Big picture, bro: all three stories are really about who controls the pipes — compute pipes, fiscal pipes, and literal energy pipes.

- Google’s TPUs vs Nvidia show how control of AI compute is becoming a strategic resource, with hyperscalers trying to break dependence on a single vendor and verticalize their stacks.

- The U.K. OBR headroom story shows how fiscal room (or lack of it) shapes what a government can realistically do on growth and investment without blowing up its bond market.

- Canada’s energy minister / B.C. pipeline fight is about physical export pipes — how and whether Canada can turn resources + LNG + clean power into actual long-term cashflows within tight climate and indigenous-rights constraints.

From an investor angle, the through-line is:

Own the enablers that sit on these choke points — AI silicon platforms (NVDA, GOOGL), credible sovereign debt / macro exposure (gilts, U.K. domestic plays), and well-positioned infra/energy names in Canada — but always price in policy, legal, and ecosystem risk, because that’s where the edges will be made or lost.

Good: Google’s TPUs vs Nvidia’s GPUs – what’s really different?

Whats Up?:

Bloomberg’s piece is basically asking: are Google’s homegrown AI chips (TPUs) finally a real threat to Nvidia’s GPUs?

Quick context:

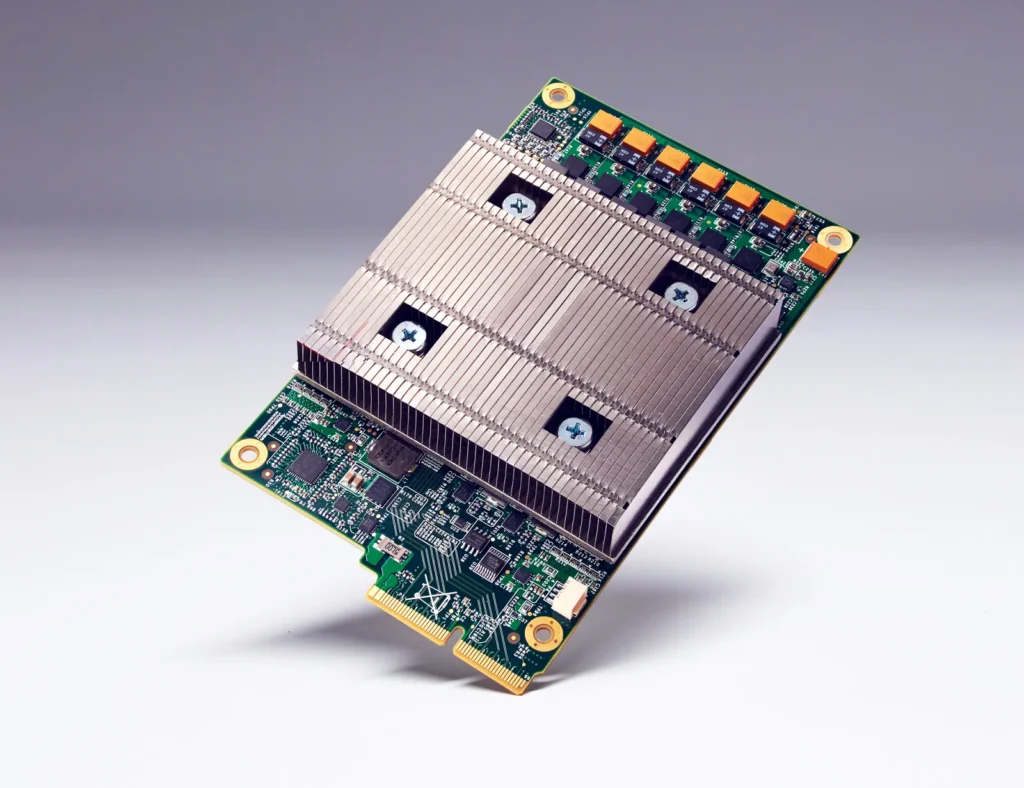

- TPUs (Tensor Processing Units) are Google-designed AI accelerator ASICs, tuned for matrix math and TensorFlow workloads. They’ve been used internally since 2015 and offered on Google Cloud since 2018.

