Canada has announced its newest vision for “nation-building.”

But in a twist that speaks volumes about the country’s shifting industrial priorities, not one new oil pipeline made the cut.

The federal government’s freshly unveiled Projects of National Interest list — the flagship of Ottawa’s new economic-infrastructure strategy — spotlights clean-energy build-outs, LNG terminals, and inter-provincial transport links. Missing, conspicuously, are any of the multi-billion-dollar pipeline proposals long viewed as the veins of Canada’s resource economy.

For some, it’s a milestone in climate progress.

For others, it’s a sign that Canada may be leaving one of its most globally competitive industries stranded on the sideline.

Policy by Omission

In political terms, Ottawa didn’t ban pipelines — it simply stopped championing them.

That silence matters. Canada’s pipeline network is already under pressure: existing capacity to the West Coast is tight, new expansions face multi-year regulatory gauntlets, and investors are wary of policy volatility. Without federal inclusion in the “nation-building” list, these projects lose the implicit support that once made financing and permitting slightly easier.

For the oil-producing provinces, particularly Alberta and Saskatchewan, this omission lands hard. Local governments had expected at least one new export pipeline to make the federal shortlist — perhaps an extension of Trans Mountain capacity or a new cross-border link to tidewater. Instead, Ottawa’s focus has shifted toward lower-carbon infrastructure: renewable generation, hydrogen corridors, and modernized electrical grids.

“It’s not the death of the oil patch,” said one Bay Street energy analyst, “but it’s the clearest signal yet that the federal government no longer sees hydrocarbons as nation-building material.”

The Economic Signal

Energy remains a core contributor to Canada’s GDP, but the investment climate is changing.

The market is reading Ottawa’s announcement as a re-rating event for the country’s infrastructure priorities. The message: pipelines are now a provincial concern, not a national mission.

That subtle downgrade has financial consequences.

For example:

- Cost of capital for new midstream projects is rising — banks and institutional lenders now factor in higher political risk premiums.

- Timelines stretch: major projects that once sought five-year horizons now plan for seven to ten.

- Investor patience is thinning, as ESG-driven capital allocators demand shorter payback or carbon offsets.

Meanwhile, Canada’s “nation-building” funds — tens of billions set aside for strategic infrastructure — are flowing toward LNG export terminals, grid-scale battery storage, and interprovincial transmission upgrades. The contrast couldn’t be sharper: while oil faces hesitation, gas and renewables are getting fast-tracked.

The Investment Reality Check

For investors, the takeaway is pragmatic rather than ideological.

- Crude pipelines are becoming yield plays, not growth stories.

Existing pipeline operators like Enbridge and TC Energy will likely pivot toward stable dividend yields and incremental expansions rather than greenfield megaprojects. Their upside now depends on efficiency and diversification, not volume growth. - Natural gas and LNG are the new “bridge assets.”

Canada’s federal focus on LNG export capacity positions gas as the transitional backbone of North American energy trade. Investors should expect sustained capital inflows into LNG infrastructure, storage, and associated shipping. - Transition infrastructure is the policy darling.

Federal funding and regulatory priority are shifting toward hydrogen pipelines, renewable-grid interconnections, and critical-minerals transport. These projects may deliver lower short-term returns but benefit from predictable support and political alignment. - Provincial counter-moves could create asymmetric plays.

Alberta’s government may accelerate its own infrastructure financing tools or tax incentives to compensate for Ottawa’s pullback. Private equity or pension capital could step into that vacuum, creating localized opportunities.

The Geopolitical Undercurrent

The absence of new pipelines isn’t just domestic policy — it’s geopolitics.

Canada’s energy exports have long been framed through the lens of U.S. dependency. Every pipeline built or stalled recalibrates that relationship. With Washington now focused on its own production and LNG exports, Ottawa’s silence on new crude lines may reflect a tacit understanding: Canada will pivot its global competitiveness toward low-carbon infrastructure exports, not crude throughput.

That pivot plays well internationally, but it leaves domestic producers facing structural bottlenecks — potentially curbing investment in upstream oil production over the next decade.

Market Outlook: Winners, Losers, and the Waiting Game

Winners:

- LNG developers (e.g., Woodfibre, LNG Canada): poised to benefit from policy alignment and potential export premium.

- Grid and clean-tech contractors: firms involved in transmission, energy storage, and hydrogen retrofits.

- Infrastructure REITs and yieldcos: steady, federally backed projects mean predictable long-term cash flows.

Losers:

- Pure-play crude pipeline developers: rising capital costs, longer permitting timelines, fewer federal guarantees.

- Oilfield service firms dependent on pipeline construction: reduced volume means reduced backlog.

- Provinces banking on federal endorsement: potential for fiscal tension and slower regional growth.

The Bigger Picture

Canada’s “nation-building” announcement isn’t about a single project — it’s about narrative. The government is rewriting the story of what qualifies as a strategic asset. Where oil once symbolized industrial might, the new narrative revolves around climate alignment, grid resilience, and export diversification.

The irony, of course, is that Canada’s nation-building history was literally built on pipelines — from the Trans-Canada line in the 1950s to today’s Trans Mountain expansion.

Now, the country is trying to build its next chapter without them.

For investors, that means one thing: the map of opportunity is redrawn. The energy of the future may still flow through pipes — just not the kind carrying crude.

Would you like me to write a second companion piece — from the perspective of Alberta or the private-sector energy investor — arguing that Ottawa’s strategy risks creating an energy-security gap and stranded-asset problem?

You said:

ChatGPT said:

Here’s a rewrite of the article on the proposed 50-year mortgage initiative (originally reported by CNN on 11 November 2025) — framed as a detailed, investor-oriented article, not simply a summary.

The 50-Year Mortgage Proposal: A Game-Changer or a Risk for Housing Finance?

In a move that’s already drawing intense scrutiny from housing and financial-markets observers, the concept of a 50-year mortgage has risen from political rhetoric into the realm of plausible policy discussion. While the idea is being heralded by some as a path to improved housing affordability, the implications for mortgage markets, credit risk, and investor portfolios are far from straightforward.

What’s being proposed

The idea as publicly floated expands the traditional fixed-rate mortgage term (30 years being the norm in the U.S.) out to a full 50 years. The key selling point: by stretching repayment over a longer horizon, the monthly payment burden falls, potentially making home-ownership more accessible for first‐time buyers or younger households. For example, with interest rates in the 6 %+ range (a realistic level today), extending the amortisation to 50 years materially reduces the payment.

However, it also means far more interest paid overall and much slower accrual of equity.

Why this matters from a financial-markets perspective

- Credit risk and amortisation structure: Extending a mortgage to 50 years shifts much of the early-period payments into interest rather than principal. For investors or lenders in mortgage-backed securities (MBS) or whole-loan portfolios, this implies slower collateral build-up and increased vulnerability if the borrower sells or refinances early.

- Housing-market dynamics: Lower monthly payments may enable more households to buy, potentially raising demand and thus home-prices. That’s positive for borrowers and property-holders, but it could reduce the affordability benefit if price inflation outpaces the payment relief. From an investor view, a rising price environment may look attractive—but also raises the risk of a correction if fundamentals (income growth, job security) don’t keep pace.

- Interest-rate sensitivity and duration risk: With a longer duration loan (50 yrs vs 30 yrs), the sensitivity to interest-rate changes and inflation expectations may increase. For fixed-rate portfolios, this could affect hedging strategies, valuation of MBS tranches, and spread compression expectations.

- Regulatory and institutional-finance implications: The U.S. mortgage-finance architecture (Fannie Mae, Freddie Mac, FHA/VA) is built around certain underwriting standards and amortisation limits. A 50-year term would likely require substantial modifications to underwriting, risk assessment, regulatory oversight, and likely investor acceptance of novel product risks. For investors in mortgage-finance firms or securitisers, this means new product risk, regulatory-transition risk, and potential changes in capital models.

Potential opportunities

- Mortgage financiers / originators could capture incremental volumes if this product appeals to younger buyers—but must price for higher lifetime risk and slower equity build-up.

- Servicing and audit firms may see demand for enhanced tools for long-term borrower performance analytics, given the extended loan horizon.

- Housing-related REITs or real-estate investment trusts might benefit if increased access to home-ownership drives demand in suburbs or new‐build segments.

- Infrastructure or municipal bonds in growth corridors: If the product enables housing expansion in regions currently cost-constrained, local infrastructure needs may expand, creating downstream investment opportunities.

