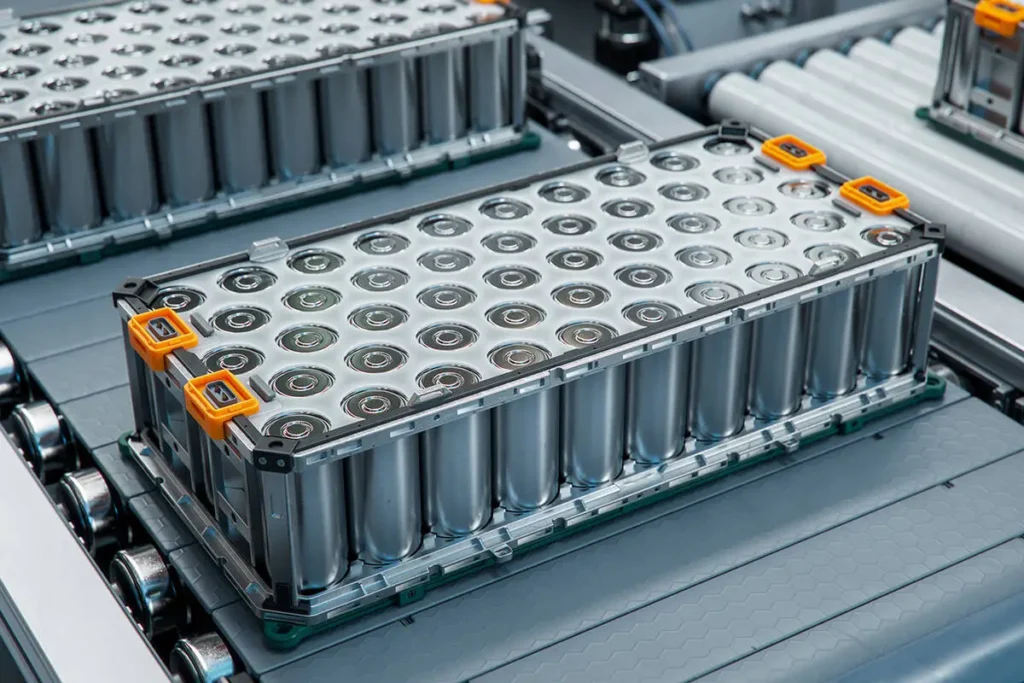

Good:Lithium Stocks Surge After CATL Suspends Operations at Chinese Mine

- What it is

Contemporary Amperex Technology Co. Ltd. (CATL), a major battery manufacturer, has halted operations at a significant lithium mine in China’s Jiangxi province. This move sparked a sharp spike in lithium prices and a rally in lithium-related stocks, including Tianqi Lithium (up ~19%) and Ganfeng Lithium (up ~21%) on the Hong Kong market. The performance rippled through to Australian and U.S. lithium miners, and futures prices jumped to the daily limit on the Guangzhou Futures Exchange Bloomberg.com. - What it will do

The shutdown removes a supply chunk from the lithium market, tightening availability of the critical battery metal. If CATL’s suspension persists or expands, supply constraints could intensify, potentially leading to sustained higher lithium prices. This could also pressure global manufacturers to seek alternative suppliers or accelerate recycling and battery technology innovations. - How you as an investor can benefit

Rising lithium prices and heightened supply risk may elevate profit margins for existing miners. Investors could consider exposure to lithium equities—like Tianqi or Ganfeng—or ETFs focused on EV and battery supply chains. Broader gains may follow in battery and EV sectors as their cost structures evolve. Trade angles include anticipating further supply disruptions and riding the commodity rebound.

