Put together, these three stories are all about who controls the next layer of capital and compute:

- The SEC wants to reopen the public-market spigot, which means you’ll see more small/mid-cap listings and more chances to get in earlier on real businesses — plus more junk you have to filter out yourself.

- Apple is quietly turning AI into a hardware tax and locking it into a 2-billion-device ecosystem, making itself thedefault “safe AI” equity for a lot of portfolios.

- The quantum race reminder from Martinis says the US/China tech rivalry is moving from GPUs to qubits, and the knock-on effect will be bigger budgets for quantum R&D and quantum-safe security.

For an investor, the playbook looks like this:

Own the platforms (AAPL, MSFT, GOOGL), own the pipes & security (exchanges, cyber, PQC), and treat the new IPO/quantum stuff as high-beta satellites — not the core of the portfolio.

Good: SEC chair: “Public markets are worth reviving”

Whats Up?:

SEC chair Paul Atkins at the NYSE says: we’ve over-regulated public markets, and it’s time to roll some of that back.

Key points:

- Atkins notes US public listings are down ~40% since the mid-1990s.

- He blasted “regulatory creep” and “voluminous disclosure requirements,” especially for smaller companies, and pitched less paperwork as a kind of “250th birthday gift for CEOs.”

- Earlier this year he blessed the idea of twice-yearly earnings reports (like Europe), instead of relentless quarterly guidance. Semafor

- The whole agenda: cut disclosure burden and size-based rules so more smaller firms find IPOs attractive again.Ground News

So the story in plain English: the SEC is actively trying to “make IPOs great again” and bring more companies back to public markets.

What’s Next:

- More IPOs, especially small/mid-cap names:

- Lower compliance cost + easier listing = more companies deciding to list instead of staying in VC/PE purgatory.

- Higher noise and risk in the public universe:

- Looser rules mean more good companies and more questionable ones make it out. The filter shifts from the SEC to the market.

- Less concentration over the long run:

- If this works, the US market slowly transitions from “all in mega-cap tech” to a richer mid-cap ecosystem again. That’s good for diversification, but it will take time.

- Disclosure asymmetry:

- Semiannual reporting and lighter disclosure = fewer datapoints. The informational edge shifts toward investors who actually read filings and do channel checks, not just scan quarterly headlines.

What Can You Do?:

Here’s how you can use this:

- Prep for an IPO wave (2026–2027 vintage):

- Expect more listings in software, AI infra, climate/energy tech, biotech, and niche industrials.

- Treat them like public VC: small positions, basket approach, high failure tolerance.

- Small-cap and exchange plays:

- IWM / IJR and other small-cap ETFs benefit if the listed universe expands and liquidity improves.

- NDAQ / ICE / CBOE benefit from more listings + more trading volume.

- Do your own fundamental work:

With lighter rules, “trust the SEC to filter for me” stops working. You want to lean into:- Revenue quality (recurring vs one-off),

- Path to profitability / cash flow,

- Insider lockups and dilution risk.

This is a nice setup if you like hunting early-stage public names, but you have to treat it like hunting, not passive indexing.

Bad: Apple’s stock hitting fresh highs

Whats Up?:

Apple is back near/all-time highs and on a serious streak, and strategists are explaining why.

From recent Yahoo coverage:

- Apple (AAPL) just hit a fresh intraday high and is on track for its 7th straight day of gains, per the Canada video hub snippet.

- The stock has flirted with or approached a $4T market cap, powered by optimism around its iPhone cycle and the broader market drifting back toward record levels.

- Strategists are pointing to:

- Strong demand for the newest iPhones,

- The perceived safety of Apple in a choppy macro tape,

- Growing belief that “Apple Intelligence”/on-device AI could kick off a multi-year upgrade wave as older devices miss out on the full feature set. Yahoo Finance

So the story: Apple is being re-rated as the “steady compounding AI hardware platform,” not the flashy AI lab — and the market likes that.

What’s Next:

- AI = upgrade tax: If full-fat AI features only run well on newer devices, you get a forced refresh dynamic: people upgrade just to stay in the ecosystem. That supports multi-year hardware revenue.

- Services piggyback: More modern devices = more services attach (iCloud, TV+, Arcade, Pay, etc.) → higher ARPU and more recurring revenue. That’s what justifies a premium multiple.

- Apple as a “defensive AI play”: Versus high-beta AI names, Apple feels boring in a good way: massive cash, buybacks, entrenched ecosystem. In a world where people are nervous about an “AI bubble,” that relative stability is a selling point.

- Valuation ceiling risk: Near $4T and record highs, expectations are loaded. Any disappointment in iPhone units, China demand, or AI rollout could produce sharp pullbacks.

What Can You Do?:

Practical ways to think about it:

- Core hold, not lottery ticket:

- AAPL works as a core portfolio anchor if you want tech and AI exposure without gambling on unprofitable names.

- Set a max weight (e.g. 4–6% of equity book) and treat it like infrastructure, not a meme.

