Good: U.S.–Britain Nuclear Deal

What it is:

During President Trump’s state visit to the UK, the U.S. and Britain announced a major collaborative nuclear energy agreement. Key components include building up to 12 advanced modular reactors (AMRs) in Hartlepool with U.S. firm X-Energy and UK energy company Centrica, power projects involving SMRs (small modular reactors), and an £11 billion SMR-powered data center project in central England led by companies like Holtec, EDF, and Tritax.

What it will do:

- Faster deployment of nuclear power: Streamlined licensing via mutual recognition could cut project approval times substantially, allowing UK to deploy new reactors more quickly.

- High upfront costs & political risk: Large capital expenditures, risks of delays or cost overruns remain; public acceptance (waste, siting) and labor constraints might slow progress.

- Energy security and emissions pressure: Helps UK reduce reliance on fossil fuels and foreign energy sources (notably Russian nuclear materials)

How you can benefit:

- Nuclear reactor developers and vendors: Companies involved in SMR/AMR designs (X-Energy, Holtec, Rolls-Royce) may see contract growth and valuation bumps.

- Fuel supply & nuclear materials: Firms like Urenco (supplying advanced uranium) stand to gain as demand for lo

Bad: Bank of Canada Rate Cut: Why It’s Not a Fix for Mortgage & Housing Pressures

What it is:

The Bank of Canada is widely expected to cut its overnight rate, likely in mid-September, aiming to ease borrowing costs. Variable-rate mortgage holders may benefit immediately, and some fixed-rate holders near renewal could see relief. But while lower rates reduce interest costs, they don’t directly tackle the biggest issues facing Canada’s housing market: high home prices, low supply, and the structure of mortgage renewals. Many mortgages are fixed for 3- to 5-year terms, so even with rate cuts, homeowners face higher payments during renewal if long-term bond yields don’t drop in tandem.

What it will do:

- Modest impact on housing demand, as rate cuts may stimulate some buying, but price levels and down payment needs remain major barriers.

- Limited effect on affordability without supply growth; cost of homes won’t fall just because carrying costs drop.

How you can benefit:

- Financial institutions and mortgage lenders: Variable-rate portfolios may see improved cash flows. Expect higher signing volume among those offering adjustable or variable products.

- Bond market and long yields: Monitor the spread between overnight rate and long-term bond yields; fixed-rate mortgage costs tie to long yields. A drop in yields would magnify the benefit to homebuyers and to companies that produce mortgage-backed products.

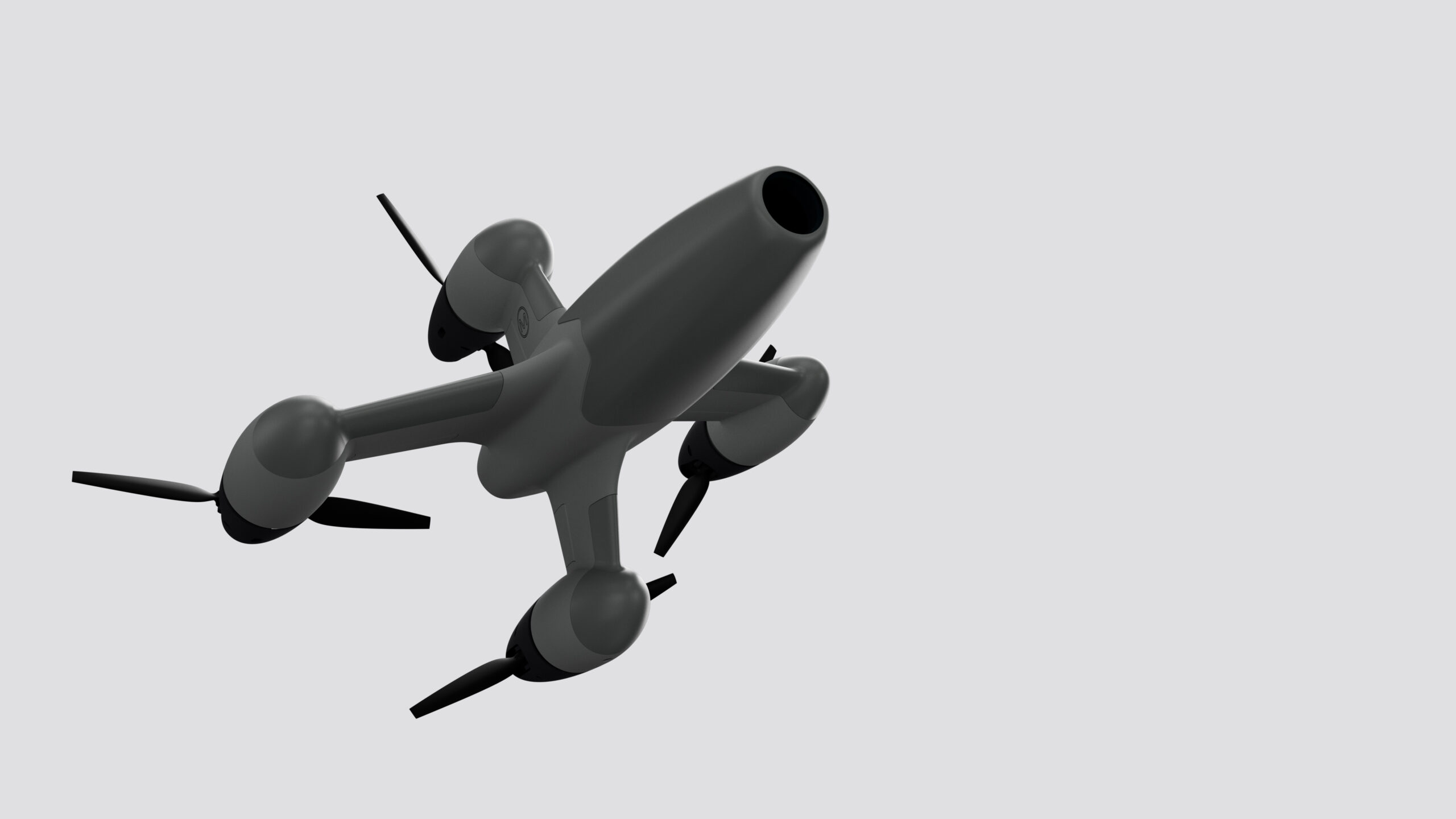

Ugly: Europe’s New Hope Against Russian Shahed Drones

What it is:

Europe is ramping up deployment of “interceptor drones” — unmanned aerial systems designed to neutralize hostile drones such as the Russian Shahed series. These interceptors may ram Shaheds or use small warheads or explosive charges to destroy them. The technology is gaining attention because Shaheds have become a recurring threat over Ukraine and elsewhere, and existing air defenses struggle with cost and reaction time.

What it will do:

- Proliferation & countermeasure arms race: As interceptors get deployed, adversaries may adapt—faster Shahed models, stealthier UAVs, new swarm tactics. Expect improvements in counter-countermeasures and AI guidance.

- Strategic alignment under NATO: Shared procurement, testing, and standardization may accelerate as countries seek interoperable solutions, procurement efficiencies, and common doctrine.

How you can benefit:

- Interceptor manufacturers & primes: Companies developing and producing interceptor systems (e.g., MARSS, Destinus, Cambridge Aerospace) are likely to see government contracts, R&D funding, and export orders. Those already in production or close to production cycles may benefit sooner.

- Sensors, AI, and autonomy tech providers: Interceptors need high-speed vision or IR sensors, reliable guidance, robust AI for detection/tracking, and rapid decision making. Suppliers in those niches are likely to see demand rise.