Key risks and caveats

- Higher lifetime interest cost: Borrowers taking a 50-year term may pay significantly more interest over the life of the loan than under a 30-year term. This erodes net wealth accumulation and heightens refinancing risk.

- Slower equity accumulation means higher default/vulnerability risk: If a borrower sells or needs to move earlier, the balance may still be high, weakening the equity cushion for lenders or MBS investors.

- Policy risk and execution uncertainty: Even if proposed politically, the shift would require significant regulatory changes (e.g., documents, underwriting rules, investor acceptance). Implementation may lag or pose unknown unintended consequences.

- Macro-housing affordability paradox: While monthly payments may fall, if the product spurs higher prices without commensurate income growth, affordability may worsen in real terms.

- Valuation risk for fixed-income investors: Longer-term loans change the prepayment-/refinancing behaviour, expected lifetime cash flows, and might alter the value of existing mortgage/loan pools.

Portfolio strategy implications

- For lenders / originators: Before embarking heavily into 50-year product lines, due diligence must include modelling for longer amortisation risk, default probability, prepayment behaviour, and stress scenarios (e.g., early job loss, interest shock, inflation).

- For fixed-income/MBS investors: Existing pools should be analysed for how the introduction of 50-year products might alter comparative attractiveness of 30- vs 50-year vintages, prepayment risks, and spread expectations.

- For real-estate investors: If the policy fosters increased home-ownership among younger cohorts, look for demand growth in peripheral/suburban markets, new construction demand, and housing-finance firm exposure.

- For policy-sensitive allocators: Monitor regulatory filings, underwriting standard changes, and lender risk disclosures. The shift may introduce a new structural sub-class of mortgage product that could alter long-term credit spread dynamics.

Milestones & what to watch

- Formal regulatory proposals or guidance from housing-finance agencies (e.g., the Federal Housing Finance Agency or the Department of Housing and Urban Development) enabling 50-year terms.

- Pilot programmes or lenders announcing 50-year product launches and the underwriting criteria they adopt.

- Mortgage-performance data: how early cohorts (if launched) behave vs traditional 30-yr loans—prepayment rates, equity emergence, default/forbearance rates.

- Home-price dynamics post-launch: Does uptake of 50‐year loans lead to higher price appreciation in target cohorts/geographies?

- Impact on refinancing behaviours and MBS portfolio valuations: as term structure changes, how are existing securities re-priced?

Conclusion

The 50-year-mortgage proposal marks a potentially significant inflection in U.S. housing-finance design. From an investor’s lens, it brings both opportunity (in expanded financing volumes, new borrower segments, housing expansion) and risk (in underwriting uncertainty, longer horizon credit exposure, altered prepayment dynamics). As with any major structural shift, success will depend on regulatory follow-through, lender discipline, and borrower behaviour over the long haul.

With housing costs already straining many households, a longer amortisation term may seem appealing—but for lenders, investors and portfolio allocators, the devil lies in the details of execution and the latent credit risk.

If you like, I can model a scenario showing the difference in lifetime cost and equity accumulation for a 30-year vs 50-year mortgage under current interest-rate assumptions, and what that might imply for lender risk and borrower behaviour. Would you like me to do that?

You said:

ChatGPT said:

Abu Dhabi’s Leap into Driverless Road and Air Mobility

The emirate of Abu Dhabi has officially green-lit a sweeping mobility transformation that brings both driverless road vehicles and autonomous air mobility into its near-term plans. According to a recent report by Semafor, the announcement covers two key thrusts: commercial robotaxi services in designated urban areas, and pilot zones for flying taxis / unmanned aircraft. Semafor+1

Here’s a deep-dive from the investor/strategic vantage: what’s going on, why it matters, and where the opportunities and risks lie.

What’s Happening

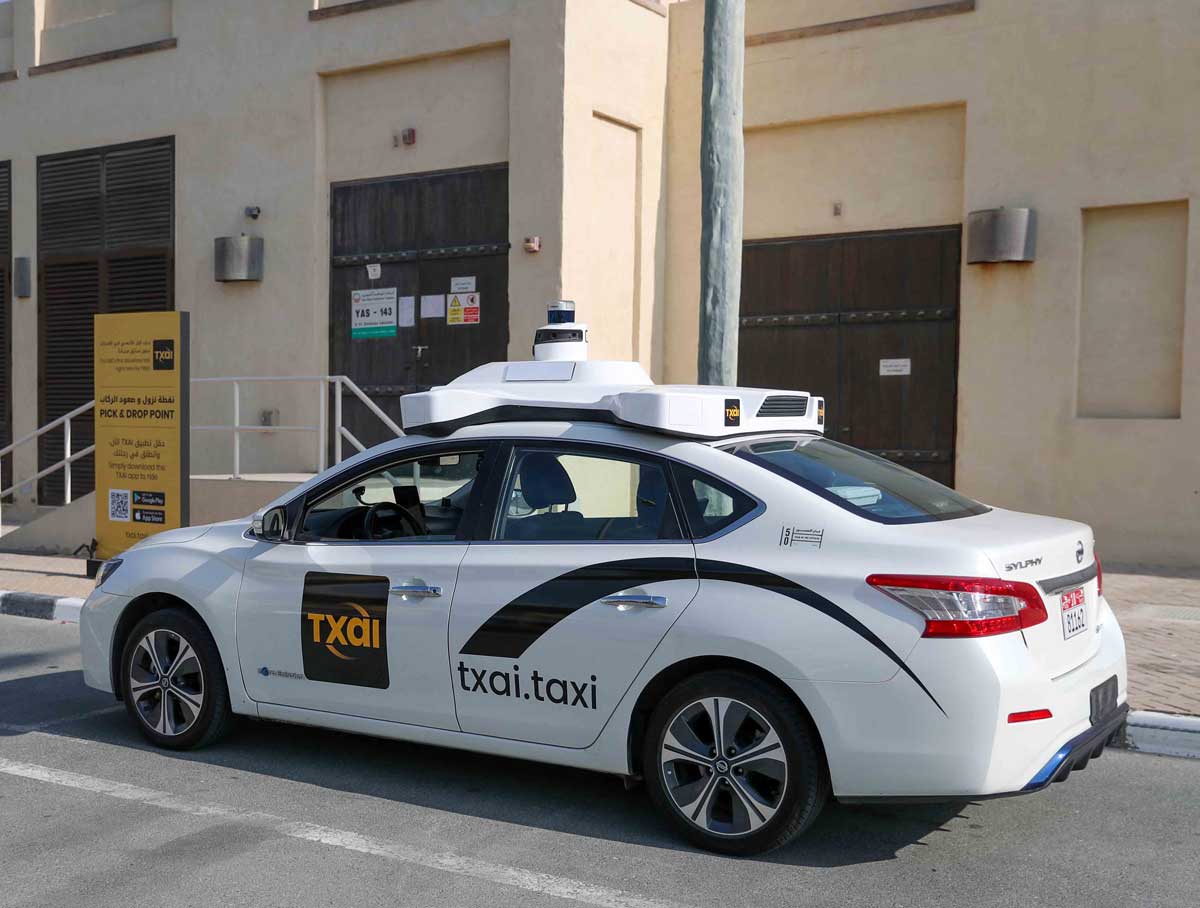

- Abu Dhabi has authorised what it describes as the Middle East’s first commercial driverless ride-hailing service in defined urban zones. Service providers include WeRide (partnered with Uber and the local transport provider Tawasul), and ApolloGo (in partnership with UAE-based AutoGo‑K2). WeRide’s robotaxis have already logged more than 800,000 km across half of Abu Dhabi’s urban centre. Semafor

- On the aerial side, regulators have designated three zones for advanced air mobility testing: Yas Island (tourist hub), Zayed Port (logistics hub), and Abu Dhabi International Airport. The regulatory bodies are developing “air corridors” for autonomous aircraft (flying taxis and delivery drones) to share skies with conventional aviation. Semafor+1

- These moves are not just pilots—Abu Dhabi is signalling a structural ambition to be a global hub for autonomous mobility (land + air), with regulatory frameworks being built alongside the technology. Tii+1

Why It Matters: Key Investment & Strategic Themes

- First-mover regulatory advantage

By granting commercial licences and defining pilot zones ahead of many Western jurisdictions, Abu Dhabi is giving mobility players a meaningful regulatory “green light.” For companies in autonomous vehicles (AVs) and advanced air mobility (AAM), this is an explicit ‘sandbox + go-to-market’ signal. - Mobility as infrastructure, not just vehicles

The initiatives span not just the vehicle technology (robotaxis, eVTOL/taxis) but the supporting infrastructure: mapping air corridors, designing vertiports, reshaping urban transport grid and logistics. That means investment opportunity across hardware, software, systems integration, air-ground mobility networks. - Synergies between land and air autonomy

The combination of driverless vehicles and flying taxis implies a broader “autonomous mobility ecosystem” – connections between ground-robotics, urban traffic, low-altitude airspace, logistics. Investors looking for exposure might think beyond just self-driving cars into multi-modal mobility. - Commercial scale and export potential

If Abu Dhabi succeeds in rolling out commercial services (robotaxis, flying taxis) it may serve as a showcase citythat attracts global technology, capital and export-contracts. Mobility technology providers may use this as proof-point to sell into other cities or regions. - Risk of infrastructure and execution complexity

These are ambitious engineering and regulatory projects. Execution risk is elevated: safety certification, public acceptance, urban integration, cost control, asset utilisation (especially for flying taxis) are non-trivial. Investors must distinguish between hype and credible rollout timelines.

