The Basic Story

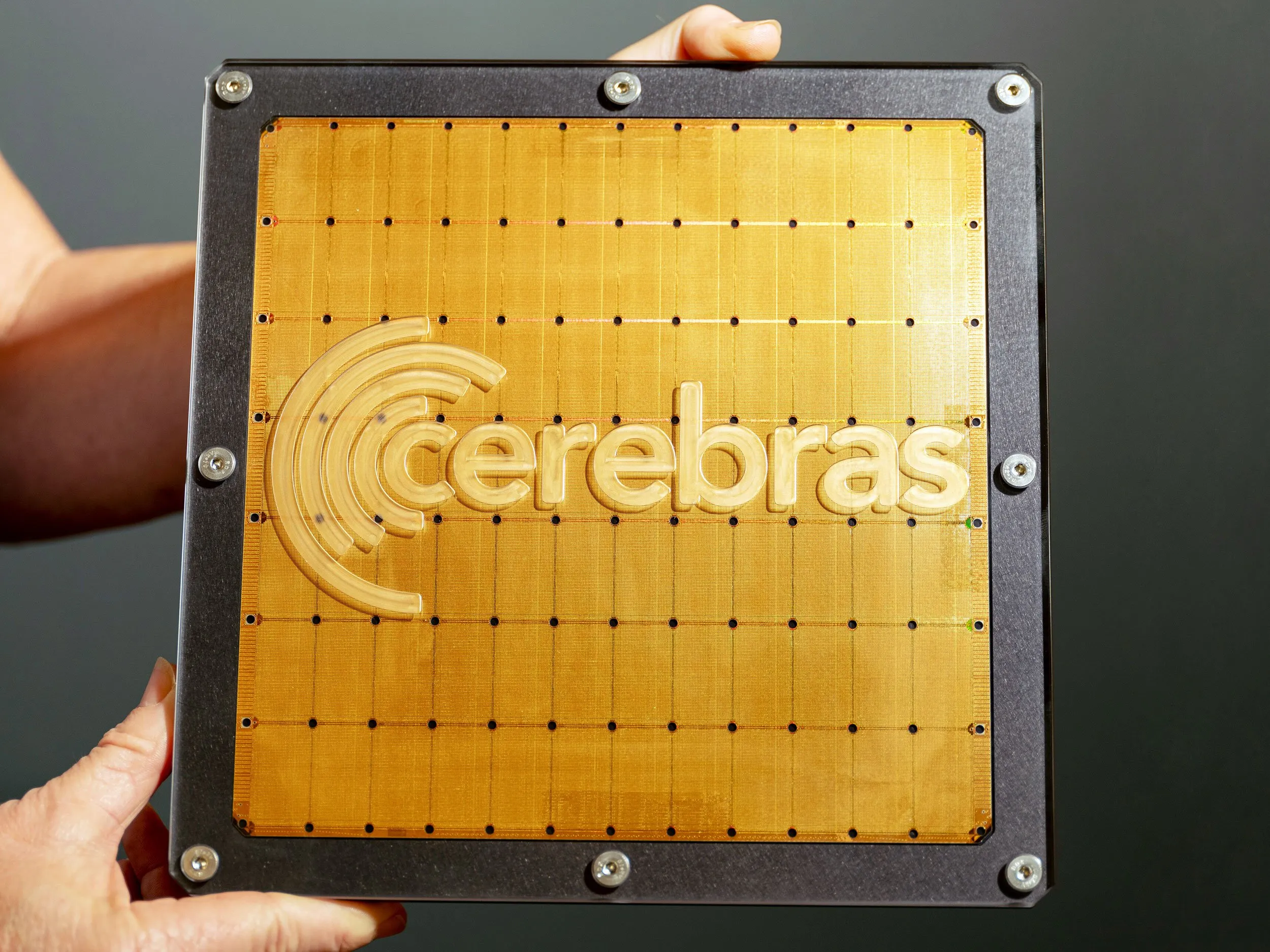

- Cerebras Systems, a leading AI chip / accelerator hardware startup known for its massive wafer-scale engines, has secured $1.1 billion in new financing roughly one year after announcing plans to go public.

- The funding comes at a higher valuation (i.e. it’s a fresh private round), signaling continued investor confidence despite postponing the IPO.

- This new capital is expected to support scale in production, supply chain, sales expansion, R&D, and sustaining competitive positioning in the AI hardware arms race.

Strategic & Market Implications

- AI Hardware Arms Race Intensifying

The fact that a hardware startup can still command a billion-dollar raise—even while delaying an IPO—underscores how critical compute hardware (especially AI accelerators) remains. Deep pockets are still chasing differentiation and performance advantages. - Premium on Differentiated Architecture

Cerebras’s wafer-scale engine architecture (very large, monolithic or near-monolithic layouts) is distinct from GPU or tiled-accelerator architectures. If it maintains performance leadership, it commands a “hardware moat” that’s hard to replicate. - Challenges of Scaling from Lab to Volume

The transition from prototype/demonstration to mass production is fraught: yields, defect rates, supply chain, cooling, packaging, software stack, thermal management all scale nonlinearly. The new capital must show operational discipline. - Delayed IPO is a Signal, Not Always Negative

Many hardware companies delay IPOs because scaling hardware demands capital, and going public prematurely can expose cash flow risk. The fact that Cerebras can raise more privately suggests sufficient investor appetite and runway extension, but it also delays the liquidity event. - Risk Premium for Hardware Startups Remains Elevated

While investor confidence is high, hardware startups carry high capital burn, long cycle times, component risks, and competitive pressure from incumbents (Nvidia, AMD, Intel) and emergent startups (Graphcore, SambaNova, etc.).