- Play the supply chain if you want more torque:

If you buy the “AI-driven supercycle” thesis:- Look at high-quality component suppliers (chips, cameras, displays, RF) that get unit leverage.

- Those can have more upside on strong cycles, but more downside on misses.

- Be patient on entry:

At all-time highs, it’s reasonable to:- Scale in over time,

- Add more aggressively on macro scares or Apple-specific dips (reg headlines, short-term demand worries) rather than chase spikes.

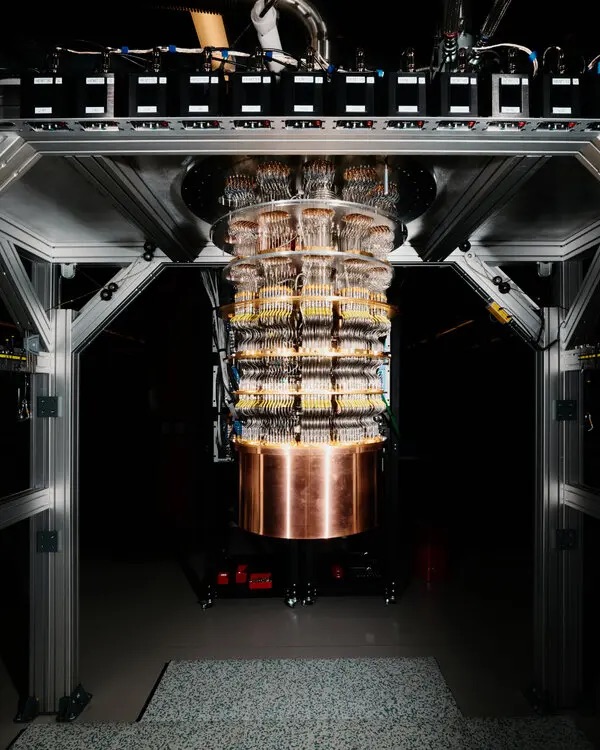

Ugly: Nobel winner John Martinis: China is “nanoseconds” behind in the quantum race

Whats Up?:

John Martinis, one of this year’s Nobel Prize in Physics winners. Martinis warns that China is “nanoseconds” behind the US in quantum computing, not miles behind.

He says, “People should be concerned that there’s a real race,” and notes China is “definitely very competitive” in the field.LinkedIn

The context:

The US has led high-profile demonstrations of quantum supremacy, but China has made big strides in quantum communication, photonic systems, and state-backed industrial effort.

The stakes are national security (breaking encryption), commercial advantage (optimization, materials, pharma), and tech prestige.

So the story is: a top physicist is basically ringing the bell that the US/China quantum gap is narrow and strategic, not comfortable.

What’s Next:

- Quantum R&D spending ramps: A “race” framing + national security implications = more government money into quantum hardware, software, and post-quantum cryptography (PQC).

- Pressure on encryption & security standards: Even if large-scale, code-breaking quantum machines aren’t here yet, the possibility forces governments and big firms to start migrating to quantum-resistant cryptographic schemes.

- Industrial policy & export controls: Expect more US export controls around quantum hardware, as well as China doubling down on domestic capability. That could mirror the AI chip situation, but with dilution refrigerators and qubits instead of GPUs.

- Timeline uncertainty, but direction is clear: Nobody can say “when” with precision — but the message is: this is not sci-fi anymore. That’s enough to move budgets and standards.

What Can You Do?:

- This is early-stage stuff, so you want to play the picks & shovels + security, not try to guess the winning qubit design.

- Big-tech R&D backers (safer angle):

- MSFT, GOOGL, IBM, AMZN all have significant quantum programs and cloud-based quantum offerings.

- You’re not buying them for quantum, but quantum is a free call option layered on top of core businesses.

- Post-quantum cryptography & security:

- Cyber/security firms that work on PQC, key management, identity security (think big names like PANW, CRWD, FTNT, OKTA, plus niche crypto/security vendors) stand to benefit as standards shift.

- Banks, telecoms, and governments will need help migrating critical systems.

- Avoid YOLOing quantum pure-plays unless you size tiny:

- Hardware is insanely capital intensive and science-risk heavy.

- Many listed “quantum” small caps are more story than substance. If you touch them, treat it like VC-style spice in the portfolio, not the main course.

🏛 Theme 1 – “Public Markets Revival” (SEC loosening the screws)

🔹 What you’re playing

SEC wants to make it easier/cheaper to go public and possibly move toward twice-yearly reporting for many companies. That means:

- More IPOs, especially small/mid-cap

- More trading volume

- More noise → edge shifts to people who actually do homework.

🧱 Core holdings (lower risk, structural plays)

These are ways to benefit from public-markets revival without having to pick specific IPOs:

- IWM / IJR / similar small-cap ETFs

- Broad exposure to US small caps that should benefit from a richer listed universe over time.

- NDAQ / ICE / CBOE

- Own the venue and plumbing: more listings + more volatility = more trading fees and data revenue.