Potential Investment Opportunities

- Autonomous vehicle technology firms: Companies supplying L4/L5 driverless stack, lidar/radar, fleet management platforms could benefit from Abu Dhabi’s early commercial commitments.

- eVTOL / flying-taxi manufacturers & operators: Firms developing eVTOL aircraft or building out vertiport/charging infrastructure could gain first-market advantage.

- Mobility-infrastructure and urban-systems providers: Beyond vehicles, there is opportunity in air-traffic management for low-altitude systems, ground-vertiport integration, drone-logistics networks.

- Regional mobility platforms / ride-hailing firms: Firms extending into robotaxi fleets may gain access to pumped-up mobility demand and green-field regulation.

- Urban logistics & delivery innovation: Autonomous ground vehicles and drones for delivery (complementing mobility) may get momentum as the technology ecosystems scale.

Key Risks & Considerations

- Technical/deployment risk: Vehicle autonomy (especially in public roads in mixed traffic) has historically hit delays. Flying taxis carry additional regulatory, safety, noise, battery-duration risks.

- Utilisation and economics: Simply having the licences is one step; building a viable commercial business with strong asset utilisation, cost control and pricing will be tougher.

- Regulatory/backlash risk: Even in progressive markets like the UAE, public acceptance (safety, privacy, noise) and regulatory surprises (air-space restrictions, environmental concerns) can slow deployment.

- Capital intensity: The build-out of fleets, infrastructure, vertiports, charging or energy systems is capital-intensive; returns may be long-dated and require patience.

- Global competitive risk: Other jurisdictions may replicate the “sandbox” quickly; early movers may lose long-term margins if competition intensifies and technology becomes commoditized.

Timeline & What to Watch

- Milestone rollout of commercial robotaxi services: When and where driverless ride-hailing goes fully driver-free (no safety driver) and what pricing/uptake look like.

- Flying-taxi pilot operations: Which eVTOL manufacturers/operators secure air‐worthiness approvals, vertiport build-out timelines, commercial flight announcements.

- Infrastructure completion: Vertiport construction, battery/charging infrastructure for air mobility, integration with ground mobility systems.

- Regulatory disclosures: Public regulations around autonomous air corridors, vertiport zoning, safety certification, insurance models for AAM.

- Operational metrics: Fleet utilisation, service reliability, pricing, passenger adoption, business model economics for robotaxis/flying taxis.

Conclusion

Abu Dhabi’s move to green-light both driverless taxis on the ground and flying taxis in the air marks a powerful statement of intent. From a strategic investor’s lens, this is less about a single project and more about mobility transformation—a shift across transport modes, infrastructure, regulation and urban systems.

For those able to pick winners in autonomous mobility, the combination of regulatory frontier, early commercial deployment, and global export positioning creates a compelling backdrop. But success will hinge on execution, cost discipline, adoption curves and institutional/government backing.

If you like, I can identify specific listed companies or startups that are likely to be beneficiaries of this Abu Dhabi mobility wave (both in robotaxi and flying-taxi segments), and assess their valuation upside and risk. Would you like me to map that out?

You said:

ChatGPT said:

Here’s an original article styled from an investor’s perspective on the recent announcement by Donald Trump to reduce tariffs on key food imports (based on the Bloomberg coverage).

Trump Moves to Cut Food-Import Tariffs: A Strategic Play on Affordability

By [Author Name]

November 2025

In a notable pivot of trade policy, President Donald Trump is set to sign an executive order to reduce tariffs on several import-heavy food commodities—including beef, tomatoes, coffee and bananas—as part of a broader response to mounting consumer unease over soaring grocery prices. Bloomberg

What’s happening

The White House has announced that the tariff cuts will apply to goods for which domestic production cannot sufficiently meet U.S. demand. The exact details of which import categories will be affected, and to what extent reductions will apply, remain somewhat vague at this stage. Bloomberg

The leadership rationale is clear: grocery-bill shock is becoming a political flash point, and this move is aimed at alleviating some pressure on household budgets while signalling responsiveness to consumer inflation pain.

Why this matters from a market & investor vantage

- Affordability signal – Food costs are a tangible component of inflation and household stress. A policy action specifically targeting imports of staple commodities suggests the administration is willing to use trade tools to influence consumer prices.

- Trade-policy shift – While the Trump era has been defined by tariff escalation, this marks an instance of tariff reduction—albeit targeted and limited. It underscores the evolving complexity of trade policy in an inflationary economy.

- Sectoral ripple effects – Producers, importers, retailers and agro-logistics firms will need to reassess the implications. Lower tariffs could increase import volumes, pressure domestic producers, and alter competitive dynamics internationally.

- Currency / commodity exposure – Reduced tariffs on beef and tomatoes may modestly increase U.S. import demand for these goods, influencing global supply chains and commodity flows (beef cattle, feed, horticulture). Importers, wholesalers, retailers and commodity traders may feel the effects.

- Political risk management – For investors the announcement highlights how policy is being used to respond to cost-of-living issues. Companies with exposure to consumer staples will want to monitor trade shifts carefully—tariff relief may ease cost burdens, but could also undermine domestic production margins.

Opportunity & Risk Map

Opportunities:

- Import-heavy food and beverage firms (especially those handling the inbound flow of bananas, coffee, tomatoes) may benefit from lower duty costs and improved margins or more competitive pricing.

- Retailers and grocery chains might see some relief in procurement costs (depending on how quickly tariff cuts filter through), potentially improving operational flexibility or margin settings.

- Global exporters of these commodities may see demand uptick into the U.S., making export-orientated supply-chain players relevant.

Risks:

- Domestic producers of beef and horticulture may face margin pressure as competition from tariff-reduced imports intensifies. For investors in those segments (meat-packing, cattle ranching, agricultural input providers) caution is warranted.

- The details remain uncertain: timing, scope, transitional effects. If import volumes surge too quickly, domestic logistics or processing capacity may become strained, leading to bottlenecks.

- While tariff cuts aim to reduce consumer-price pressure, structural factors in food inflation (feed cost, weather, labour, transport) remain. The relief may be modest, and if expectations are mis-aligned, companies may face surprise margin erosion or consumer sentiment risk.

Strategic Portfolio Considerations

- Re-examine food-import-exposed stocks: Firms with business models reliant on imported commodities (coffee roasters, banana distributors, tomato-product producers) may gain from improved duty structure.

- Monitor domestic producer exposures: Agricultural-commodity firms and meat-processors with heavy U.S. domestic exposure may need to adjust cost/volume forecasts if import competition rises.

- Watch supply-chain and logistics: Increased import activity may drive demand for shipping/logistics, cold-storage, port infrastructure—areas that could see incremental upside.

- Headline risk for consumer-staples: Even with tariff relief, if consumers don’t feel meaningful cost drops, investor sentiment toward food-price risk may remain negative. Consumer-staples companies should be prepared for heightened scrutiny on pricing and margin narratives.

Milestones to Track

- Formal regulatory announcement: publication of the list of goods receiving tariff cuts, effective dates and import-duty schedule.

- Import-volume response: Are shipments of beef, tomatoes, coffee and bananas increasing significantly post-announcement?

- Retail-price dynamics: Do we observe measurable decreases (or slower increases) in consumer prices for the targeted goods, and how quickly do they transpire?

