All three point at the same macro: infrastructure + optionality. OpenAI’s AMD pact institutionalizes a two-supplierfuture for frontier compute and kicks off a new power/packaging/HBM capex wave; BofA’s note reframes AI as a resources supercycle, with copper and grid hardware as the critical path; and Sikorsky’s Nomad shows defense shifting to modular, autonomous fleets with fast payload iteration. Investor playbook: buy the bottlenecks and enablers (HBM, optics, cooling, transformers, wire/cable), take selective copper/grid exposure for the AI build-out, and keep a sleeve in defense sensors/autonomy/counter-UAS to ride the military’s software-paced refresh.

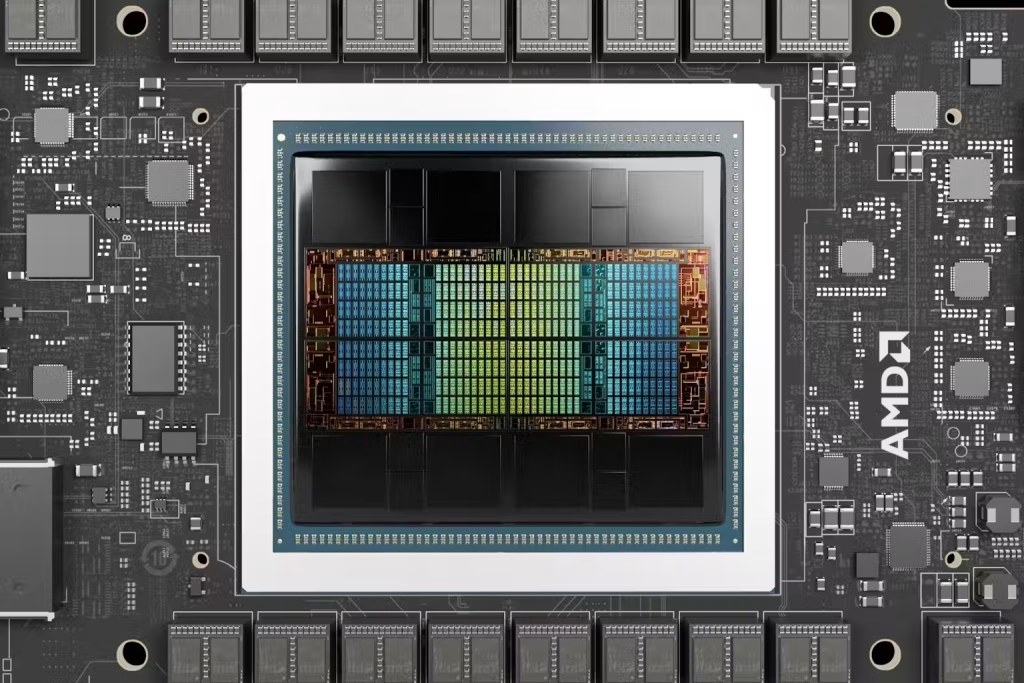

Good: OpenAI’s mega-deal with AMD — diversifying away from a single GPU supplier

What it is:

OpenAI struck a multi-year chip supply partnership with AMD built around AMD’s next-gen Instinct MI450 GPUs. Headlines highlight ~6 gigawatts of compute capacity over the agreement, with an initial ~1 GW deployment starting 2H 2026. OpenAI also received warrants for up to ~160M AMD shares (≈10%) contingent on milestones — a financial sweetener that signals long-duration alignment. This is about supplier diversification: OpenAI has leaned heavily on Nvidia; this deal builds a second pillar so model training/inference isn’t bottlenecked by a single vendor’s roadmap or allocation. AMD shares spiked >20% on the news.

What it will do:

- Two-horse race gets real: Big buyers now have credible dual-sourcing for frontier compute, which can improve pricing, availability, and bargaining power versus a one-vendor world. Expect tighter competition on software stacks (ROCm vs CUDA) and on HBM/packaging supply priority.

- Power is the new capex governor: Standing up 6 GW of AI compute drags along substations, transformers, liquid cooling, and fiber backhaul — the constraint may be megawatts and materials as much as chips.

