Alright bro: these three stories all point to “maturity, concentration, and risk” in big sectors. CATL shows how scale and global expansion still reward, but only if you navigate geopolitics. X has opened a market place for dormant @’s/handles. And AWS’s outage is a reminder that massive concentration in critical infrastructure carries big fragility. For investors: lean into the companies building durable infrastructure or enabling diversification (battery supply chain, cloud resilience, value-added social apps), and keep an eye on risk triggers (export controls, monetization stalls, infrastructure dependency).

Good: Contemporary Amperex Technology Co. (CATL) Profit Surges 41% as Overseas Push Rolls

What it is:

CATL, the massive Chinese EV-battery maker, just posted a 41.2% year-on-year net profit increase for Q3 2025, roughly RMB 18.5 billion (about US $2.6 billion). Revenue grew ~12.9% to ~RMB 104.2 billion, improving from an 8.3% rise in Q2. Reuters They’re still top of the world in battery supply (to automakers like Tesla, Inc., Volkswagen AG, etc.), and are aggressively scaling production overseas (for example a plant in Hungary). But there’s a wrinkle: China is implementing new export controls on lithium‐battery parts starting November, which clouds CATL’s overseas plans.

What it will do:

- CATL consolidates a leadership position globally in EV battery systems, giving it pricing and scale advantages despite tough competition and slowdowns in the EV market.

- The export control risk means CATL’s overseas expansion could hit slower growth, higher costs, or regulatory bottlenecks—investors will be watching geopolitical risk.

- In broader terms, battery supply chains are shifting: dominance by a few players, greater value from overseas facilities, and new entrants trying to eat into CATL’s share (like internal battery-making by automakers).

How you can benefit:

- If CATL continues its margin expansion and overseas facility ramp-up, owning or gaining exposure to CATL (or companies heavily linked to its supply chain) could pay off.

- The export-control risk suggests opportunity for non-Chinese battery/parts companies (or automakers diversifying suppliers) to pick up share—so looking at “second tier” battery makers or equipment suppliers might be smart.

- Also, since CATL is entrenched, consider companies upstream in battery materials, e.g., lithium, cobalt, nickel, which feed battery makers: if CATL scales overseas, demand for those materials grows.

- Watch for earnings upgrades or analyst raises (some are already boosting CATL forecasts).

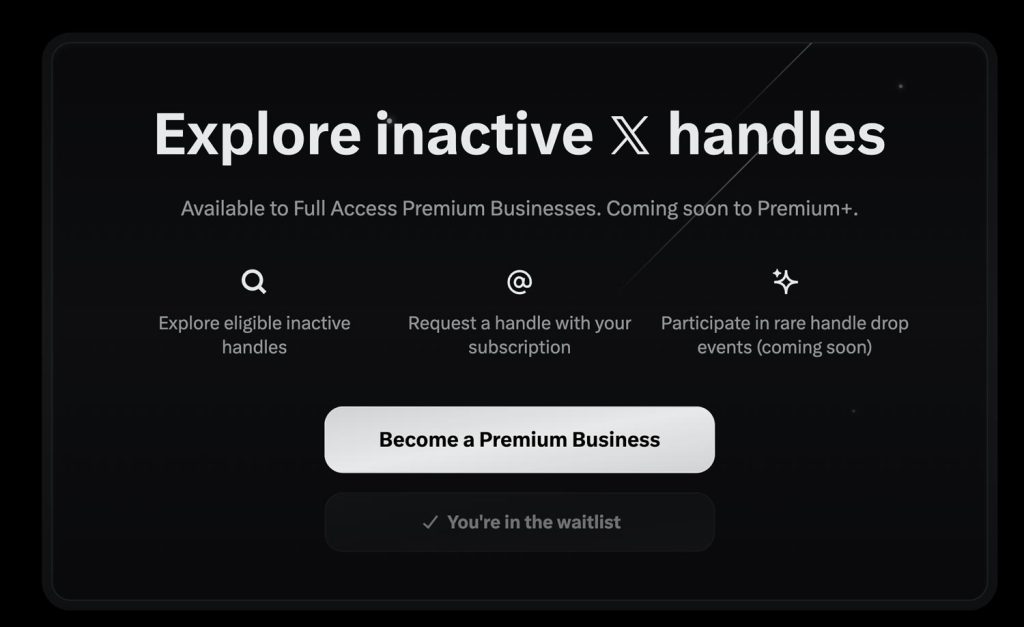

Bad: X’s “Handle Marketplace” — Buy the Username You Always Wanted

What it is:

X, the social platform formerly known as Twitter, is launching a new feature called the Handle Marketplace (or similar). Premium Plus and Premium-Business users will soon be able to browse and purchase inactive usernames (that is, @handles that are dormant) that they couldn’t snag originally.The Verge Handles are split into two pools: Priority handles (full names, alphanumeric combos) offered for free to eligible users, and Rare handles (high-demand, short, generic words) that will cost serious cash — from ~$2,500 up to over a million dollars depending on rarity.The Verge X says if you grab a new handle, your old handle is frozen (so no one else gets it), and if you downgrade your subscription, you may lose the purchased handle and revert to your old one.The Verge The move has big monetization intent: Get more paid subscribers, extract value from dormant handles, and create scarcity around naming rights.

What it will do:

- Branding arms race 2.0: Premium influencers, creators, companies will compete for premium handles (like @Music, @News, @Cars) — that drives up handle price and so X could unlock big bills.

- User equity & backlash risk: Many casual users may feel the “free username” pool is now rent-priced; risk of community frustration if handle-economy gets seen as pay-to-play.

- Subscription stickiness increases: By tying handle ownership to paid tier, X boosts its ongoing revenue and raises the cost of downgrading — reinforcing the premium tier.

- Precedent for digital identity monetization: This could lead other platforms to monetize dormant account names/assets, shifting user-identity norms.

How you can benefit:

- Platform monetization tailwind: If X can show new revenue from handle sales + higher subscription retention, the platform’s monetization multiple can expand. Consider exposure to X’s parent ecosystem (if public) or ad-tech infrastructure that supports premium features.

- Vertical opportunity for digital-identity services: Companies that help brands manage handle portfolios, monitor inactive name availability, or provide bidding/market data for rare names may emerge.

- Subscription ecosystem leverage: The model reinforces “paid tier = premium asset access.” Platforms with similar models could copy this: look at other apps where exclusivity (handles, vanity names, VIP badges) drives paid subs.

- Hedge the backlash risk: Because this is “pay for name” terrain, you might keep a hedge in ad/consumer platforms less dependent on monetizing identity-assets (just in case community push-back slows adoption).

Ugly: White House feud with Anthropic reveals deeper AI safety divide

What it is:

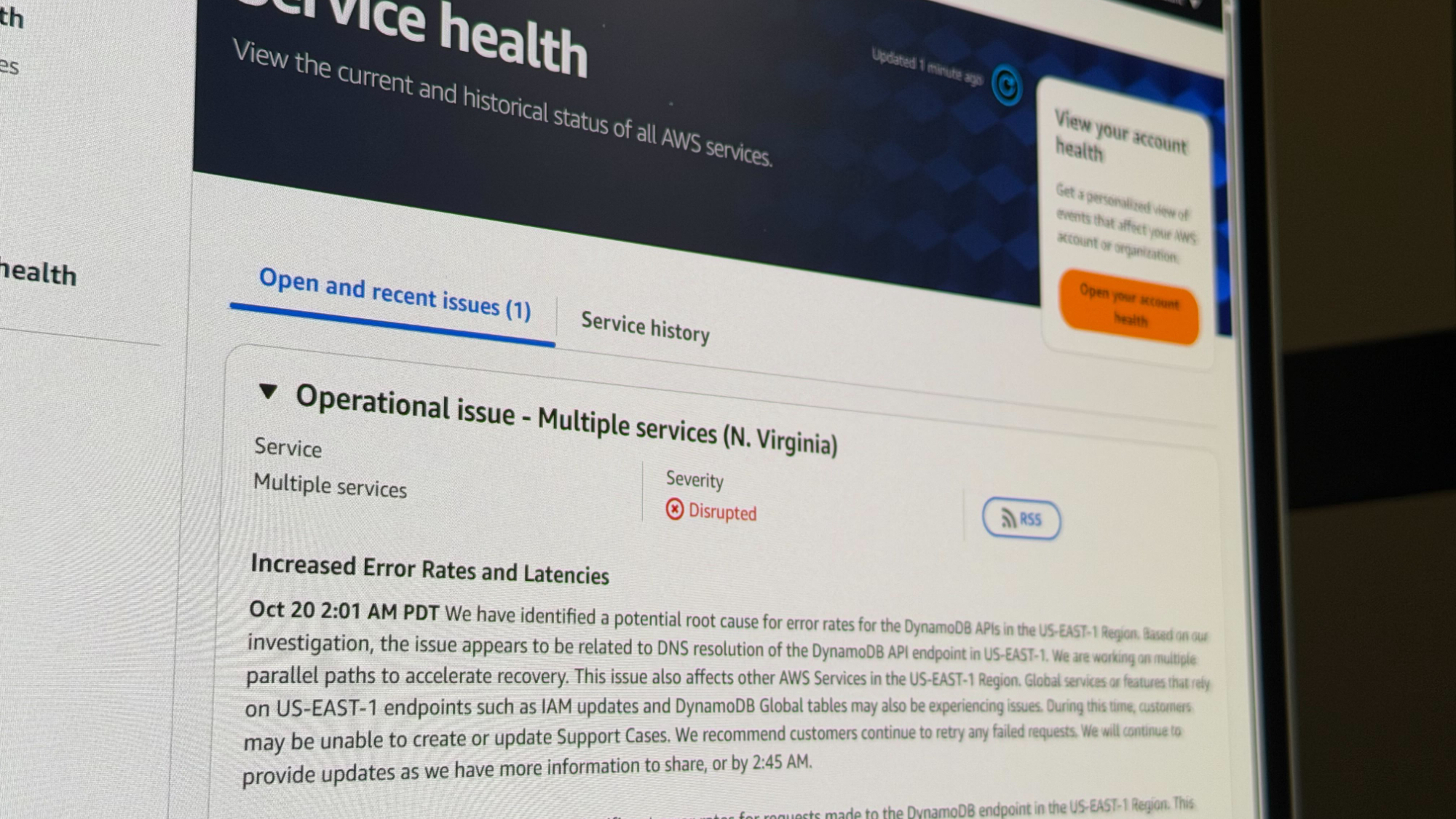

On October 20, 2025, AWS experienced a major global outage impacting dozens (if not hundreds) of major apps and services—¡including games like Fortnite, messaging apps like Snapchat, financial services, banking platforms in the UK, etc. Reuters The root cause appears linked to DNS or other infrastructure in AWS’s US-EAST-1 region. While AWS resolved the core issue in hours, the incident underlined the fragility of cloud infrastructure and the risk of concentrated dependencies.

What it will do:

- Enterprises and governments will reassess cloud risk and may diversify providers, build multi-cloud or hybrid cloud strategies more aggressively.

- Demand increases for resilience, monitoring, backup, incident-response services in cloud infrastructure—businesses willing to pay for reduced downtime risk.

- AWS (and other cloud providers) face reputational risk; their pricing/margins may get pressured if customers demand higher SLA credits or alternative architectures.

How you can benefit:

- Buy into companies offering cloud-resilience tools, backup solutions, multi-cloud management, etc.—as infrastructure risk becomes a sector theme.

- Also consider cyber-incident response, latency monitoring, DNS security firms—these could pick up demand from companies rethinking cloud architecture.

- On the flip side, cloud providers may face headwinds: slower spend growth, pricing pressure, or loss of share to smaller multi-cloud players. So consider hedging large cloud-incumbent exposures or tilting to emerging cloud providers.