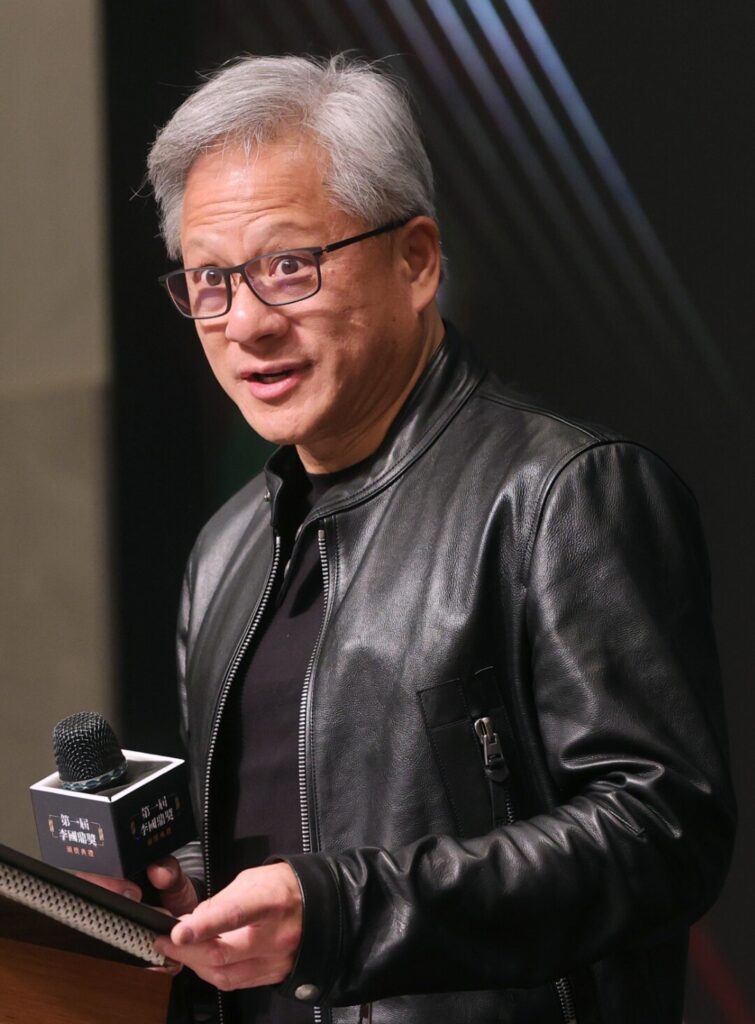

Bad: Nvidia Unveils “Cosmos” World Models & Infrastructure for Physical AI

What it is

Nvidia announced a suite of new AI tools tailored for robotics and physical applications, anchored by Cosmos Reason, a 7-billion-parameter reasoning vision-language model designed to enable AI agents and robots to plan and make decisions based on memory and physics. It also introduced Cosmos Transfer‑2, which accelerates synthetic data generation and a distilled, faster version. Additional infrastructure includes neural reconstruction libraries for 3D sensor-based rendering (integrated into CARLA), updates to the Omniverse SDK, the RTX Pro Blackwell Server for robotics workflows, and the DGX Cloud management platform TechCrunch.

What it will do

These tools enable developers to create more capable, physically aware AI agents, simulate environments, and train robots more efficiently using synthetic data. Nvidia’s infrastructure further streamlines the robotics development pipeline—from simulation to deployment—positioning the company to dominate in AI hardware, modeling, and software platforms for physical AI.

How you as an investor can benefit

This deepens Nvidia’s leadership in the future-facing field of robotics and embodied AI. Investors might consider existing exposure to Nvidia (NVDA) for upside, or look at ETFs focused on AI, robotics, or next-gen computing. Long-term, industries like manufacturing automation, autonomous vehicles, and smart logistics could benefit—offering cross-sector opportunities for technology-driven growth.

Ugly: Security Flaws in Automaker Portal Could Allow Remote Car Unlocking

What it is

A security researcher discovered critical vulnerabilities in an unnamed major automaker’s online dealer portal. The flaws allowed creation of a “national admin” account, granting access to private customer data, vehicle tracking, and remote features like unlocking cars via pairing through the portal. The vulnerability stemmed from login checks being bypassed via browser-side code manipulation, and also included single-sign‑on and user-impersonation risks across dealer systems. The automaker has since patched the issue TechCrunch.

What it will do

The disclosure raises awareness of cybersecurity weaknesses in dealer and OEM connectivity systems. We may see increased regulatory scrutiny, enhanced security budgets in auto OEMs, and potential liability or reputational costs. Patch mandates and compliance requirements could proliferate across the industry to prevent unauthorized access and ensure customer safety.

How you as an investor can benefit

Cybersecurity firms specializing in IoT, vehicle networks, and enterprise systems may see rising demand. Companies offering secure authentication, encryption, or incident response services could benefit from increased auto-sector demand. Conversely, direct equity exposure in the unnamed automaker may entail reputational risk; investors may prefer diversified cybersecurity ETFs or firms with a proven track record in automotive security.