All three stories rhyme on infrastructure as destiny. GPUs are behaving like a new commodity — with power, memory, and cooling as the cartel levers; defense is shifting to modular autonomy kits that refresh fleets on software cadence; and U.S. connectivity is bottlenecked by spectrum policy just as edge AI arrives. Investor takeaway: own the bottlenecks and enablers (HBM/packaging, optics, liquid cooling, grid gear; autonomy stacks/sensors; fiber/backhaul/towers), trade the policy calendars (FCC auction authority, defense awards), and avoid narratives that depend on resources (compute or spectrum) without secured supply.

Good: “GPUs > Oil?” — the ‘digital oil’ thesis

What it is:

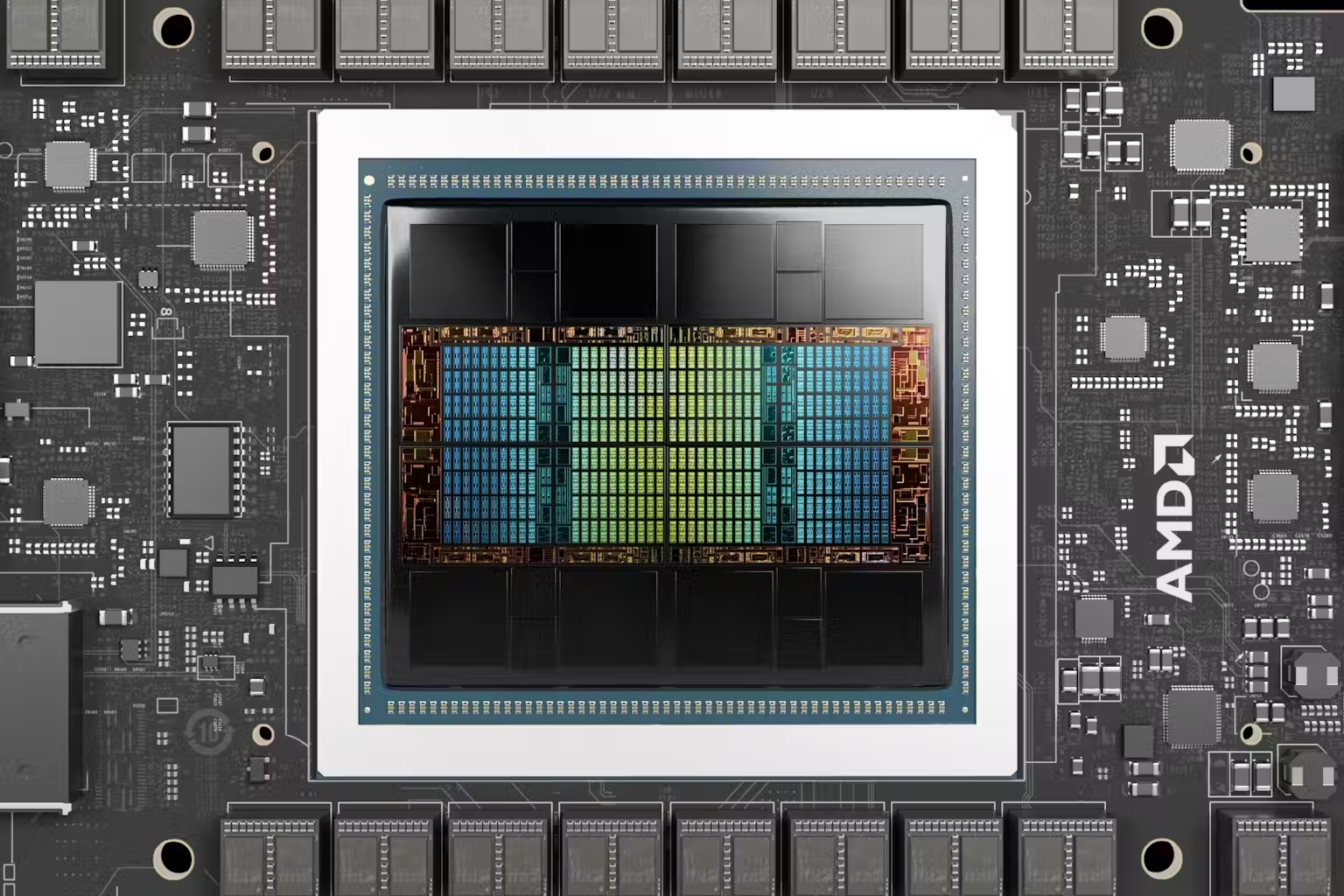

AInvest lays out a provocation: the GPU market could scale from roughly $70B (2024) to ~$237.5B by 2030 (~22.6% CAGR), riding AI model training/inference, autonomous systems, and blockchain — and, over a longer arc, potentially rival oil’s centrality as the world’s “fuel.” They contrast that with oil’s much slower growth path toward ~$2.7T by 2030(~0.9% CAGR), noting decarbonization headwinds. The piece also frames GPUs as embedded in “critical infrastructure” (AVs, data centers) and flags Asia-Pac as the adoption leader. It’s a thesis, not a forecast, but the direction of travel is clear: compute is becoming a macro commodity with real supply chains (HBM, advanced packaging, power, cooling).

