So What: Understanding SK Hynix

- Company Overview: SK Hynix Inc. (KRX : 000660), headquartered in Icheon, South Korea, is a leading global semiconductor manufacturer specializing in memory chips, including DRAM and NAND flash products. SK Hynix’s memory products are found in a variety of consumer electronics, including DVD players, cellular phones, set-top boxes, personal digital assistants, networking equipment, and hard disk drives.

- Background: Established in 1983, SK Hynix has evolved into the world’s second-largest memory chipmaker, supplying products to major technology companies globally.

- Product Portfolio:

- DRAM: Dynamic Random-Access Memory used in PCs, servers, and mobile devices.

- NAND Flash: Non-volatile storage solutions for SSDs, USB drives, and memory cards.

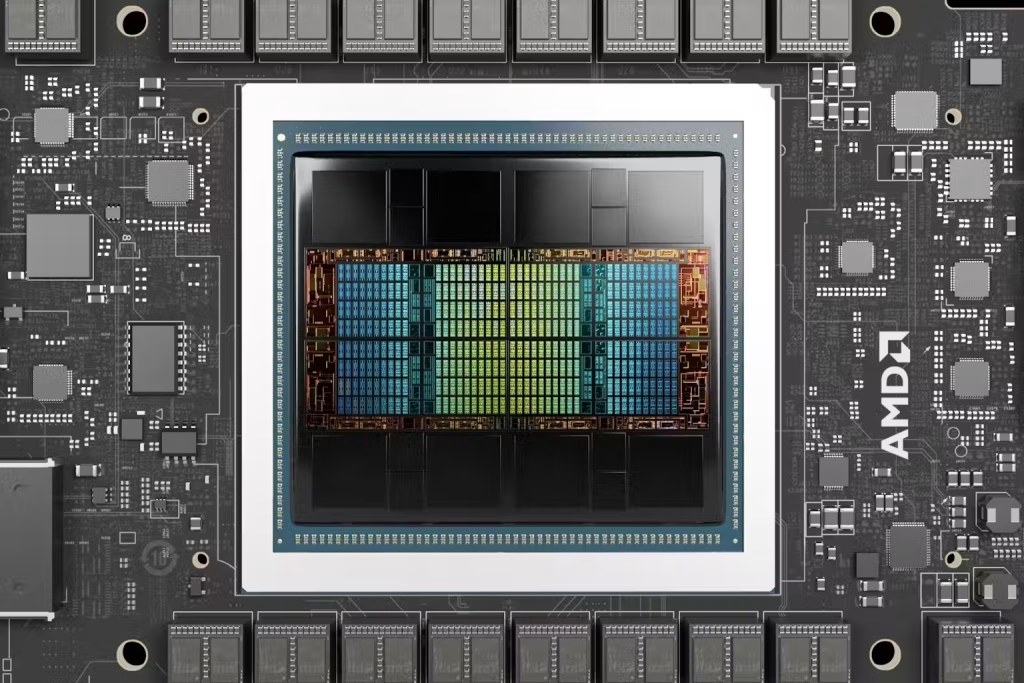

- HBM (High Bandwidth Memory): Advanced memory for high-performance computing and AI applications.

- CMOS Image Sensors: Sensors for capturing images in cameras and smartphones.

- Enterprise SSDs: Solid State Drives designed for data centers and enterprise storage.

- Notable customers include:

- Microsoft: Utilizes SK Hynix’s memory solutions in various computing products.

- Apple: Incorporates SK Hynix’s memory chips into its devices.

- Asus: Employs SK Hynix’s memory components in its hardware offerings.

- Dell: Integrates SK Hynix’s memory products into its computing systems.

- MSI: Uses SK Hynix’s memory solutions in its products.

- HP Inc.: Incorporates SK Hynix’s memory chips into its devices.

- Hewlett Packard Enterprise: Utilizes SK Hynix’s memory solutions in its enterprise products.

- Future Plans:

- Expansion of HBM Production: SK Hynix plans to increase capital spending to the mid-to-high 10 trillion KRW range to meet growing demand for HBM chips.

- Yongin Semiconductor Cluster: The company is investing approximately $6.8 billion in its first chip plant in Yongin, South Korea, aiming to enhance production capacity for AI semiconductors.

- Technological Advancements: Development of the world’s largest capacity 16-layer HBM3E, a 48 GB memory chip, to strengthen its position in the AI memory market.

The Grain of Salt:

- Market Volatility: The semiconductor industry is inherently cyclical, with periods of oversupply leading to price declines and reduced profitability. Fluctuating demand, especially in consumer electronics, can exacerbate this volatility.

- Competition: SK Hynix competes with major players like Samsung Electronics and Micron Technology. These competitors continually invest in advanced technologies and capacity expansion, intensifying market competition.

- Supply Chain Disruptions: Global events, such as the COVID-19 pandemic, have disrupted supply chains, affecting production and delivery schedules.

- Technological Advancements: Rapid technological changes require continuous investment in research and development to maintain competitiveness. The transition to next-generation memory technologies necessitates significant capital and expertise.

- Intellectual Property Disputes: The semiconductor industry is prone to patent litigations. SK Hynix has faced legal challenges, such as the DRAM price-fixing scandal and disputes with companies like Rambus and Netlist, which can result in financial penalties and reputational damage.

- Talent Acquisition and Retention: The semiconductor industry requires highly skilled professionals. Attracting and retaining top talent is crucial for innovation and maintaining a competitive edge.

The Quant: Financial Performance

- Revenue: In Q3 2024, SK Hynix reported revenues of 17.5731 trillion KRW (approximately $13.2 billion USD), marking an all-time high.

- Profitability: The company achieved an operating profit of 7.03 trillion KRW (approximately $5.3 billion USD) and a net profit of 5.7534 trillion KRW (approximately $4.3 billion USD) in the same quarter.

- Debt Position: SK Hynix has managed its debt effectively, maintaining a stable financial structure.

- Investments: The company plans to increase capital spending to the mid-to-high 10 trillion KRW range to meet growing demand for HBM chips.

These figures indicate a strong financial position, with significant growth in both revenue and profitability, underscoring the company’s effective strategies and market demand for its products.

What Now: Implications for Stakeholders

- Investors: SK Hynix’s strong financial performance and strategic focus on AI memory position it as a compelling investment opportunity. However, investors should remain vigilant about market cycles and competitive pressures.

- Customers: Companies relying on advanced memory solutions can benefit from SK Hynix’s cutting-edge products, particularly in AI and data center applications.

- Industry Observers: SK Hynix’s advancements in HBM technology and strategic investments highlight its role as a key player in the evolving semiconductor landscape.