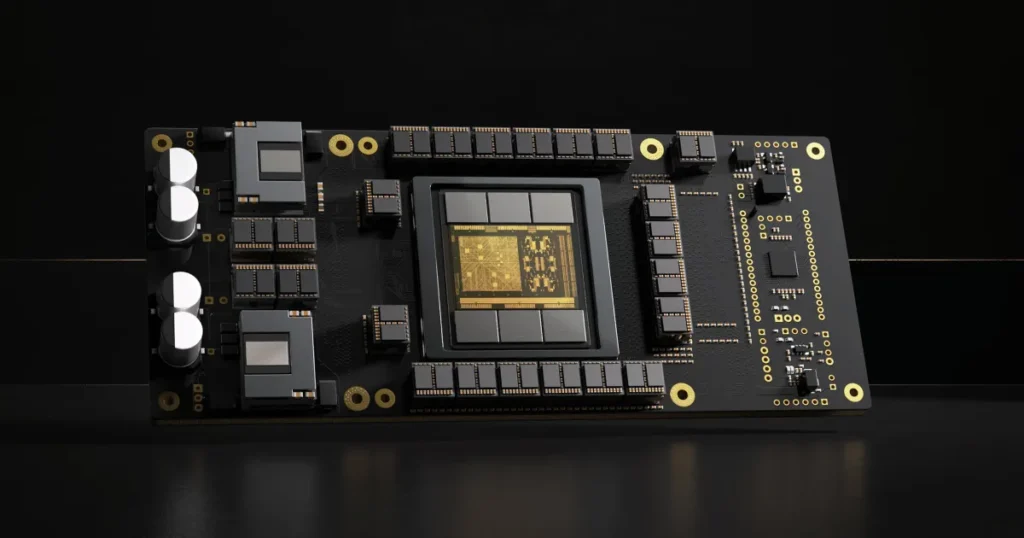

- Nvidia’s GPUs have been the default for AI because of CUDA + ecosystem + flexibility — you can train almost any model, on almost any framework, at massive scale.

- The article is landing right as reports say Meta is in talks to use Google TPUs for data centers, potentially renting them from Google Cloud, which spooked Nvidia’s stock and signaled TPUs are no longer just “Google internal toys.” Wall Street Journal

In short: Google’s been quietly iterating TPUs for a decade; now with Trillium (v6) and TPU v7 “Ironwood”, they’re fast and efficient enough that hyperscalers (Meta, maybe others) are openly considering them as an alternative to Nvidia in at least part of their stack.

What’s Next:

- Real (but not fatal) competition for Nvidia:

- TPUs are ASICs: great for specific large-scale AI workloads (like LLM training/inference on Google’s stack).

- Nvidia’s edge is still: flexibility + ecosystem + developer mindshare + CUDA. Most open-source tooling assumes “Nvidia first.” Competitors have to fight software inertia, not just hardware. Tom’s Hardware

- Cloud platforms become AI hardware vendors:

- Google isn’t just selling cloud — it’s selling its own silicon as a platform. Same direction for AWS (Trainium/Inferentia) and Meta building in-house chips. That fragments demand for Nvidia over time.

- Pricing power could soften:

- If Meta and others secure large TPU capacity, Nvidia may lose some “take any price” leverage at the margin, especially on future generations (Rubin, Feynman).

- Specialization vs fungibility:

- TPUs are killer inside Google Cloud and for customers willing to adapt to that stack. Nvidia’s GPUs remain the fungible asset you can deploy across clouds, on-prem, different vendors — that still matters to a lot of enterprises and startups.

What Can You Do?:

Nvidia (NVDA)

- Still the “AI picks & shovels” king, but multiple compression risk if investors start to price in real competition.

- For existing holders: this feels more like “air out the froth” than “game over.” Watch:

- Data center revenue growth

- GPU utilization and backlog

- How aggressively they push Rubin / Feynman roadmap vs price cuts.

Alphabet / Google (GOOGL)

- TPUs turn Google Cloud into a vertically integrated AI infra play: chips + models (Gemini) + platform.

- Things to watch:

- Cloud growth vs Azure/AWS

- Disclosed TPU utilization / big external deals (Meta, Anthropic-style)

- Margins on AI infra (does in-house silicon drop unit costs?)

Second-tier GPU / accelerator challengers (AMD, Intel Gaudi, etc.)

Thesis: you get a basket of “Nvidia alternatives” if you believe we’re moving from single-vendor dominance to a more mixed environment.

If hyperscalers are now willing to experiment away from Nvidia, that’s also a door opening for AMD AI GPUs, Intel Gaudi NPUs, etc.

Bad: U.K. government gets more “headroom” under its fiscal rules

Whats Up?:

The WSJ/OBR angle: the Office for Budget Responsibility (OBR) says the U.K. government now has more “headroom” to meet its self-imposed fiscal rules than it did earlier, thanks to updated forecasts and Rachel Reeves’ tax-heavy budget.

Key bits from the OBR read-through: MarketScreener

- They expect U.K. GDP growth around 1.5% in 2025, then a modest pickup later.

- Public finances still look tight, but the combination of tax rises and spending decisions gives Reeves some cushionrelative to her rule that debt must be falling as a share of GDP over a 5-year horizon.

- “Headroom” doesn’t mean lots of spare cash; it means the risk of breaking the rules is a bit lower than feared.