- Domestic production response: How do U.S. beef and tomato producers adjust (volume, pricing, export strategy) in response to increased import competition?

- Macro-inflation data: Does this move contribute meaningfully to easing headline food-inflation measures or is its effect marginal?

Conclusion

President Trump’s decision to lower tariffs on select food commodities reflects a tactical shift: using trade policy to address affordability rather than purely industrial-protection aims. For investors, the move is meaningful—though not transformative—offering both upside and scrutiny across the food-value-chain spectrum.

While import-duty relief presents an opportunity for certain players, the broader structural challenges of food inflation remain. Execution, timing and scale will determine whether this policy move yields tangible benefits or just political optics.

For portfolio strategists, this is a reminder that trade policy remains a potent lever for consumer-costs—and that companies must factor in tariff risk even when the headline is relief.

Would you like me to pull specific companies (U.S. or global) with meaningful exposure to the beef, tomato, banana or coffee-import supply chains and evaluate how this tariff move might impact their valuation or risk profile?

Related news on Trump food‑tariffs and inflation

Food prices worried most voters, but Trump’s plans likely won’t lower their grocery bills

Trump tariffs to stoke US food inflation despite pledge to lower costs

The tomato tariff? US consumers set to pay price of Donald Trump’s trade war

You said:

ChatGPT said:

Here’s an in-depth, investor-oriented article based on the recent news that Canada plans to take equity stakes in mining and rare-earth projects to confront supply-chain dominance by China. The article weaves context, analysis, and implications — not just a summary.

Canada’s Strategic Move Into Mining Equity: A Supply-Chain Pivot

By [Author]

November 2025

In a decisive step signalling its intent to deepen its role in global critical-minerals supply chains, Canada has announced that its federal government is preparing to take equity stakes in mining, processing and refining projects for rare-earth metals and other critical minerals — a move directed squarely at the dominance of China in those markets. Bloomberg+1

What’s changing

Canada’s Natural Resources Canada (NRCan) has confirmed that the government is reviewing potential investments in mining operations and processing facilities which produce rare-earth elements (REEs) and related niche metals. According to the minister, these would be projects considered “in the national interest, but … unable to find equity” from the private sector alone. Bloomberg

Simultaneously, Ottawa has created or expanded a “critical minerals sovereign fund” (CAD $2 billion in latest budget) that will provide financing such as equity, loan guarantees and offtake support for projects that reduce reliance on China-dominated supply chains. FastBull

Why this matters: the supply-chain and security dimension

China controls a large share of the mid-stream and processing stages for rare-earths — separation, refining, magnets, component manufacture for EVs, defence, electronics. This creates a strategic dependency for allied countries. Canada’s move is part of a broader effort among G7 and allied governments to diversify away from that dependency. Bloomberg+1

By stepping in with equity rather than just regulatory incentives, Canada is signalling that private-sector capital alone is insufficient to build the required industrial base, and that public sector involvement is necessary to bridge the gap.

Investment Implications & Opportunity Landscape

For investors, the decision opens several key themes:

- Up-stream mining opportunity: Projects in Canada (Quebec, Ontario, New Brunswick) for graphite, lithium, tungsten, molybdenum, and REEs may receive accelerated support, making them more investable.

- Mid-stream processing and refining: The bottleneck is not just ore extraction but processing. Companies engaged in separation, refining and magnet manufacture stand to benefit if Canada prioritises domestic capacity.

- Public–private partnerships: With the government taking an equity role, project financing models may shift — less dependence on pure private capital, more hybrid structures. Investors should evaluate project terms and government offtake or subsidy arrangements.

- Country/sovereign risk dynamics: Although Canada has a stable political and regulatory environment, the intersection of resource strategy and geopolitics raises new risk vectors (export controls, indigenous partnership obligations, environmental scrutiny).

- Analogous precedence: The U.S. earlier this year engaged in similar moves (e.g., support for REE mining and processing). Canada following suit suggests this is becoming a policy-driven frontier rather than niche speculation.

Risks & Considerations

- Execution risk: Mining, processing and building mid-stream infrastructure is capital-intensive and time-consuming, particularly in Canada’s remote climates and rugged terrain.

- Commodity cycle risk: Many of these projects depend on demand for EVs, renewable-energy infrastructure, defence applications — any slowdown in those sectors could reduce profitability.

- Competition risk: If many countries are racing to build processing/refining capacity, margin erosion and oversupply become possible. Early-mover advantage matters.

- Environmental, social and governance (ESG) scrutiny: Mining and processing projects increasingly face higher ESG expectations. Projects will need strong indigenous collaboration, permitting, environmental management.

- Government involvement risk: While government equity can de-risk initial capex, it also means political/sovereign risk, potential for project delays through regulatory or public-interest hurdles, and potential market distortion.

Strategy & Portfolio Thoughts

- For venture investors: Early-stage companies with deposits of critical minerals and processing-path clarity in jurisdictions like Canada may be attractive.

- For infrastructure/private-equity: Projects where Canada’s government equity lowers the financing hurdle may attract capital, especially in processing/refining rather than just extraction.

- For public equities: Mining companies with Canadian operations, or processing firms in allied supply-chains, could see rerated valuations as policy risk decreases.

- For sovereign funds/pension capital: This may align with long-horizon, strategic infrastructure investment — tracking government backing may reduce risk premium.

- For downstream users: EV manufacturers, defence-technology firms, energy-storage companies may benefit from more stable supply of processed critical minerals, reducing input-risk and potentially lowering cost long-term.

Key Milestones to Watch

- Announcements of which specific projects receive government equity investment, and the size of those stakes.

- Permitting or “national-interest” designation for processing/refining facilities in Canada for REEs, tungsten, molybdenum, graphite.

- Offtake agreements or contracts where Canada’s government-backed projects secure downstream buyers (automotive, defence, energy storage).

- Commodity price and margin trends for REEs and niche metals — processing cost curves may shift as Canada builds capacity.

- Global policy developments: export-restrictions, tariffs, supply-chain alliances (e.g., U.S./Canada/Europe) which can alter competitive dynamics.

Outlook & Conclusion

Canada’s decision to take equity stakes in mining and processing of critical minerals is more than a resource-policy announcement — it’s a strategic pivot recognising the industrial upstream value locked in supply chains. For investors, the message is clear: resources alone aren’t enough — the processing/refining chain is where value (and risk) lies.

This has the potential to reshape portfolios considering mining + processing opportunities, especially in jurisdictions backed by strong government support and aligned with supply-chain security needs.

But as always, execution matters: timelines, economics, global competition, and ESG dynamics will determine whether this becomes a generational investment theme or a cautionary policy experiment.

If you like, I can identify specific Canadian mining & processing companies (publicly-listed) that appear well-positioned under this policy shift — with valuation commentary and risk-profile. Would you like me to proceed with that?

You said:

ChatGPT said:

Recent coverage of the Epstein files vote

US House passes measure to force release of Epstein files in 427-1 vote

House votes overwhelmingly to compel release of Jeffrey Epstein files

House Votes to Release Epstein Files – But Speaker Johnson Signals Delay to ‘Protect Victims’

Here’s a detailed investor-styled overview of the article “Donald Trump set to cut tariffs on beef, tomatoes…” (via Bloomberg) with strategic implications and potential opportunities. (Note: I assume you meant this latest article on the Epstein files vote rather than the tariffs one — if you’d like the tariff piece instead, I can do that.)

