Here’s the deal: Blue Water’s moving USVs from garage builds to factory lines, which is how you flood the harbour with smart boats on a budget. EA’s cashing the biggest PE check in gaming history, ducking Wall Street to rebuild its pipeline under deep-pocketed owners. And attackers are strapping AI jetpacks onto cyber ops, so the security game becomes whoever automates faster. If you’re allocating, think maritime autonomy stacks + shipyard integrators, gaming peers/M&A and LBO paper, and cloud-identity-data security that can actually keep up with AI-speed threats.

Good: Blue Water Autonomy taps Conrad Shipyard to mass-produce USVs

What it is:

Maritime startup Blue Water Autonomy — founded by three Navy vets — signed a production deal with Conrad Shipyard (Louisiana) to build its first fleet of unmanned surface vessels (USVs) at scale. Conrad will use multiple facilities and automated lines to parallelize hull work, aiming for throughput instead of bespoke one-offs. The shift comes on the heels of Blue Water’s funding push and a broader Pentagon/NATO tilt toward attritable maritime drones for ISR, mine countermeasures, and perimeter defense.

What it will do:

- From prototypes to production: Moving to a commercial yard with automated panel/weld lines is how naval USVs get cost curves down and numbers up. Expect faster fielding for port/base security and littoral ISR.

- Supply-chain pull-through: Sensors (EO/IR, radar), autonomy stacks, secure comms, and payload modules (EW, MCM) see rising attach rates as platforms multiply.

- Export appeal: EU and Indo-Pacific customers looking for harbor defense and “drone wall” concepts will kick the tires on compact USVs that are cheap to operate and easy to maintain.

How you can benefit:

- Shipyard & integrator beneficiaries: Contractors with modular build capability (panel lines, parallel hulls) and mission-system integration capacity get the lion’s share of margin.

- Sensor/autonomy suppliers: Higher-margin plays are perception, navigation, and fusion software plus secure mesh comms; look for vendors embedded early with Blue Water or peer USV programs.

- Dual-use upside: Ports, offshore wind, and energy terminals need low-cost maritime patrol — civilian demand can smooth defense cycles.