What it will do:

- Power and supply become the new OPEC: If demand follows the model-training curve, the chokepoints won’t just be NVIDIA’s product cadence; it’s HBM capacity, advanced packaging, high-speed optics, liquid cooling, and grid power near load centers. Whoever controls those gates controls the tempo of AI rollout.

- Capex gets long-dated: Multi-year contracts for GPUs and data-center buildouts turn this from a hype cycle into a capital program. Expect persistent strain in semicap tools, substrate supply, and utility interconnect queues as AI campuses scale.

- Oil doesn’t go away — it rotates: Oil remains foundational for transport/petrochemicals, but the growth multiple shifts; the incremental story tilts to chemicals, LNG arbitrage, CCS/hydrogen vs. pure volume.

How you can benefit:

- Own the bottlenecks, not just the logos: Consider suppliers of HBM/DRAM, advanced packaging, optical transceivers, immersion/precision cooling, switchgear/substation EPC, and AI-ready data-center REITs. These ride capex regardless of winner.

- Grid adjacency: Monitor utility interconnect backlogs and local approvals; exposure to transmission buildout, transformers, and backup generation vendors can track AI clusters’ siting.

- Oil rotation vs. replacement: If you’re long energy, tilt from volume-beta to petrochemicals, LNG infrastructure, and CCS/hydrogen platforms that can capture policy and margin while transport oil demand gradually compresses.

Bad: BAE x Forterra team up on an autonomous AMPV

What it is:

BAE Systems is partnering with Forterra to bolt a full autonomy stack onto the U.S. Army’s Armored Multi-Purpose Vehicle (AMPV) — the first external tie-up under BAE’s new “capability-kit” push (rapid, modular upgrades). Target: prototype by 2026 with a demo to follow. The Army wants kits that drop in fast to counter drones/EW/autonomous threats; Forterra brings an open-architecture AutoDrive platform designed to port across fleets (AMPV today, potentially Bradley A4 and M109A7 Paladin next).

What it will do:

- Faster refresh cycles: The kit model compresses multi-year development into iterative drops, keeping heavy armor relevant vs. swarming drones and EW-dense battlefields.

- Crew risk down, mission tempo up: Autonomous/optionally-manned modes unlock high-risk missions (resupply, CASEVAC, recon) without putting crews in the most lethal lanes.

- Interoperability premium: Open architectures that plug into multiple vehicles earn procurement leverage — the same autonomy stack across AMPV/Bradley/Paladin means training, sustainment, and software-update efficiencies.

How you can benefit:

- Name-level exposure: Track primes/sensors houses that monetize the kit economy: autonomy controllers, sensors (EO/IR, radar, LIDAR), edge compute, secure networking, and counter-UAS tie-ins for combined arms. Award flow will likely mirror AMPV fleet upgrades and then spill to Bradley/Paladin.

- Software + sustainment flywheel: Autonomy is a software lifecycle. Look for vendors positioned for continuous integration/field updates, DevSecOps on classified nets, and predictive maintenance analytics — recurring revenue vs. one-off platform sales.

- Supply-chain radials: Mid-cap suppliers of actuators, power distribution units, armored harnessing, ruggedized compute, and vehicle networking can see multi-year volume as kit adoption scales across brigades.

Ugly: AT&T’s CEO: America’s Spectrum House Isn’t in Order

What it is:

AT&T CEO John Stankey said the U.S. lacks a “deep spectrum footprint” vs. China, warning the next decade won’t be “enviable” without a strategic pipeline of auctionable airwaves. He tied better connectivity to AI-enabled networks(traffic management, less congestion) and nodded at regulatory overhangs (e.g., net neutrality) as investment variables. Core point: without coordinated mid-band spectrum releases and predictable FCC auction authority, U.S. wireless capacity — and the AI apps riding on it — will lag.

What it will do:

- Throughput becomes policy-capped: Without fresh mid-band (think 3–7 GHz) and backhaul upgrades, U.S. mobile networks hit ceiling effects just as AI-at-the-edge ramps (vision agents, on-device generation). That’s a growth tax on entire categories of apps.

- Capex timing whipsaw: Operators won’t front-load radios/fiber if auction authority is uncertain. That stalls rural 5G and slows dense-urban capacity adds — lag that compounds over years.

- China gap widens: If China continues coordinated spectrum planning while the U.S. debates, expect a growing delta in latency/coverage, with knock-on effects for industrial IoT and connected-vehicle pilots.

How you can benefit:

- Pre-position for auctions: When Congress restores FCC auction authority and releases a spectrum “pipeline,” radio vendors, towercos, and RF front-end names typically catch a bid. Calendar the hearings/markups; trade the run-up.

- Fiber & backhaul enablers: Independent fiber builders, microwave backhaul, and edge-DC operators are the picks-and-shovels for the next capacity wave. Look for BEAD-adjacent grants + carrier capex guides as triggers.

- Policy hedge: If delays persist, overweight fixed wireless vendors and private LTE/5G ecosystems selling directly to enterprises and municipalities — they move faster than national macro-policy.