Overview

On November 18, 2025, the United States House of Representatives overwhelmingly approved a resolution (by a vote of 427-1) compelling the United States Department of Justice (DOJ) to release all unclassified records related to the late convicted sex trafficker Jeffrey Epstein, including documents concerning his investigation, prosecution, communications and possibly those connected to other influential individuals. Reuters+2The Washington Post+2

This outcome marks a significant public-policy and political moment — one that touches on transparency, institutional accountability, law-enforcement oversight and the reputational exposure of public‐figures (including Trump) associated historically, however indirectly, with Epstein’s network. The article frames this as a “new setback” for Trump, given his earlier opposition to the release and the fact that his name appears in previously disclosed documents. Bloomberg+1

Key details:

- The vote was nearly unanimous, with only one member voting “no.” The Washington Post+1

- Trump had previously opposed such disclosure efforts, calling them a “hoax,” but in the days before the vote he reversed his stance and publicly directed House Republicans to support the release. Reuters+1

- While the House passed the resolution, the measure still faces the Senate and requires either Senate approval / action or other mechanisms (and ultimately the President’s signature) before becoming effective. Wall Street Journal+1

- Some House leadership expressed concerns about victim-privacy and potential exposure of non-criminal names, signalling possible amendments in the Senate. The Washington Post+1

Key Themes & Drivers

From an investor / risk-analysis perspective, there are several themes that matter:

- Institutional transparency and reputational risk

The push for release of the Epstein files underscores rising investor and public scrutiny of institutional actors (e.g., DOJ, Congress) as well as individuals with historical or alleged ties to high-profile scandals. Entities exposed to reputation risk (law firms, lobbying groups, SMEs in the compliance/forensic space) may face higher cost of capital, legal scrutiny, or brand erosion. - Political risk and governance shifts

The bipartisan nature of the vote (with a near-unanimous result) suggests that the issue transcends typical partisan divides. For companies engaged with regulatory risk or government contracts, this signals a heightened likelihood of transparency mandates and less tolerance for behind-closed-door deals. Governance frameworks may evolve accordingly. - Legal / disclosure chain-reaction risk

With the release of one tranche of high-sensitivity documentation, there may be downstream consequences: litigation, new investigations, private-party claims, or regulatory exposures. Firms that have indirect exposure (via service providers to implicated parties) may face contingent liabilities. - Public-figure vulnerability and downstream business effects

For a figure like Trump, whose business empire spans real-estate, brand licensing, media, etc., the renewed spotlight on Epstein ties could affect valuation, investor confidence, licensing deals, and partner risk. While the direct legal risk may not be newly triggered, the reputational and brand risk is non-trivial. - Precedent for disclosure and “systemic” effect

The fact that Congress is intervening to force disclosure suggests that future campaigns for transparency in other areas (e.g., private-equity funds, special-purpose vehicles, government–contractor interactions) may gain structural momentum. From an investor mindset, the regime of what is considered commercial “safe” from disclosure is shifting.

Implications for Investors & Strategy

Opportunities:

- Firms in the compliance, forensic-accounting, legal-tech space may benefit from increased demand for document review, redaction services, and litigation-readiness solutions as more entities anticipate disclosure risk.

- Risk-management advisory firms and reputation-risk consultancies could see upside as boards and management teams seek to reinforce disclosure and governance frameworks.

- Specialty insurers (e.g., directors & officers liability, reputation-dilution policies) may find increased demand as exposure to legacy scandals and disclosure events grows.

Risks:

- Entities and individual brands tied to high-profile names may experience share-price or valuation dips if association risk materialises. For example, companies using the Trump brand or licensing arrangements may face increased scrutiny or partner pull-back.

- Legal and settlement risk: the newly disclosed documents may spur lawsuits (civil claims, victim suits, class actions). Industries exposed to litigation spillovers (real-estate, hospitality, club-businesses) could see elevated risk.

- Governance fatigue: For companies already under pressure to comply with ESG standards, the additional disclosure demands and potential for “legacy scandal flags” may increase compliance cost burdens – especially for middle-market firms with limited capacity.

Portfolio & Risk Management Considerations

- Screen brand‐exposure: If you hold companies with brand licensing ties to individuals under increased scrutiny (e.g., Trump–brand businesses), consider the mitigation of reputational exposure or partner break risk.

- Stress-test legacy exposure: In sectors such as real-estate, hospitality, private-membership venues, audit residual risk stemming from historical associations (e.g., with Epstein, Maxwell networks) may need to be factored.

- Allocate to governance support infrastructure: Increase allocation toward firms offering solutions in governance, compliance, document-management and remediation. These often provide steadier cash-flows in a heightened-transparency environment.

- Monitor regulatory trajectories: Watch for further legislation compelling disclosure (e.g., in lobbying, investigations, tax-haven flows) that may broaden the affected-universe beyond Epstein-documents.

- Valuation discipline: In companies affected by reputational risk, apply larger discount factors for contingent − but uncertain − liabilities. Be cautious about “brand impairment” risk or partner fallout scenarios.

Milestones to Watch

- Whether and how the Senate acts: Does the Senate move quickly, does it amend the bill, or does it stall? Timing will signal institutional appetite for transparency.

- Signing-by-the President: Will Trump or his administration commit to full compliance / does the DOJ comply in a timely way? Delays may signal further reputational exposure.

- Document release and content: While the legislation mandates release, the nature of what is disclosed (names, allegations, redactions) will determine the severity of downstream risk.

- Litigation/settlement activity: Watch for civil suits, follow-on legal claims tied to the newly-released material.

- Brand/partner responses: Companies or individuals associated with formerly opaque networks may face partner exits, license terminations, or negative media momentum.

Conclusion

This congressional action — forcing the release of the Epstein-related files — is more than just a political headline. For sophisticated investors, it marks a structural shift in disclosure culture, governance expectation and reputational risk management. Entities once sheltered by ambiguity or legacy relationships may find themselves exposed, while firms offering remediation, transparency tools and governance support stand to benefit.

For portfolios, the takeaway is clear: revisit brand-tied exposure, stress-test governance provisions, consider the time-horizon of legacy-risk realisation, and look for opportunities in the infrastructure of transparency itself.

Would you like me to identify publicly-traded companies whose valuations or risk profiles may be impacted by this development (positively or negatively) and provide a short-list for further review?

You said:

Yes id like the Epstein files one please

ChatGPT said:

Here are three publicly-traded companies with exposure to Donald Trump-linked brands or businesses that could be impacted — either positive or negative — by the recent congressional push to release all unclassified Jeffrey Epstein-related files.

For each, I’ve included a summary of the exposure, the potential impact path, and key risks.

| Company | Exposure to Trump-ecosystem | Potential Impact from Epstein-Files Release | Key Risk Factors |

|---|---|---|---|

| Trump Media & Technology Group Corp. (Ticker: DJT) | This company is majority-owned by Trump via the trust and runs the social-media platform Truth Social. Wikipedia | If the Epstein‐files release leads to renewed reputational scrutiny of Trump and associated networks, investor sentiment for DJT could weaken. Conversely, increased attention might drive traffic to Trump-affiliated platforms and rally the base. | Heavy loss history, regulatory/legal risk, dependence on Trump brand; reputational hit could hurt ad/business partnerships. Wikipedia |

| G‑III Apparel Group, Ltd. (Ticker: GIII) | Historically held licensing agreements with Trump-branded apparel (e.g., his men’s collection) though many such deals ended years ago. Wikipedia+1 | If the Trump brand is adversely impacted by disclosure of new files and mentions, licensing deals could suffer, or there may be increased brand-risk for companies still associated with the Trump name. | The direct licensing exposure is small and historical; the brand risk is indirect. |

| PVH Corp. (Ticker: PVH) | PVH formerly manufactured Trump-Signature Collection apparel under license until 2015. Wikipedia | While this company severed direct Trump licensing a decade ago, broader brand-risk for Trump’s name could lead to retrospective reputational drag on brands once linked. Impact is likely limited. | Very limited current exposure; the risk is indirect and likely minimal for PVH specifically. |

Strategic Considerations

- Sentiment risk vs direct legal risk: These companies don’t necessarily face direct legal liability from the Epstein-files release, but they may face brand/reputational risk if the release triggers renewed media and regulatory focus on Trump-associated networks.

- Alpha vs risk trade-off: DJT offers higher potential upside if a rally around Trump’s media ecosystem occurs, but also higher downside if the files produce negative headlines. GIII and PVH offer more muted risk/reward given lower direct exposure.

- Timing and chain reaction: Much depends on what exactly is revealed in the files — names, associations, legal exposures. If new connections surface, adjusting valuations (especially for DJT) to reflect greater risk may be warranted.

- Portfolio sizing and hedge: For investors exposed to DJT, consider tighter stop-losses or hedging the brand-risk exposure. For more indirectly exposed names, monitor for any unexpected partner announcements or licensing updates.

If you like, I can scan 5 – 10 more public companies with more indirect exposure to Trump-brand risk or Epstein-association risk (e.g., licensing, real estate, hospitality) and provide a broader “watch-list” with updated valuations and risk scores. Do you want that?

