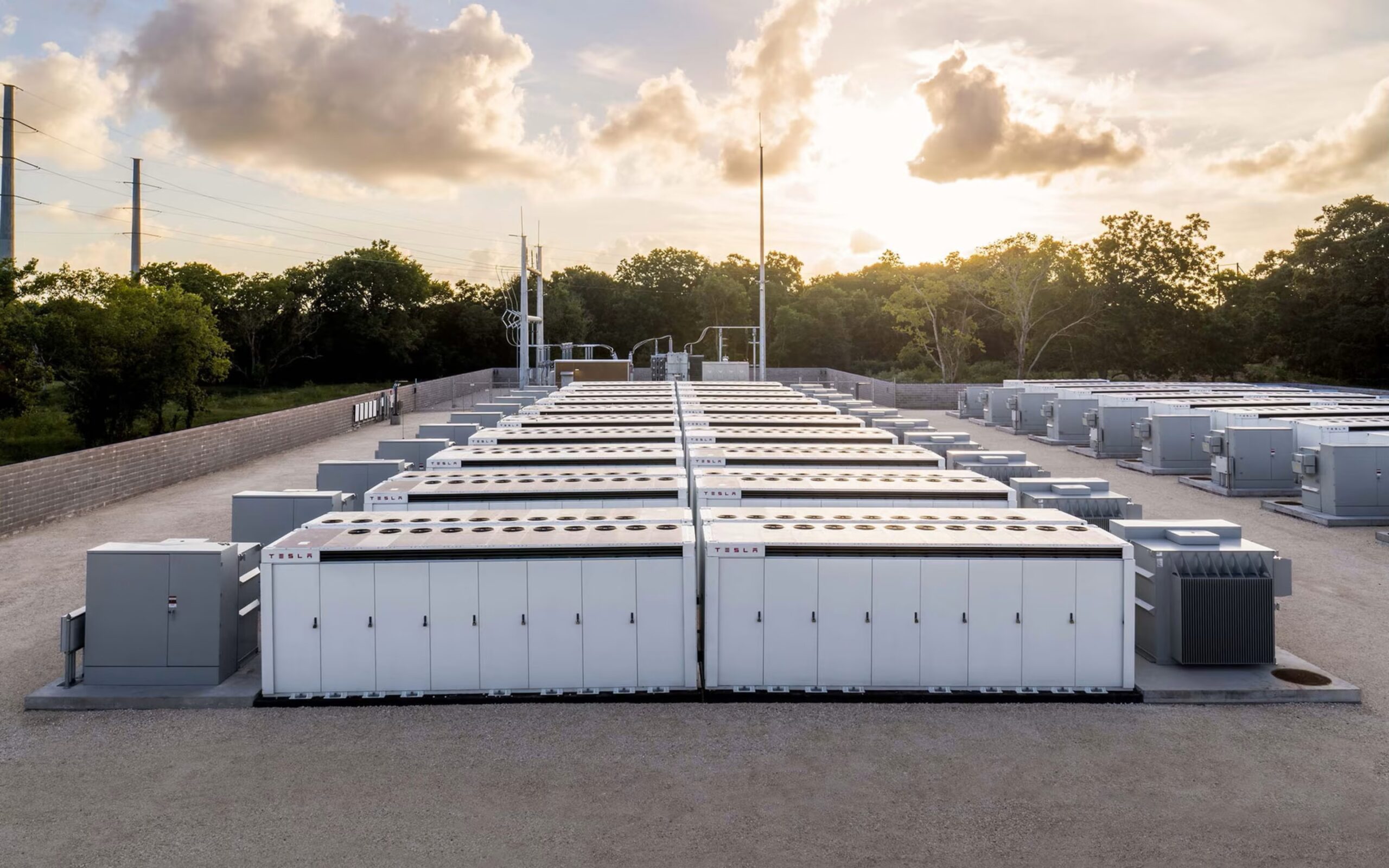

Tesla revealed a bold refresh to its struggling energy storage lineup with two key offerings: Megapack 3 and Megablock—a modular, plug-and-play system aimed squarely at utilities, data centers, and grid operators facing mounting renewable intermittency demands.

What’s New with Megapack 3 & Megablock

- Megapack 3 Enhancements

Tesla boosted storage capacity—adding roughly 1 megawatt-hour over its predecessors—and engineered the thermal bay to be dramatically simpler, slashing connection points by 78% to reduce failure risk. The result: longer lifespan and better reliability under heat stress. - Megablock: Integrated, Faster, Leaner

Megablock bundles four Megapack 3 units with onboard transformers, switchgear, and software. Tesla promises 23% faster installation and up to 40% lower construction costs compared to conventional deployments, enabling a typical system to power around 4,000 homes for four hours. - Localized U.S. Production

Production will ramp up at Tesla’s Houston Gigafactory by late 2026. Both Megapack 3 and Megablock will also incorporate cells—and production—from Tesla’s Nevada LFP plant and suppliers in Southeast Asia and China.

Why Tesla Is Doubling Down

Tesla’s energy storage division has been in retreat—installations have declined for two straight quarters, even as competitors press ahead. The rest of the sector is growing rapidly, pulling Tesla’s energy growth off-track despite its prior leadership in battery storage deployments.

Investor Insights & Tactical Considerations

| Strategy | Insight |

|---|---|

| Valuation Reset Catalyst | If Megapack 3 and Megablock drive a reversal of energy division declines, Tesla’s energy segment could regain scaled growth—validating long-term diversification beyond EV revenue. |

| Operational Scale-Up Observation | Watch deployment volume commentary in earnings calls; quick cost/labor savings from Megablock could move breakeven curves earlier. |

| Margin Recovery Potential | Construction-cost savings represent margin upside. If Tesla can leverage factory-built, plug-in execution, it could achieve scale efficiencies faster than peers. |

| Supply Chain & Localization Plays | Greater U.S. cell sourcing (Nevada) lessens dependence on foreign inputs—boosting resilience. Potential tailwinds for domestic LFP suppliers and logistics setups. |

| Competitive Edge Watch | Megablock’s ease of deployment might outflank other storage offering architectures—keep tabs on how utilities respond to a speed-first play. |

| Cross-Segment Signaling | Investors should see energy refresh as a signal Tesla still aims to grow non-auto revenue aggressively. If delivered effectively, it strengthens investor thesis around Tesla as a diversified clean-technology platform. |

What to Track Moving Forward

- Deployment Data: Look for Tesla to highlight breakout quarters where energy segment growth reverses course.

- Order Pipeline: New contracts—especially with utilities or large-scale renewables—will validate Megablock’s value proposition.

- Cost Metrics: Any details on installation-related labor and time savings will help backstop bullish scenarios.

- Regulatory and Infrastructure Trends: Grid modernization grants or renewable mandates could accelerate adoption.

- Cross-Divisional Leverage: Watch synergies with Autobidder or Solar Roof; integration could boost energy revenues further.

Bottom Line:

Tesla’s rollout of Megapack 3 and Megablock is a clear gambit to re-energize its flailing storage business. For investors, execution and market reception will be pivotal—this could be the moment Tesla transitions from EV-first to genuinely diversified clean energy enterprise.