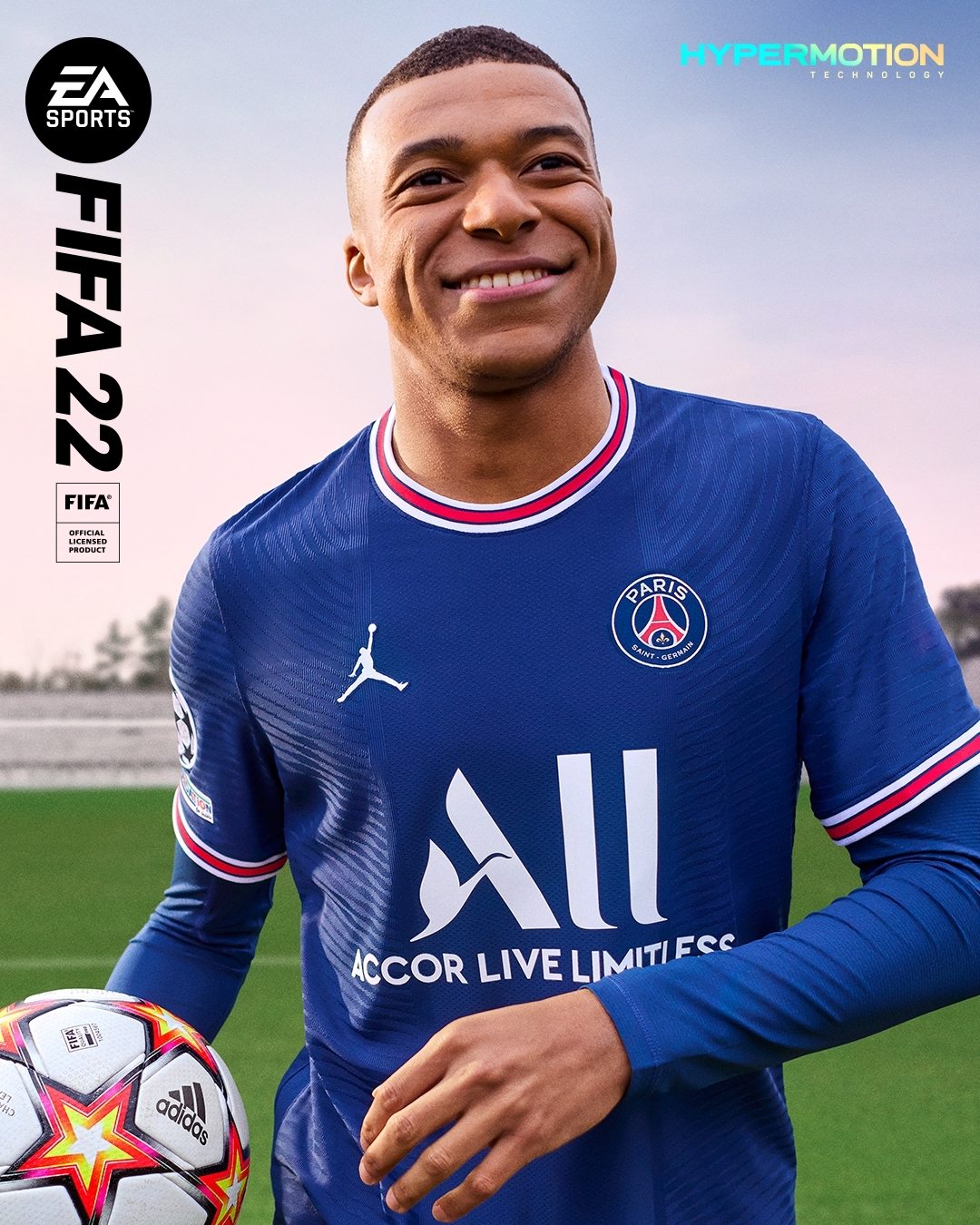

Bad: EA to go private in a ~$55B deal backed by Silver Lake, PIF & Jared Kushner’s Affinity Partners

What it is:

Electronic Arts agreed to a take-private valued around $55B (enterprise value): $210/share cash to stockholders, financed by ~$36B equity and ~$20B debt (led by JPMorgan). The buyer group: Silver Lake, Saudi Arabia’s PIF(rolling its ~9.9% stake), and Affinity Partners (Jared Kushner). CEO Andrew Wilson stays on; close is targeted for early fiscal 2027 pending approvals. It’s the largest all-cash sponsor take-private to date, and it yanks a top gaming IP house (Madden, FIFA/FC, Battlefield, The Sims) out of public markets during a content pipeline reset across the industry.

What it will do:

- Less quarterly pressure, more pipeline bets: Private ownership gives EA room to restructure studios, shift cadence, and fund bigger swings (live-service, sports, new engines) without public EPS heat.

- Geopolitical scrutiny: PIF and Affinity involvement may draw regulatory/PR attention in the U.S. and EU; licensing with sports leagues and platform partners will be watched closely.

- Valuation read-through: A premium multiple for at-scale IP may buoy comps (TTWO, CDR, UBI) and stoke more PE interest in gaming/content libraries.

How you can benefit:

- Public peers & suppliers: If the take-private premium resets comps, Take-Two and key tool vendors (game engines, back-end analytics, anti-cheat) can re-rate. M&A chatter likely increases around mid-cap studios.

- Debt & credit plays: Largest LBO since TXU means chunky loan/bond issuance; watch new-issue HY/loan booksand CLO appetite tied to gaming cashflows.

- Platform leverage: Console/PC storefronts (and cloud platforms) gain bargaining power during integration—track any rev-share or catalog access shifts.

Ugly: Wiz CTO; AI is transforming cyberattacks — faster recon, bespoke payloads, and mass social engineering

What it is:

In a TechCrunch interview, Ami Luttwak (CTO/co-founder of cloud-security unicorn Wiz) details how AI supercharges attackers: automated recon across cloud assets, tailored phishing at scale, code-assist for exploit dev, and “living-off-the-land” tooling that evades traditional detection. The punchline: AI turns what used to be a boutique skill set into something industrialized and repeatable, squeezing defenders on speed and precision.

What it will do:

- Time-to-breach compresses: AI-assisted recon and lure generation shrink dwell time; identity and misconfig exposures get popped faster.

- Defender stack must evolve: Expect spend to shift into cloud posture, identity security, data-centric detection, and AI-native anomaly hunting.

- Talent model changes: Blue teams rely more on copilot-style tools and managed detection/response to match attacker velocity.

How you can benefit:

- Cloud-first security winners: Posture management, CNAPP, identity threat detection & response (ITDR), and data security platforms that already operate at hyperscaler scale (Wiz peers/partners) stand to gain.

- Managed services & IR: MDR/XDR providers with in-house AI for triage/automation benefit as customers outsource 24/7 response.

- Detection enrichment: Telemetry, graph, and LLM-powered analytics vendors (correlation, UEBA) get uplift as enterprises re-platform SecOps around AI.