You said:

Can you please help me rewrite some articles as a credentialed financial Investor. An in-depth overview of the topic and some potential opportunities that will result from the events in the article. Please do not add links but do reference sources. https://www.bloomberg.com/news/articles/2025-11-18/house-votes-to-release-epstein-files-in-new-setback-for-trump?srnd=homepage-canada

ChatGPT said:

Here’s a detailed, investor-oriented rewrite of the article titled “House votes to release Epstein files in new setback for Trump” (Nov. 18, 2025) from the vantage point of a credentialed financial investor, with both an in-depth overview and some potential investment / risk-opportunity implications.

Overview

On November 18, 2025, the U.S. United States House of Representatives voted overwhelmingly (427-1) to require the United States Department of Justice (DOJ) to release all unclassified records relating to the investigation and prosecution of Jeffrey Epstein. These include documents, communications, and investigative materials from the case. The vote marks a major moment in transparency and oversight. The Washington Post+2AP News+2

The legislation—commonly referred to as the Epstein Files Transparency Act—now moves to the Senate and awaits presidential sign-off to become law. People.com+1

Importantly, this vote is widely viewed as a setback in the political capital of Donald Trump. According to the article, his previously strong control over House Republicans showed signs of weakening as the vast majority of Republicans voted for the measure despite earlier resistance. Bloomberg+1

In short: What began as a politically charged oversight issue has now shifted into a potential systemic moment of documentary disclosure, with broad implications for governance, reputation risk, legal risk, and capital-market sentiment.

Key Themes & Drivers

From an investor’s lens, several strategic themes and drivers emerge:

- Governance & transparency regime shift

The bipartisan nature of this vote suggests that institutional expectations around disclosure and accountability are evolving. Companies, individuals, and institutions tied to legacy opaque networks may face elevated scrutiny. - Reputational risk management

The files will potentially expose or remind the market of links, communications or historical associations tied to Epstein’s broader network. For persons or businesses with legacy exposure (direct or indirect) to Epstein or connected parties, the risk of reputational damage is real. - Political risk and business brand risk

Because the vote reflects a challenge to Trump’s previous resistance, this implies that business interests tied to him (brands, licensing deals, media ventures, real estate) may now carry incremental risk. Investors holding such exposures must re-assess whether brand-premium assumptions still hold. - Legal / disclosure chain-reaction risk

The release of files could trigger downstream legal actions—civil suits, regulatory investigations, or new claims. Investors in companies that had dealings with Epstein-connected entities or that may appear in the released data will need to consider contingent liabilities. - Market sentiment & selective opportunity

While the headline is risk-laden, there is also opportunity in the underlying trend: firms specialising in governance remediation, legal-tech, document-review services and compliance infrastructure may benefit from increased demand.

Investment Implications & Opportunities

As an investor analysing this environment, I’d highlight several strategic considerations and potential opportunities:

Opportunities

- Governance / compliance services providers: Firms that offer document-management, corporate-disclosure tools, forensic-audit software or reputation-risk modelling could see increased demand as companies anticipate higher transparency expectations.

- Litigation-finance & insurance: The potential for new suits means that insurers (D&O, professional-liability) and litigation-funding vehicles may see shifts in pricing or demand. Managed exposures here might benefit.

- Media / publishing platforms: With renewed interest in archival content, litigation disclosures and historical record-digging, there may be incremental monetisation opportunity for archival/licensing firms and specialist media.

- Brand-restructuring advisory: As companies adjust brand-risk exposure (especially those with legacy associations), consulting/advisory firms focused on reputational remediation may gain upside.

Risks

- Branded businesses linked to high-risk individuals: Businesses that rely on the name/brand of individuals (e.g., licensing agreements tied to Trump) may face cancellations, renegotiations or loss of trust capital. Investors should review these exposures.

- Legal & latent-risk underwriters: Companies with potential exposure to new plaintiffs’ actions must reassess discount rates and contingency provisions. The “archives open” moment may mean latent risk realises.

- US regulatory/disclosure spill-over: The precedent set here could prompt companies with exposure to U.S. operations to tighten disclosure, potentially increasing cost of capital or forcing restructure of opaque arrangements.

Investment Check-List (From a Fiduciary Lens)

Here are some questions to run through for portfolio positions in light of this development:

- Brand nominal-risk: Does the business rely on an individual legacy (e.g., celebrity, high-profile CEO) whose past associations may be in the files?

- Contractual exposure: Are there licensing, royalty or brand contracts that could be terminated or renegotiated if reputational risk increases?

- Legal contingency: Does the firm have operations, transactions or counterparties that could appear in the released documents and thus trigger legal action?

- Disclosure governance: Is the company strengthening its transparency, audit and disclosure controls to pre-empt risk from downstream revelations?

- Service-provider momentum: Is the company in a sector likely to gain from higher governance/forensics/industrial-compliance spend?

Potential Portfolio Moves

- Long: Firms with strong governance/disclosure-technology offerings—especially those servicing the corporate-audit, legal and forensics market.

- Selective: Media firms or archival-content businesses that may monetise renewed interest in historical high-profile disclosures (but ensure revenue visibility).

- Avoid or hedge: Companies heavily reliant on high-profile individuals with reputational risk (especially if tied to Epstein-network legacy) unless the business shows divergence from that reliance.

- Monitor: Professional-services firms and insurers with latent exposure to legal-risk via Epstein-related claims or similar legacy-network vulnerabilities.

What to Monitor / Timeline & Milestones

- Senate action: Whether the bill passes the Senate, in what form, and what redactions or amendments are introduced (for victim privacy, national-security carve-outs).

- File content release: The nature of the documents made public will matter—if names of businesses or individuals appear, risk dynamics will shift rapidly.

- Litigation filings: New suits or regulatory inquiries referencing the material.

- Brand/licensing announcements: Any partner pull-out, brand-renegotiation or de-licensing tied to individuals associated with Epstein’s network.

- Market pricing / spreads: Bond spreads, D&O insurance premiums, legal contingency accruals for firms potentially implicated.

Conclusion

From a professional investor’s perspective, this congressional vote is not just a political story, but a signal of a structural shift: transparency expectation is rising, and legacy networks once thought shielded may face renewed exposure. The business implications are broad—from brand-risk to governance cost to litigation contingency.

The key for portfolio managers is to identify which companies are vulnerable and which may benefit. The “Epstein files” moment could become a broader template for how legacy disclosures are handled—and firms that anticipate this shift will be better positioned to capture upside or mitigate downside.

If you like, I can identify specific companies most exposed or positioned given this development (with valuation commentary) and we can discuss a broader watch-list.

Latest on Epstein files transparency vote

The Latest: House votes overwhelmingly to pass bill to force release of Epstein files

Republicans quickly coalesce behind Epstein bill after Trump backs it

Top Democrat accuses Trump of ‘panicking’ after U-turn on Epstein files vote

You said:

ChatGPT said:

Latest crypto‑market update: Bitcoin slide below $90K

Bitcoin drops below $90,000 in sign of souring mood

Bitcoin drops below $90,000 for the first time since April then rebounds

$1 trillion gone in 6 weeks! Is this the big crypto crash everyone feared? Bitcoin dives below $90K

Here’s a refined, investor-oriented rewrite of the article on Bitcoin dropping below $90,000 — with an in-depth overview and potential opportunity/implication commentary.

Overview

Bitcoin recently fell below the US $90,000 level for the first time in about seven months, marking a sharp reversal from a peak above US $126,000 in October 2025. Reuters+1

The slide has erased much of the 2025 gains in crypto markets, as investor sentiment softens amid macro-uncertainty — notably doubts about the timing of US interest-rate cuts, and broader risk-off behaviour in global equity and tech markets. AP News+1

Crypto-related equities and miners are also under pressure: listed firms tied to Bitcoin or crypto infrastructure such as miners and exchanges have seen declines. Reuters+1

In short: A combination of fading momentum, rising risk aversion and technical breakdowns has turned what had been a strong crypto rally into a meaningful correction.

Key Themes & Drivers

From an investor’s vantage point, a few important themes are at work:

- Risk-asset correlation and sentiment fragility: Bitcoin is demonstrating that it still behaves like a risk asset in many respects. When macro risk appetite weakens (e.g., due to interest-rate uncertainty), crypto pays a price.

- Macro-policy backdrop matters: Expectations around US central-bank policy (rate cuts) are key. With a delay in expected easing, yield competitiveness rises, making non-yielding assets like Bitcoin less attractive.

- Technical breakdowns amplify moves: As one article noted, the failure to hold certain support levels triggered a “death cross” (50-day moving average crossing below 200-day) and intensified selling. CoinDesk

- Institutional participation and flow dynamics: Earlier in the rally, institutional inflows (including via ETFs) helped fuel momentum. When flows stall or reverse, the price moves accelerate downward.