So the story is: the U.K. is not out of the woods, but the bond vigilantes’ nightmare scenario (à la mini-budget 2022) is not where we are right now.

What’s Next:

- Gilt market relief, but not euphoria: More headroom + credible watchdog = less risk of a sudden gilt tantrum. That can keep 10-year gilt yields from blowing out, which in turn stabilizes mortgage rates, corporate borrowing, and FX expectations. TradingView

- Policy space for targeted investment: Reeves can theoretically fund some priority areas (infrastructure, green investment, NHS, defence) without instantly breaking her own rules. But any negative growth shock or revenue shortfall can eat that headroom very fast.

- Political risk still matters: Future budgets, elections, and any surprise spending promises could flip this narrative. Markets now watch credibility as much as numbers — the memory of past fiscal chaos is still fresh.

What Can You Do?:

- Gilts / U.K. duration: If you believe Reeves will stay disciplined, U.K. government bonds could look more stable, maybe decent for carry if yields remain above other safe assets. Watch: OBR revisions, growth surprises, and any large off-balance-sheet commitments.

- U.K. domestic equities (FTSE 250, small/mid caps): A more stable fiscal outlook reduces tail-risk premia — supportive for domestically geared names (banks, homebuilders, retailers). Focus on sectors that benefit from any incremental public investment: infrastructure, construction, green/energy transition, rail/transport.

- GBP positioning: “More headroom” is mildly GBP-positive vs a scenario of looming fiscal blow-up. But FX will still trade heavily on relative growth vs U.S./Eurozone and BoE policy path, not just budget rules.

Ugly: Ottawa’s energy minister, B.C., and the new pipeline/LNG fight

Whats Up?:

The Yahoo Finance piece is part of a cluster of Canadian stories around Ottawa’s evolving energy deal with Alberta, a potential new pipeline to the B.C. coast, and major LNG/export projects:

Key context pulled from the surrounding coverage:

- The federal government (PM Mark Carney’s team) and Alberta have agreed on the broad outlines of an energy deal that includes support for a new oil or gas pipeline corridor toward the Pacific, plus help on decarbonization.Yahoo News

- Ksi Lisims LNG on B.C.’s north coast is being framed as a “nation-building” project and could become Canada’s second largest LNG export terminal, tied into new pipeline infrastructure from the Prairies.

- B.C. Coastal First Nations and some local stakeholders are strongly opposed, warning that a new pipeline to the coast “will never happen” in their view.

- Federal Energy & Natural Resources Minister Tim Hodgson has been telling media he’ll brief B.C. MPs and the province and consult “in short order” about what Ottawa and Alberta are cooking up. Yahoo Finance

So the article is basically: Ottawa and Alberta are lining up big oil/gas export and LNG infrastructure, while B.C. and First Nations are demanding a say and hinting at hard pushback.

What’s Next:

- Pipeline / LNG optionality for Canada’s exports:

- If this corridor and Ksi Lisims go ahead, Canada gets another major Pacific export outlet, targeting Asian demand and positioning LNG as a “transition fuel” in the national strategy. Yahoo Finance

- Regulatory & legal risk is huge:

- First Nations title, environmental concerns, B.C. political dynamics, and court challenges are very real.

- Canada has a track record of big projects being delayed or cancelled after years of fight (think Northern Gateway/Trans Mountain saga).

- Energy-transition politics sharpen:

- Carney has tied his budget and climate pledges to big green/energy-transition projects; pipelines + LNG are being sold as part of that transition, not opposed to it. Yahoo Finance

- That tightrope — exports + emissions caps + LNG as “cleaner” fossil — will define federal-provincial politics for years.

What Can You Do?:

- Canadian midstream & LNG-linked names: Companies involved in pipelines, midstream, and LNG export facilities could benefit massively if these projects are permitted and financed. But: timeline and political risk are brutal. Treat these as high-beta, high-headline-risk holdings.

- B.C. critical minerals / power build-out: Parallel to the pipeline/LNG story, B.C. is streamlining renewable permitting and pushing a “Clean Power Action Plan” to double its clean power by 2050. Bennett Jones That means upside not just for hydrocarbons but also for transmission lines, hydro, wind, and critical minerals. If the pipeline drama drags, the clean-energy side might move faster and be politically easier.

- Macro Canada allocation: If Canada successfully executes: you get energy export upside + green infra build-out. If it bogs down in political/legal gridlock: capital may prefer U.S. or other producers with clearer paths. From a portfolio standpoint, you treat Canada as a levered play on global energy demand + ESG politics — great upside if policy execution is competent, messy if not.

THEME 1 — AI Compute Battle: Google TPUs vs Nvidia GPUs

Investment Thesis:

Hyperscalers are actively trying to de-Nvidia their stacks. Not a death blow, but a structural shift in bargaining power + margins.