- Equity & ecosystem knock-ons: AMD’s order book/visibility improves; adjacent suppliers in HBM memory, advanced packaging, optics and grid gear get multi-year demand signals.

How you can benefit:

- Own the bottlenecks, not just the logo: Screen HBM vendors, advanced substrate/OSAT, optical transceivers/switches, immersion cooling, transformers/HV switchgear, and EPCs tied to data-center interconnects. These monetize regardless of CUDA vs ROCm share.

- Software parity trade: Watch for ROCm adoption inflecting via frameworks (PyTorch, Triton). If tooling gaps close, AMD share of AI workloads can ramp faster than consensus — a lever for acceleration in utilization and accessoriesspend.

- Event calendar: Stage into names ahead of tape-outs, MI450 availability, and hyperscaler capex updates; hedge with options around those catalysts to manage volatility.

Bad: BofA: To Ride AI, Buy Resources — Copper is the Tip of the Spear

What it is:

Bank of America is telling clients the AI build-out isn’t just a tech trade — it’s a resources trade. Their note (picked up by MINING.COM) argues data-center expansion and electrification are copper-hungry, with BNEF pointing to ~400k tons/year of AI-linked copper demand on average over the next decade (peaking ~572k t in 2028), and cumulative ~4.3M tons for data centers alone. Supply growth lags, setting up tight markets and potentially higher prices.

What it will do:

- Capex mix shifts to “atoms”: More dollars flow to wire, cable, transformers, switchgear — and the mines feeding them. Even modest delays at new copper projects can torque the curve.

- Project economics re-rate: If copper trends toward $13,500/t by 2028 (BNEF scenario cited), marginal projects flip from borderline to bankable, pulling forward brownfield expansions and sustaining capex.

- Cross-commodity echoes: Tight copper often drags aluminum substitution, silver (for power gear/solar), and rare-earths (motors) into play — diversified miners with copper at the core benefit most.

How you can benefit:

- Quality copper first: Favor low-cost, politically stable copper producers/developers with expandable assets; stress-test with conservative decks and permitting timelines.

- Own the mid-stream: Names leveraged to wire/cable, transformers, and grid hardware monetize rising unit volumes even if metal prices chop. Track transformer lead times and utility RFPs.

- Options around catalysts: Express the thesis with structured exposure (e.g., calls or call spreads) into BNEF/IEA updates, miner production reports, and U.S. grid-funding milestones.

Ugly: Sikorsky’s “Nomad” Drone Family — Group 3 Tests Starting Soon

What it is:

Sikorsky (Lockheed Martin) unveiled Nomad, a family of VTOL, twin-proprotor “rotor-blown-wing” drones spanning Group 3 to Group 5. The first up, Nomad 100 (Group 3), is slated to begin flight testing in the coming months. The design aims at austere-environment ops (ISR, cargo, and “light kinetic”), running on the MATRIX autonomy stack with an open-systems architecture — i.e., built to slot sensors/payloads fast.

What it will do:

- From prototypes to product line: This formalizes years of rotor-blown-wing R&D into a scalable family that can cover small-unit ISR through Black Hawk–sized logistics/strike, compressing development via common autonomy and interfaces.

- Operational flexibility: Ship-deck and rough-field ops with hover-to-cruise transitions broaden mission sets and complicate air-defense/counter-UAS planning — especially if Group 4/5 variants mature.

- Procurement ripple: Open architecture + autonomy lends itself to kit upgrades and faster fielding cycles; primes and sensor houses positioned for payload swaps (EO/IR, EW, comms, SAR) gain.

How you can benefit:

- Sensors & effectors > airframes: Track suppliers in radars/IRST, EW pods, datalinks, and lightweight munitionsaligned to Nomad-class payloads; these enjoy recurring upgrade cycles.

- Autonomy & MRO flywheel: Autonomy stacks (perception, navigation, contested-EM hardening) and sustainment(spares, depot work) can be higher-margin, longer-tail revenues than one-off drone sales.

- Counter-UAS as hedge: Increased fielding of rotor-blown-wing systems should also lift counter-UAS demand (jammers, SHORAD, AI tracking) — a paired trade that lowers single-program risk.