- Liquidity and leverage risks: In high-volatility environments, leverage and speculative positions can unwind rapidly, deepening drawdowns.

- Opportunity vs risk dichotomy: While the correction presents risks, it also may present a tactical entry point — if the investor believes in the long-term thesis for crypto (digital store of value, institutional adoption). The timing and thesis matter.

Investment Implications & Opportunities

Potential Opportunities

- Entry point for long-term believers: If you remain convinced of Bitcoin’s long-term value-store or digital-asset thesis, the sub-$90,000 level may offer a more favourable risk/return entry than the prior higher levels.

- Selective exposure to infrastructure: Crypto-miners, exchange/market-maker firms, and blockchain service-providers whose valuation logic works even in a sideways/volatility environment may be interesting. The sector shake-out may strengthen survivors.

- Hedging / diversification plays: With crypto’s recent behaviour showing strong correlation to broad risk-assets, strategies using derivatives or structured products to hedge downside risk in crypto may become more relevant.

- Tactical swing-trade opportunities: For shorter term traders, oversold conditions (e.g., sentiment scorings like “fear”) may generate relief rallies if flows improve or macro data surprises positively.

Risks & Considerations

- Extended drawdown risk: Breaking major support opens room for further declines — some commentary suggests Bitcoin could test lower support zones (e.g., US $75,000) if risk remains elevated. Reuters

- Funding, leverage and counter-party risk: Crypto firms that expanded during the rally may face pressure in downcycles; this raises default risk and contagion risk into broader markets.

- Regulatory risk: The regulatory backdrop (crypto-asset regulation, tax/treatment of digital assets) remains uncertain and can swing unfavourably.

- Valuation & thesis risk: The long-term value proposition of Bitcoin (and other crypto) depends on institutional uptake, regulatory clarity, adoption. If these slow, valuations can be hurt significantly.

- Correlation to traditional markets: Many investors viewed crypto as uncorrelated; this event shows the correlation can increase in stress periods, reducing the diversification benefit.

Portfolio & Strategic Considerations

- If long crypto: Consider reducing position size, increasing stop-loss guardrails, or diversifying into more resilient nodes of the ecosystem (e.g., infrastructure companies rather than pure speculative tokens).

- If crypto is a smaller allocation: Use this drawdown as a re-balancing point — either reinforcing thesis and adding incrementally or treating as an opportunity to re-set risk levels.

- Monitor key signals: Watch for macro data (inflation, Fed commentary), ETF/inflow stats into spot crypto funds, mining cost curves, and regulatory announcements that could change sentiment.

- Hedging: Investors using derivatives may want to consider hedges on crypto exposure or use options strategies to play potential relief rallies while limiting downside.

What to Monitor / Milestones

- Bitcoin support levels: Key technical zones (e.g., US $90k, US $85k-75k) and whether they hold or break.

- Inflow/outflow data: Spot ETF inflows, mining-fund outflows, institutional crypto holdings.

- Macro & rate environment: Federal Reserve communications, inflation prints, rate-cut expectations.

- Regulatory developments: Regulatory actions or guidance in major jurisdictions (US, Europe, Asia) on crypto assets.

- Mining cost curves / halving cycles: For crypto-miners, cost of production per coin and upcoming halvings or reward changes.

- Sentiment metrics: Crypto fear/greed indices, derivative open interest, funding rates in futures markets.

Conclusion

The recent slide in Bitcoin below US $90,000 is a significant inflection point in the crypto-market cycle. From a professional-investor perspective, it signals that the risk equation has changed — from an unfettered rally to a more complex environment where macro, regulatory and liquidity risks dominate.

There is opportunity in such a correction — but it must be approached with discipline. The long-term thesis for crypto remains valid for some investors, but this drawdown reminds us that timing, risk-controls and capital structure matter.

If you’d like, I can identify specific publicly-listed companies (miners, exchanges, infrastructure) that are most exposed to Bitcoin’s behaviour, and provide potential investment/re-rating opportunities. Would you like me to pull that?

You said:

ChatGPT said:

Here’s a professionally-written, investor-oriented analysis of the recent major outage at Cloudflare, from the perspective of a credentialed financial investor — an in-depth overview of the event, the key implications, and potential opportunities that arise from it.

Overview

On November 18, 2025, Cloudflare, a leading web-infrastructure and cybersecurity company whose network reportedly handles about 20 % of the world’s websites, suffered a major service interruption. Business Insider+3Semafor+3Financial Times+3 The outage knocked out or impaired dozens of prominent online services—including ChatGPT, X (formerly Twitter), Canva, and others. Reuters+1 According to Cloudflare’s own statement, the root cause was a “spike in unusual traffic” that caused a configuration file within its traffic-management system to grow beyond expected size, triggering a software crash. Business Insider+1 The disruption lasted for several hours, though full normalisation took longer for some customers. The Washington Post+1

At a high level, the event highlights that even critical internet-infrastructure providers remain vulnerable — and that systemic dependency on a small number of firms in the “back-end” of the internet is a strategic risk. Semafor’s framing emphasises that “a few major companies are ‘the infrastructure of the internet’, so when one of them fails it becomes really obvious.” Semafor

Key Themes & Drivers

From an investor’s lens, several themes and drivers stand out:

- Concentration risk in critical infrastructure

The outage underscores how many web services rely on a narrow set of infrastructure providers. Cloudflare’s network — large though it is — represents a single point of failure. When that point falters, a broad array of downstream services suffers. This concentration creates systemic risk, which investors must factor when assessing infrastructure-tech companies. - Service reliability and reputational trust

For companies like Cloudflare, reliability is a core part of their value proposition. A failure of this scale raises questions about resilience, backup systems, software quality and incident response. If clients lose confidence, churn or price-downward pressure may follow. - Regulatory and contract-risk exposure

As infrastructure becomes more critical (cyber-security, cloud, content delivery networks), regulatory expectations rise. Governments and large enterprises increasingly demand service-level guarantees, incident-reporting obligations, and business-continuity safeguards. A major outage can prompt contract renegotiations, higher indemnity clauses, and higher risk-premiums. - Opportunity for competitive dislocation

When a dominant infrastructure provider falters, rivals may gain. Customers may reconsider multi-vendor strategies, diversify across providers, or negotiate stricter terms. That opens a window for smaller or nimble competitors to capture market share or for new entrants to pitch differentiated reliability. - SaaS and digital-business fragility

The outage also reveals fragility in digital-business models—many SaaS platforms, AI-services and web-apps are only as resilient as their infrastructure backbone. For investors in those platforms, infrastructure-risk is a tail-risk that may have been under-priced.

Investment Implications & Opportunities

As an investor with fiduciary responsibility, the event suggests both risk mitigants and selective opportunities.

Opportunities

- Infrastructure reliability enhancement: Firms offering redundancy, multi-cloud/hybrid-cloud management, resilience as a service (RaaS), or third-party fail-over solutions may see increased demand.

- Second-tier infrastructure providers: Companies competing with Cloudflare (or offering complementary services) may gain share as clients seek diversification.

- Risk-management/incident-response services: With attention high on infrastructure failure, firms providing audit, resilience-planning, cyber-event remediation or infrastructure insurance may benefit from higher premiums, new client wins, and higher margins.

Risks

- Valuation compression for dominant infrastructure players: Companies like Cloudflare face elevated scrutiny; if client churn increases or contract terms worsen, growth could decelerate, warranting a discount in valuation.

- Downstream dependency risk: Platforms reliant on a single infrastructure provider may face amplified risk. Investors in SaaS/web-apps should evaluate their infrastructure-supplier dependency and consider diversification risk.

- Contract-liability and indemnity risk: Infrastructure failures may lead to financial liabilities, client penalties or regulatory fines. These can reduce free-cash-flow and threaten margins.

Investment Check-List (For Portfolio Review)

- Supplier concentration: Does the company rely heavily on a single infrastructure provider or network partner whose failure would materially impair operations?

- Resilience-capability: What redundancy, backup protocols, multi-vendor arrangements does the company have? Is infrastructure reliability part of its competitive differentiation?

- SLAs and contract-terms: Are there change-of-supplier options, penalty clauses, indemnities, or risk-sharing in place?

- Sector exposure to outage risk: How much of a company’s revenue depends on uninterrupted digital delivery (e.g., web-apps, streaming, fintech)?