Primary Tickers

| Ticker | Company | Why It Matters |

|---|---|---|

| NVDA | Nvidia | Still king of AI compute, but faces erosion in hyperscaler dependence. |

| GOOGL | Alphabet | TPU verticalization → lower AI compute cost, higher gross margins in Cloud. |

| AMD | AMD | Beneficiary of any “multi-vendor GPU” trend. |

| TSM | TSMC | The real winner under every scenario — builds both Nvidia GPUs and Google TPUs. |

| META | Meta | If they shift meaningful workloads to TPUs, they reduce AI capex dependency. |

Investor Action Plan

Base Case Position (Neutral/Constructive):

- Long NVDA, but trim exposure from hyper-concentration (no more than 5–7% of a portfolio).

- Add GOOGL as a “AI Infra Margin Expansion” play.

- Add TSM as the safest semi pick — benefits regardless of chip winner.

Offense (If you think TPU adoption accelerates):

- Increase GOOGL exposure → TPUs = cloud margin expansion + bargaining power.

- Add AMD as an asymmetric play if hyperscalers diversify.

Defense (If AI compute pricing falls fast):

- Reduce NVDA multiple-sensitive holdings.

- Pair-trade long GOOGL vs short high-multiple AI hardware names.

🇬🇧 THEME 2 — U.K. Fiscal Headroom & Stabilization

Investment Thesis:

No boom, but markets are calming. Reduced sovereign risk → better environment for domestic equities, gilts, and GBP stability.

Primary Tickers / Instruments

| Ticker | Asset | Why It Matters |

|---|---|---|

| EWU | U.K. equities ETF | Macro way to express “U.K. stabilization” trade. |

| SMDS.L / SBRY.L / TSCO.L | U.K. domestic consumer names | Sensitive to borrowing costs + stability. |

| BARC / LLOY | U.K. banks | Benefit if gilt yields stabilize and mortgage markets calm. |

| IGLT | UK Gilt ETF | Duration play if fiscal credibility strengthens. |

| GBPUSD (FX) | Currency pair | Mildly GBP-positive scenario. |

Investor Action Plan

Base Case (Reeves stays disciplined):

- Add EWU for broad exposure.

- Pick 1–2 domestic cyclicals (Tesco, Sainsbury’s) for stability.

- Consider small exposure to IGLT for carry.

Offense (If growth beats & fiscal picture improves):

- Tilt into U.K. banks (Barclays, Lloyds).

- Long GBPUSD on a 6–12 month view.

Defense (If fiscal rules get blown later):

- Tighten U.K. exposure,

- Avoid gilts,

- Keep GBP hedged.

🇨🇦 THEME 3 — Canada’s LNG / Pipeline Corridor Fight

Investment Thesis:

If Ottawa & Alberta push through LNG + pipeline expansion, this becomes the biggest Canadian energy unlock in a decade.

But political and First Nations opposition = timeline risk.

Primary Tickers

| Ticker | Company | Why It Matters |

|---|---|---|

| ENB | Enbridge | Most levered to new pipelines & midstream expansion. |

| TRP | TC Energy | Gas transport backbone — direct beneficiary. |

| TOU / ARX / CNQ | Canadian nat-gas & oil producers | Higher export capacity = better netbacks. |

| LNG | Cheniere (U.S.) | Indirect play — global LNG flows tighten if Canada ramps. |

| FTS / EMA | Utilities tied to B.C.’s clean power build-out | If renewable permitting accelerates. |

Investor Action Plan

Base Case (Project moves slowly but steadily):

- Accumulate ENB + TRP on dips.

- Hold Canadian producers with gas leverage (TOU, ARX).

- Add a small position in LNG for global LNG upside.

Offense (If Ottawa, Alberta, and B.C. actually align):

- Increase midstream exposure → ENB, TRP become multi-year compounders.

- Add higher-beta upstream names (Peyto, Birchcliff).

- Rotate into B.C. clean-grid utilities.

Defense (If political/legal blockage stalls everything):

- Avoid over-concentration in Canadian midstream.

- Stick with global LNG exporters (LNG, Shell, EQNR).

- Keep CAD exposure hedged.

🧩 COMBINED TAKEAWAY: THE META-STRATEGY

Across all three stories, the winners sit on infrastructure bottlenecks:

• AI Compute Bottleneck → NVDA, GOOGL, TSM

• Fiscal Stability Bottleneck → EWU, U.K. domestics, gilts

• Energy Export Bottleneck → ENB, TRP, LNG names

So your best overall investor plan is:

**⭐ Target infrastructure choke points

⭐ Diversify between compute, energy, and sovereign macro

⭐ Size positions based on political/regulatory risk

⭐ Use dips to scale into long-duration themes**