🎯 Speculative satellites (higher risk, alpha hunting)

- Selective new IPOs in:

- Software / infra

- AI tools

- Climate/energy tech

- Niche industrials

- Small-cap “fallen angels” that benefit from more liquidity and risk-on flows (stuff that got crushed 2022–2024 but still has real businesses).

How to handle satellites:

- Basket them (don’t fall in love with a single name).

- Think 1–3% total portfolio across all these combined, not per name.

⏱ Key catalysts (12–24 months)

- Actual SEC rule changes finalized (disclosure/reporting frequency).

- Visible pickup in IPO volume & reopening of the “normal” IPO calendar (not just mega deals).

- Periods of risk-on (VIX dropping, credit spreads tighter) → better window for new listings.

- Any moves on retail investing access (e.g., rules making it easier to participate fairly in IPOs).

🍏 Theme 2 – Apple & the “On-Device AI Tax”

🔹 What you’re playing

Apple turning AI into a hardware/upgrade tax: if you want full Apple Intelligence and new AI toys, you need newer devices. That means:

- Multi-year iPhone + ecosystem upgrade cycle

- Services ARPU grind higher

- Apple as the “boring, reliable AI trade” vs frothy LLM startups.

🧱 Core holdings

- AAPL

- Treat it as a core compounding anchor: cash machine, buybacks, sticky ecosystem, AI as a demand kicker.

- Good for people who want AI exposure but don’t want to babysit 20 speculative names.

Optional “AI platform barbell” next to AAPL:

- MSFT, GOOGL – both benefit from AI, quantum, and cloud; good to pair with Apple if you want a mega-cap AI trio.

🎯 Speculative satellites

If you want more torque than AAPL itself:

- Apple supply-chain names (examples of types):

- High-end camera/sensor makers

- Advanced display suppliers

- RF / connectivity chips

- Packaging / foundry capacity tied to Apple SoCs

- Accessory ecosystem: high-margin stuff that rides the install base (audio, peripherals, etc.).

These can outperform AAPL in hot cycles but will also get smoked harder in slowdowns.

⏱ Key catalysts (12–24 months)

- iPhone launch cycles and how “AI-only on newer chips” messaging evolves.

- Uptake/engagement data on Apple Intelligence and AI features.

- Services numbers: subscriptions growth, ARPU trends in earnings.

- Any big regulatory hits (app store, competition policy, China tension) that create dip-buy windows.

⚛️ Theme 3 – Quantum Race & Quantum-Safe Security

🔹 What you’re playing

Nobel laureate Martinis basically saying China is only “nanoseconds” behind the US on quantum. Translation:

- Governments see this as a national security / encryption / power issue.

- Big ramp in quantum R&D + post-quantum cryptography (PQC) budgets.

- Security + infra layer becomes a long-duration growth story.

🧱 Core holdings

You don’t need to guess the exact qubit tech – you can own the platforms & security:

- Big Tech with quantum programs

- MSFT (Azure Quantum + enterprise/security DNA)

- GOOGL (quantum hardware, AI, and cloud)

- IBM (public quantum roadmap + enterprise focus)

- You’re buying cloud + AI + software, with quantum as a call option.

- Cybersecurity & identity / access

- Think a basket like CRWD, PANW, FTNT, OKTA

- These will be at the center of:

- PQC migration projects

- “Quantum-safe” enterprise and government upgrades

- AI-enhanced detection and threat response

🎯 Speculative satellites

- Quantum pure-plays (hardware, niche software):

- Extremely early, science + capital intensive, very story-driven.

- If you touch them, think 0.5–1% of portfolio total across all such names, max.

- PQC / crypto-infra niche players

- Smaller companies building quantum-resistant key management, PKI, or secure messaging.

- They can win big if chosen as standards, or vanish if not.

⏱ Key catalysts (12–24 months)

- Government quantum initiatives (US, EU, China, etc.) – new funding announcements, national strategies.

- Adoption of post-quantum crypto standards (NIST, big consortia etc.), and first large enterprises actually migrating.

- Early, credible demonstrations of useful quantum advantage beyond lab hype.

- Big contracts in defence / finance / telecom for PQC and quantum-related infra.

🧩 Putting it together – a simple structure

Obviously not financial advice, just a framework you can tweak:

1️⃣ Core bedrock (60–75% of equity chunk)

- AAPL, MSFT, GOOGL (and possibly IBM)

- Small-cap exposure via IWM / IJR

- 1–2 cyber names (e.g., CRWD + PANW)

- Optional: 1 exchange/market infra name (NDAQ/ICE)

These give you:

- AI + platform upside

- Public-market revival exposure

- Security/quantum-risk hedge

2️⃣ Thematic “edges” (15–25%)

- Add to:

- Extra cyber/identity (OKTA, FTNT)

- Extra small/mid-cap factor

- Apple/AI supply chain picks you like after research

3️⃣ True speculative satellites (max 5–10% total)

- New IPO basket (small checks in 3–8 names)

- Quantum pure-plays / niche PQC names

- Any “offense-side” cyber/defence tech startups that eventually list

Treat this bucket as venture-style: you expect a few duds, and you size it so portfolio-level damage is small.