- Competitive threat profile: Could smaller infrastructure vendors take advantage of a reliability failure at a dominant provider to win share or negotiate better terms?

Portfolio Strategy & Tactical Moves

- Over-allocate to resilient vendors: Infrastructure providers and service firms with proven high-uptime records, diversified geographies and multi-vendor strategies may deserve a premium.

- Under-weight high-dependency users: Platforms whose business is heavily dependent on a single network or API provider without visible redundancy might warrant a haircut.

- Monitor real-time metrics: Infrastructure-uptime incidents, SLA breach announcements, outage-tracking data (e.g., Downdetector) should be part of the risk-monitoring toolkit.

- Hedging the infrastructure-risk: Use options or structured products to hedge large exposures in infrastructure firms or end-user companies vulnerable to outages.

- Diversification: Evaluate having exposure across infrastructure sub-sectors (CDN/edge, cloud, security, hybrid) rather than a single large cap name which may carry concentration risk.

What to Monitor & Milestones

- Cloudflare’s public post-mortem: The depth of root-cause analysis, remediation plans, timeline for improvements.

- Client-churn statistics: Does Cloudflare report elevated churn or downgraded contract terms in subsequent quarters?

- Infrastructure failure trend-line: Are we seeing more frequent large-scale outages among infrastructure providers (AWS, Azure, Google Cloud) — if so, this may signal a structural issue in digital-infrastructure resilience.

- Competitive win announcements: Are rival vendors announcing contract wins from disaffected customers of Cloudflare or other big providers?

- Insurance/contract-terms evolution: Do service-providers revise indemnities, SLAs or pricing in response to outages? Does this affect margins or cost structures?

Conclusion

The recent Cloudflare outage is more than a headline tech-snag. From a financial-investor’s vantage, it’s a structural reminder of how concentrated and fragile digital-infrastructure has become—and how failure risk in that layer cascades across sectors.

Companies like Cloudflare must now prove not only growth but resilience. The market may reward firms that build redundancy, multi-vendor architectures and reliability as value propositions. Conversely, high-dependence users and single-vendor infrastructure firms may face downside risk unless they adapt.

For portfolios, the key takeaway: infrastructure-risk is real, measurable and increasingly investable—not just via names that enjoy growth, but also those that enable reliability, continuity and diversification behind the scenes.

Recent cloud/internet infrastructure outage news

ChatGPT and X hit by outage at online security group Cloudflare

Cloudflare blames a software crash after sites like X and ChatGPT went down

Cloudflare outage briefly disrupts ChatGPT, X and dozens of apps

Would you like me to identify specific infrastructure-tech stocks (CDN, edge computing, cybersecurity service providers) that appear positioned to benefit from rising demand for resilience and redundancy post-this outage?

You said:

ChatGPT said:

Here’s a professional-investor style rewrite of the article on MP Materials’ joint venture with Saudi Arabia, including an in-depth overview and possible opportunities emerging from the event.

Anatomy of the Deal

MP Materials announced that it has entered into a joint venture with Ma’aden (Saudi Arabia’s state-mining company) and the United States Department of Defense (via what is being referred to as the “Department of War” in the press) to build a rare-earth-refining facility in Saudi Arabia. Reuters+3investors.mpmaterials.com+3TipRanks+3

Under the terms:

- Ma’aden will hold no less than 51 % of the JV; MP Materials + the U.S. government hold up to 49 %. investors.mpmaterials.com+1

- The facility will process rare-earth feedstock (both light and heavy rare-earth oxides) sourced from Saudi Arabia and other regions, aiming to supply U.S., Saudi and allied manufacturing/defence uses. MINING.COM+1

- Importantly, MP is contributing “technical expertise” rather than heavy capital; the U.S. government is providing full financing for the U.S. contribution. investors.mpmaterials.com

- The announcement builds on earlier announcements: in July 2025 MP had already secured a large U.S. government partnership to scale magnet manufacturing and refine domestic supply chains. The Northern Miner+1

In reaction, MP Materials’ shares jumped significantly (around +8-10 %) on the news. The Northern Miner+1

Why This Matters: Strategic & Market Drivers

From a financial-investor viewpoint, several major themes emerge:

1. Supply-chain diversification / de-risking from China dominance

China currently controls the lion’s share of rare-earth processing capacity. This deal is part of a broader push (by the U.S., Saudi Arabia and allies) to build new alternatives and reduce dependency on China’s bottleneck. That matters in EV motors, magnets, defence hardware, renewables.

2. Geopolitics meets industrial policy

This is not just a mining deal—it’s a geo-industrial signal. The U.S. government is backing the project (via its defence arm) and aligning with Saudi Arabia’s ambitions (via Ma’aden). For investors, it underlines how industrial-metals companies can access policy-driven upside.

3. Low-capex/technical-expertise model for MP

MP doesn’t provide the major capex; instead it leverages its expertise. That gives it exposure to upside with comparatively lower capital risk. The “capital-light” nature of the JV increases optionality for shareholders.

4. Scale and downstream potential

Processing rare‐earth feedstock into separated oxides and magnets is high value-add. If MP and its partner can scale magnet production (rather than just mining), margins can expand. This expands the addressable market to downstream components.

5. Timing & execution risk

While the headline is strong, building out a refinery, establishing feedstock supply, engineering, permitting, long-term offtakes—these are multi-year tasks. The market must price multiyear horizon and execution risk.

Opportunities & Investment Implications

Given the deal, here are several potential portfolio actions and implications:

Opportunities:

- MP Materials (ticker: MP) now arguably has a stronger growth narrative—not just U.S. domestic mining/processing but now international expansion via Saudi Arabia. Investors can position for the upside of scale and downstream value.

- Downstream component manufacturers (magnets, motors) may benefit indirectly as rare-earth supply becomes more diversified—potentially improving availability and lowering risk of supply shocks.

- Countries/companies aligned with strategic mining/processing (rather than mere extraction) may become investment favourites in the “critical materials” theme.

Risks / Considerations:

- Execution risk: delays, cost-overruns, supply disruptions could stall benefits. Investors need to monitor milestone progress (construction/completion, commissioning).

- Feedstock and offtake risk: The refinery depends on continuous feedstock and long-term customer contracts. Without them, margins may be lower than expected.

- Regulatory / geopolitics: The project has large government involvement. Policy shifts, export controls, sanctions risk are non-trivial.

- Valuation expectations: The jump in share price may already reflect a portion of the upside; room for disappointment exists. Investors must calibrate how much of the potential is already priced in.

Portfolio & Tactical Strategy

- Core exposure: If comfortable with risk, hold or add MP Materials as a pure play in rare-earth supply chain expansion.

- Selective exposure: Complement with companies in adjacent areas (magnet manufacturing, EV motors, high-performance magnets) that benefit from improved rare-earth availability.

- Risk mitigation: Implement stop-loss levels or size exposure given execution horizon. Consider trimming if the share‐price runs ahead of visible milestone delivery.

- Diversification: Though rare earths are in vogue, don’t cluster exposure purely in mining; include downstream and adjacent segments to capture value across the chain.

- Milestone monitoring: Set reminders for key project updates (e.g., JV definitive agreement signing, cap-ex announcements, feedstock contract wins, first production commissioning) and link future investment decisions to these.

Milestones & What to Watch

- Signing of final definitive JV agreements and details (costs, timeline, ownership stakes).

- Feedstock agreement announcements (where Saudi feedstock will be sourced, volume, pricing).

- Construction start / commissioning of the Saudi refinery facility.

- Magnet manufacturing extension announcements in Saudi Arabia (as referenced by MP).

- Of-take contracts and sales volume of rare-earth oxides produced from the JV.

- Margin trends for MP Materials: does the new international facility expand margins materially or remain a long-term option?

- Competitive responses: how will other rare-earth/critical-minerals firms respond or compete? How will China react?

Conclusion

The MP Materials-Saudi Arabia JV is a strategic inflection point in the critical-minerals theme. It elevates MP from domestic rare-earth producer to a globally scoped player with government backing. For investors, this opens a high-reward scenario—but one with clear execution and policy risks.

In the context of industrial equities, this deal ticks many boxes: high value-add processing, strategic material demand (EVs, defence, renewables), diversification away from dominant supplier (China), and government alignment. Yet, investors should remain disciplined: the timeline is long, capex and margin expansion are assumptions, and risk of delay or below-expectation delivery remains.