Investment Plays & Positioning

Considering this development, here’s how I’d think about structuring exposure:

A. Core / Strategic Positions

- Cerebras (private equity / venture exposure)

If you have access to late-stage private markets or crossover funds, getting in now may provide high upside if/when it goes public. The raise suggests valuation potential remains strong. - FPGA / alternative accelerator vendors

Entities creating unique or differentiated compute architectures (e.g. wafer-scale, chiplet arrays, domain-optimized accelerators) may benefit from the hardware redesign trend. - Foundries & advanced node suppliers

Wafer-scale or large-die accelerators impose heavy demands on wafer quality, yield, reticle size, packaging, test, and substrate. High-end foundries, advanced packaging firms, interposer / 3D IC players stand to gain. - Software / compiler stack providers

Hardware is only one part — optimization, compilation, scheduling, memory & data movement, toolchains, debugging, profiling are critical. Companies offering infrastructure for hardware specialization may capture value. - Cooling / thermal infrastructure & power systems

Deploying large compute clusters at scale requires efficient cooling, power delivery, heat dissipation designs. Firms that offer hardware, materials, systems, and innovations in that domain can benefit from every new hardware cluster build-out.

B. Watch / Select Exposure

- Hybrid compute / cloud providers bridging to novel hardware

Cloud or AI platform companies that commit to or adopt Cerebras or similar hardware may become early customers; investing in or partnering with those may yield upside. - Edge / domain-specific acceleration sectors

Some designs (e.g. for genomics, fluid simulation, physics, modeling) may benefit from novel architectures. Niche specialized accelerator startups or partners to Cerebras may benefit.

C. Caution / Hedging

- Incumbent GPU/accelerator vendors

Some existing players may be vulnerable if customers shift to new architectures; cautious exposure to highly exposed incumbents is reasonable. - Hardware startups with weak differentiation

Many startups claim performance gains but lack clear architectural differentiation or scaling path; hedging or avoiding these “me-too” hardware plays is prudent.

Risks & Execution Challenges

- Manufacturing/yield risk: Wafer-scale or large-die designs often suffer lower yields. Production defects, defect density scaling, thermal stress—all escalate with die size.

- Capital intensity & cash burn: Hardware scaling is extremely capital-intensive; delays in customer adoption or production missteps can stress the balance sheet.

- Software and usability friction: If developers find it hard to adopt, migrate, or optimize software on new architectures, adoption stalls regardless of raw performance.

- Competitive response & price pressure: Giants like Nvidia or AMD could respond with more aggressive hardware, bundling, pricing discount, or acquiring competitors.

- Market timing & valuation risk: If broader AI investment sentiment weakens, hardware valuations may compress. A delayed IPO increases execution uncertainty.

Return Scenarios & Valuation Outlook

| Scenario | Assumptions | Outcome / Return | Key Breakpoints |

|---|---|---|---|

| Base | Strong early customer traction, detectable performance gap, cost efficiency improvements, but moderate scaling challenges | High-return outcome: crossover IPO, strong multiples, stable margins in the mid-teens | First major customer deployments, margin improvements, revenue milestones |

| Upside | Dominance in certain workloads (e.g. LLM dense inference/training), excellent production scale, cost leadership, strategic partnerships | Very high upside: valuations >10–20× revenue, acquisition or leadership in AI infrastructure | Major cloud provider deals, consistent edge over GPU/ASIC, software ecosystem dominance |

| Downside | Yield issues, slow customer adoption, competitive displacements, capital stress, weaker margins | Lower valuation, potential downround or restructuring; returns limited or negative | High burn without scaling, customer churn, negative market sentiment |

Signals & Metrics to Watch

- Announcements of customer deployments / pilot programs (especially cloud or enterprise).

- Yield and defect rates, manufacturing scale progress, wafer throughput numbers.

- Toolchain / software stack maturity, compiler performance, optimization benchmarks.

- Margins: cost per compute unit, power efficiency, utilization metrics.

- Capital deployment pace, runway extension, cash burn.

- Competitive positioning: how rivals respond with new hardware, how they price, performance benchmarks.

- IPO timing signals: SEC filings, underwriting activity, pre-IPO advisors, deal marketing.

Bottom Line

Cerebras’s $1.1 billion raise after delaying its IPO is a strong signal that the hardware play in AI remains critical and well-funded. But the road ahead is high‐stakes: success depends not just on raw chip performance, but yield, software ecosystem, cost scaling, customer adoption, and differentiation. The real value is not just in the chip itself but in the surrounding ecosystem — compilers, integration, deployment, and reliability. For portfolios, tilting toward infrastructure, toolchain providers, thermal power systems, and advanced packaging may capture more durable upside than betting purely on the chip fabric alone.