- At a TED 2025 event, Sam Altman publicly stated that ChatGPT now has approximately 800 million weekly active users, representing about 10% of the world’s population.

- This figure marks a doubling of user base in a very short span: ChatGPT reportedly had ~400 million weekly active users just months earlier (February 2025).

- The growth is being attributed in part to viral new features (for example, image / video generation modes and more expressive features) that have helped attract mass engagement.

So Altman’s claim is that ChatGPT is now used weekly by hundreds of millions globally—a scale of adoption rarely seen for a new software / AI product.

Why This Matters Strategically & for Investors

Reaching 800 million weekly active users is not just a vanity metric—it carries deep strategic weight. Here are the major implications and how I’d think about them from a portfolio perspective:

| Domain | Implication / Strategic Signal |

|---|---|

| User Penetration & Scale Moat | At 800M weekly users, ChatGPT is reaching a level of ubiquity that starts to rival core internet utilities (search, social, messaging). It strengthens the barrier to entry for rivals: scale brings more data, user feedback loops, model improvement, app ecosystem stickiness. |

| Monetization Leverage | The large, engaged user base gives OpenAI more leverage in monetization strategies—freemium upsells, in-app purchases, enterprise / API conversion, embedded commerce, plugin marketplaces. The bigger the base, the more optionality. |

| Data / Feedback Loop Value | With hundreds of millions of weekly interactions, OpenAI can collect massive signals, usage patterns, failure cases, prompt trends—fuel for model improvement, specialized fine-tuning, domain adaptation. The more usage, the richer the feedback loop. |

| Ecosystem & Platform Power | At that scale, ChatGPT becomes a platform. Third-party developers, app builders, plugin ecosystems, agents, integrations all see incentive to layer on top. The platform becomes more valuable than just the core model. |

| Risk & Scrutiny Amplification | With scale comes scrutiny: regulatory, privacy, security, bias, monetization ethics. A user base of 800M means any misstep (data breach, policy error, misinformation) has massive exposure. |

| Valuation & Forward Multiples | Such growth can shift valuation assumptions: instead of valuing based on current revenue, models will lean into future monetization per user. Valuation multiples may stretch if the growth narrative is believed. |

| Competitive Pressure & Defense | Competitors (Google, Meta, Anthropic, others) must respond more aggressively — either through scale, cost advantage, specialization, or differentiation. OpenAI’s incumbency helps but also draws fire. |

Key Risks & Caveats to the 800M Claim

While the number is impressive, several caveats should temper our adoption of it:

- Definition of “Weekly Active”

What qualifies as “active”? Is it a single prompt, browsing, conversation? Are bot users, test accounts, or API users included? Metrics can be inflated depending on definition. - Engagement Quality vs. Quantity

Having 800M weekly users doesn’t equal deep usage. Many users might only interact for minimal tasks. The per-user value, retention, session length, repeat usage matter more for monetization and robustness. - Regional / Access Bias

Access to ChatGPT is uneven globally (due to regulation, internet censorship, language support). The reported number may disproportionately reflect certain geographies; growth outside accessible markets might be constrained. - Viral / Feature Spike Effect

Rapid adoption may partly be driven by viral new features or novelty (image/video generation modes, “Ghibli mode,” etc.). Sustaining growth over the long term is harder. Digital Watch Observatory+2PYMNTS.com+2 - Reporting / Confirmation Delay

The number comes from a public claim by Altman; independent verification (through usage data, analytics firms, audit) may lag. The downside is that overstatements or upward rounding are possible. - Monetization & Cost Challenges

Handling 800M weekly users is costly—compute, model inference, storage, bandwidth. If monetization lags, the cost base may undercut margin gains.

Trade / Positioning Ideas Based on This Milestone

Given this scale milestone, here’s how I’d recalibrate or tilt exposure in AI / tech:

| Strategy | Rationale | Tactics |

|---|---|---|

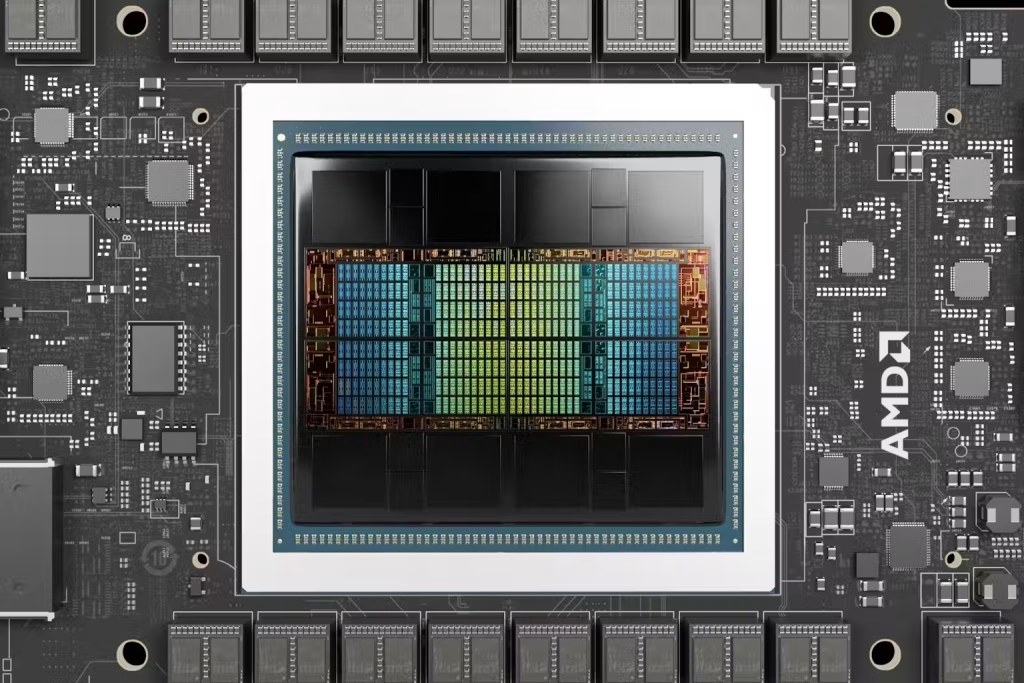

| Overweight AI infrastructure & compute stacks | With usage exploding, demand for better compute, memory, inference infrastructure, optimized GPUs, accelerators, caching layers intensifies | Increase exposure to hardware / accelerator companies, cloud providers doing AI infrastructure, memory & high-throughput I/O vendors |

| Platform / plugin / agent enablers | Third-party apps, agents, extensions, vertical tools that integrate with ChatGPT benefit from deeper platform entrenchment | Invest in toolchain companies, API integrators, workflow / agent providers |

| Selective monetization plays | Companies that can convert heavy free users into paying users or enterprise clients gain disproportionately | Monitor premium subscription conversion metrics, enterprise adoption rates, upsell flows |

| Hedging regulatory / reputation risk | With huge user base comes regulatory risk (data, privacy, bias), so hedging downside is prudent | Use options or hedges on overvalued AI / chatbot names, diversify into less exposed sectors |

| Capitalize on data / analytics / fine-tuning services | Demand for fine-tuning, domain specialization, compliance, benchmarking services grows with scale | Invest in niche AI services firms, model validation / audit / compliance vendors |

What I’d Watch as Validation Signals

- Independent, third-party analytics confirmation of 800M or more weekly users (from web traffic, app analytics firms).

- Retention and engagement curves (what fraction of users return weekly / monthly) — helps assess whether growth is sticky.

- Revenue per user trends; how many become paid users, enterprise clients.

- Infrastructure / cost scaling disclosures—whether OpenAI or its partners show evidence of managing compute cost effectively.

- Plugin / ecosystem growth: number of third-party extensions, agents, integrations.

- Geographic expansion: uptake in new countries, languages, overcoming regulatory blocks.

- Feature stickiness / feature dependency: which features are driving growth (multimodal, image, agent actions) and how central they become.

My Estimate & Betting Range

Given that ChatGPT was at ~400 million weekly active users earlier in 2025 (confirmed via Reuters) Reuters, doubling to 800 million in a few months is aggressive but not implausible, especially if viral features or product launches accelerated adoption.

For modeling purposes, I’d treat 800M as a central-to-optimistic estimate, with a downside scenario of 600M–700M (if some users are transient) and an upside of 900M–1B if growth continues past viral feature momentum.

From a portfolio perspective, I’d lean with conviction around infrastructure and monetization adjacencies rather than betting solely on the headline growth metric.